Bond Bulls Are Getting Crushed In A Relentless Selloff, It’s Not China

Bond yields keep rising higher and higher on allegedly good economic data of questionable merit. Don’t point a finger at China.

(Click on image to enlarge)

US treasury yields courtesy of StockCharts.Com.

Bond Yields

- 30-Year: 4.95 Percent

- 10-Year: 4.81 Percent

- 05-Year: 4.80 Percent

- 02-Year: 5.15 Percent

- 01-Year: 5.49 Percent

- 03-Month: 5.62 Percent

30-Year Long Bond

“Policymakers are concerned about the huge leverage that hedge funds are employing as part of the so-called basis trade.“

Never Fails – Someone Always Points at China

More on China

Has China sold any US treasuries? Likely not. Much of what China holds is hidden in State Owned Enterprises and custodied Treasuries.

What’s Going On?

China Not Responsible

Alternative Theories

How many times do we have to go over this?!

China has a trade surplus with the US. As a result of that surplus and the way China handles it, China mathematically must accumulate US dollar denominated assets, typically US treasuries and agencies.

China would prefer to buy Boeing or Apple but the US would block such transactions.

We can say that China’s surplus with the US is dropping, but it’s still a surplus.

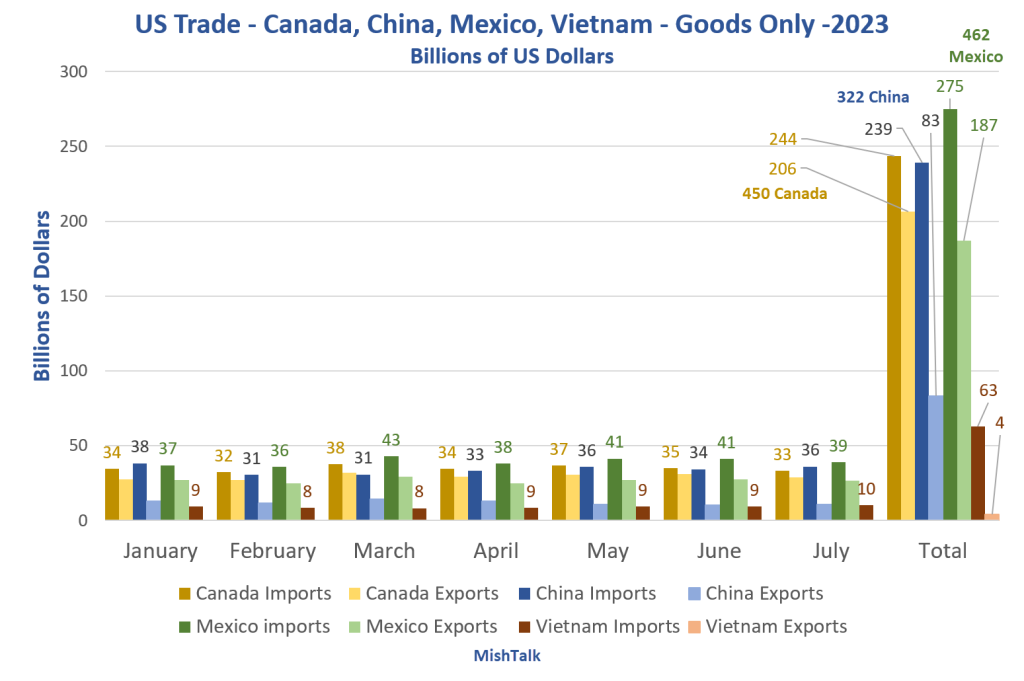

Mexico Jumps Ahead of Canada as the Largest US Trading Partner

(Click on image to enlarge)

Please note Mexico Jumps Ahead of Canada as the Largest US Trading Partner

If you wish to give Trump credit for reducing the trade deficit with China from $375 billion to $308 billion, then also give him credit for increasing the deficit with Mexico, Taiwan, and Vietnam from $124 billion to $211 billion.

Our largest deficit is still with China as noted in Mexico Jumps Ahead of Canada as the Largest US Trading Partner

Until that changes, China won’t be dumping treasuries.

The irony in all of this silly dumping treasuries talk is both Trump and Biden would like to see trade surpluses, not deficits.

In Aggregate, There Can Be No Dumping

It is mathematically impossible to dump assets in aggregate because someone must hold every treasury, every stock, every bond, and every ounce of gold 100 percent of the time.

Individuals and fund managers can buy or sell, but 100 percent of the time someone else will be doing the opposite.

Why the Selloff?

- Because market participants, right or wrong, believe the economic data is strong and that will force the Fed to hike more. The recession theory went out the window.

- Also, there are concerns over budget deficits. Such concerns don’t matter until they do.

Sentiment Changed

Sentiment towards bonds has changed. The desire to hold them is falling. That’s what’s happening, no more, no less.

The above two points are the most likely reasons but there could be other reasons, or none at all.

There does not need to be a reason. Recall that in 2006 people were lined up around the corner for the right to enter a lottery to buy a condo. A week later, there were no lines and no buyers.

Sentiment changed suddenly and there was no clear reason why. In that case, the supply of greater fools ran out.

