Bitcoin Tumbles After Treasury Unveils Stricter Crypto Reporting To IRS

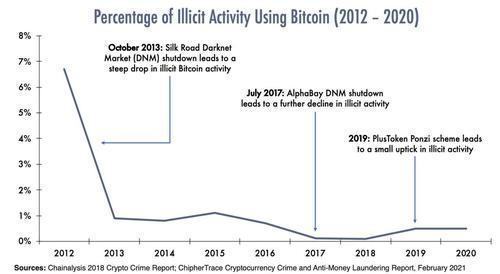

Just a month after Treasury Secretary Janet Yellen's complete fearmongering lie about Crypto being used largely for illicit finance (which has been overwhelmingly proven false, especially relative to dollars)...

Percentage of Illicit Activity Using Bitcoin (2012-2020)

(Click on image to enlarge)

The Treasury has just announced a new set of rules about reporting crypto transfers because they claim...

“Cryptocurrency already poses a significant detection problem by facilitating illegal activity broadly including tax evasion.”

If you think the timing is coincidental with yesterday's plunge, we have a bridge in Brooklyn to sell you.

“As with cash transactions, businesses that receive cryptoassets with a fair-market value of more than $10,000 would also be reported on,” the Treasury Department said in a report on tax-enforcement proposals released Thursday.

The Treasury said that comprehensive reporting is necessary “to minimize the incentives and opportunity to shift income out of the new information reporting regime.” It noted that cryptocurrency is a small share of current business transactions.

This is all part of Yellen's Tax Reclamation Plan (and likely was accelerated by the fact that Europe basically told to her to 'f**k off' with her demands for a global tax increase to cover the Biden admin's big tax hikes.

The U.S. Treasury Department estimated that wealthy taxpayers as a group are hiding more than half their income outside of wages and salaries, a conclusion that aims to bolster the Biden administration’s call for Congress to approve expanded IRS funding and broad new financial-transaction reporting requirements.

“The IRS will be able to deploy this new information to better target enforcement activities, increasing scrutiny of wealthy evaders and decreasing the likelihood that fully compliant taxpayers will be subject to costly audits,” the Treasury said of the proposed reporting requirements.

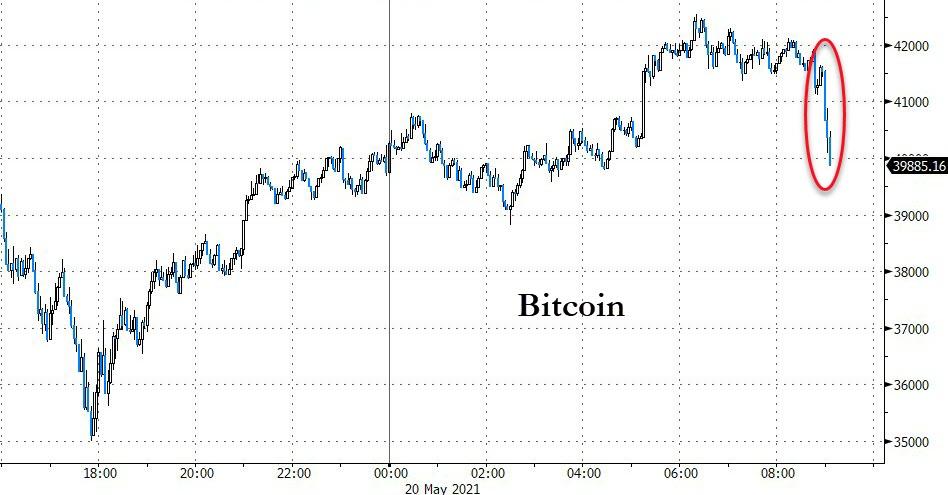

The announcement sent Bitcoin back below $40,000...

(Click on image to enlarge)

The drop, while of note, is perhaps less than some might expect. However, as several veteran crypto traders noted, this move is positive overall since it suggests 'regulation' is the way ahead for US agencies, and not a blanket ban.

So the treasury isn't looking to ban crypto contrary to repeated fake news, just to regulate it more.

— zerohedge (@zerohedge) May 20, 2021

Additionally, it seems odd to us that they would announce this plan now (just a week after the Colonial Pipeline ransomware payment). First, any large income transfer would, of course, already be tracked FROM the employer (and so very easy to find for the IRS on any paper trail); and if they are claiming this is to capture off-the-book income, that is a fallacy too, since the vast majority of off-the-book income is undertaken in dollar bills?

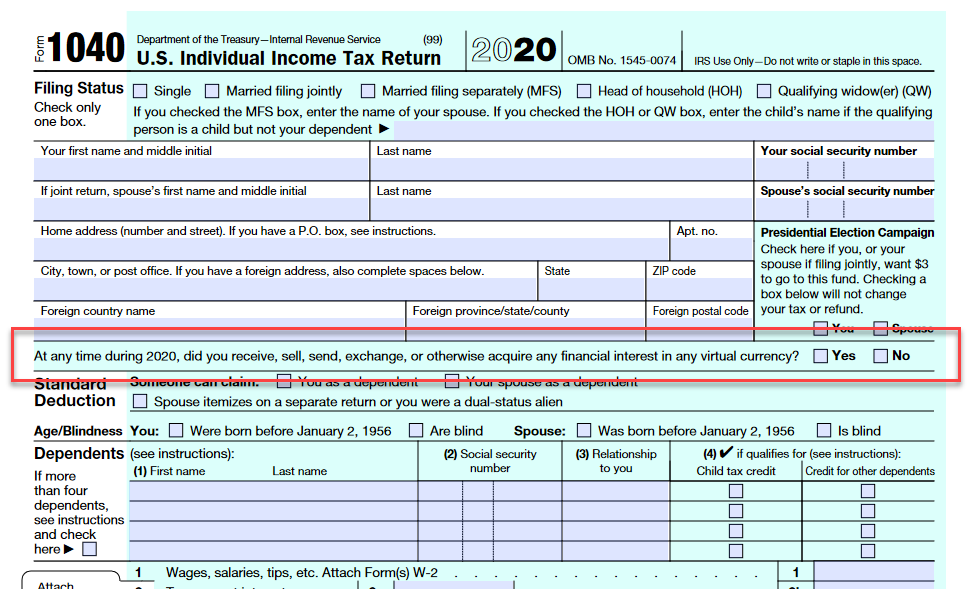

We also wonder how this question on the current tax form does not address this even more broadly by enquiring about whether you "exchanged ANY interest" in a virtual currency.

(Click on image to enlarge)

The Treasury said the new reporting regime would go into effect in 2023 to give financial institutions time to prepare for the new requirements. The Treasury estimates that the increased visibility into taxpayers’ accounts, on its own, would net the IRS $460 billion of the $700 billion over a decade.

Finally, putting bitcoin's "taxability" in context: the Fed monetizes more debt than bitcoin's entire market cap in 6 months.

Disclosure: Copyright ©2009-2021 ZeroHedge.com/ABC Media, LTD; All Rights Reserved. Zero Hedge is intended for Mature Audiences. Familiarize yourself with our legal and use policies ...

more

Banks already require it on cash. Nothing to see here. Just maturing asset class.