Always Something, Unless It’s Nothing

Sometimes there does not seem to be a reason for a market reaction and sometimes there is a delayed reaction.

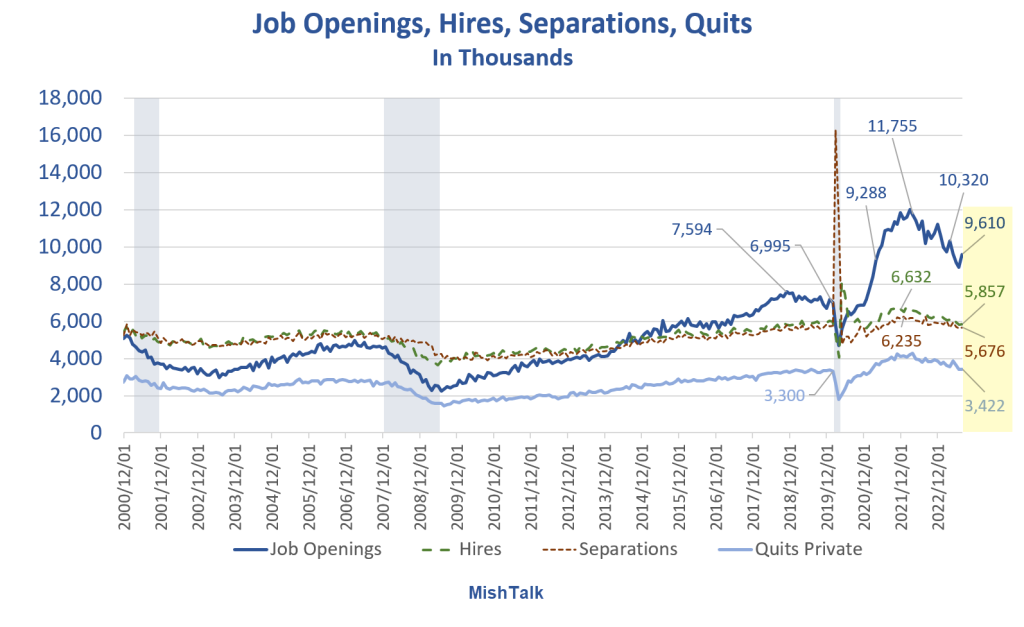

But it appears that the bond market reaction yesterday was related to job openings.

Job Openings Rise in August, Quits and Layoffs Vary by Sector

(Click on image to enlarge)

The JOLTS Survey shows job openings increase to 9.6 million in August; hires and total separations changed little.

For discussion, please see Job Openings Rise in August, Quits and Layoffs Vary by Sector

The chart is just a blip of an upturn, but when sentiment is bad, reactions can be oversized.

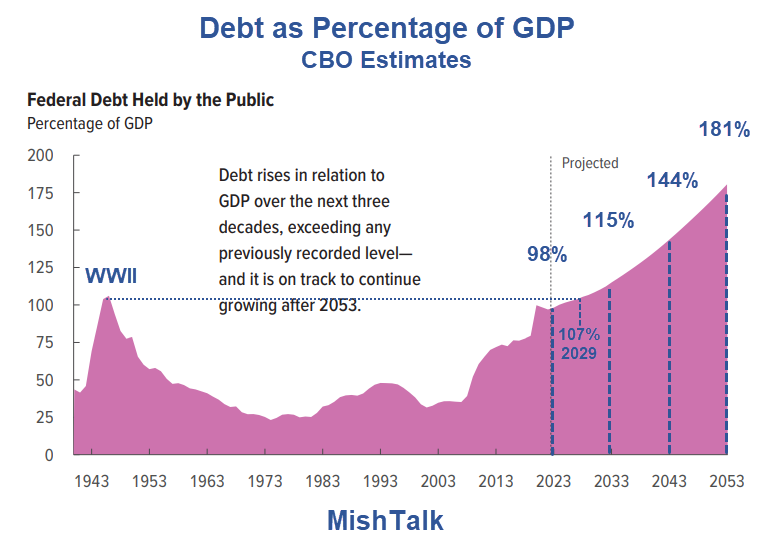

What About Deficits and the Debt Ceiling?

(Click on image to enlarge)

Debt-to-GDP image from the Congressional Budget Office, annotations by Mish.

Nothing has changed. We have deficits as far as the eye can see. That was always the case.

But things don’t matter until they do. Things now seem to matter.

No One Will Fix This

Compromise is always more spending for this in return for more spending on that.

Bnd both parties want to spend more on the military.

“Neither party will fix the deficits. Neither party will do anything about mounting debt. No one will do anything about anything because the political system is totally broken.” Mish

For discussion, please see Debt to GDP Alarm Bells Ring, Neither Party Will Solve This

There are plenty of reasons for a massive stock and bond market selloff. But it takes a sentiment change, not just reasons.

More By This Author:

McCarthy Ousted, House Essentially Frozen, There Is No Path Forward, For What?The Fed’s Emergency Liquidity Program, BTFP, Is Over $100 Billion, What’s Going On?

Job Openings Rise In August, Quits And Layoffs Vary By Sector

Disclaimer: The content on Mish's Global Economic Trend Analysis site is provided as general information only and should not be taken as investment advice. All site content, including ...

more