"Beware The Ides Of March": Nomura Sees "Sequencing Scenario" That Leads To Long-Awaited Stock Selloff

Having previously pounded the table on a "late cycle" curve-steepener trade, this morning Nomura's Charlie McElligott takes a deserved victory lap, noting that "the UST yield curve steepener I’ve been pushing continues to run, with 5s30s making fresh 12m highs / wides (57.7bps last) and 10s30s at 27m wides" even as the broader TSY complex has continued to rally (despite the previously noted sudden selloff across the curve, which has seen the 10Y reach the upper end of the descending triangle as a result of a barrage of corporate IG issuance coming and resultant rate-lock hedging), mostly thanks to “dovish capitulation” by central banks further metastasizes into a front-end rally "especially as funding mkts continue their recent collapse--LIBOR, SOFR and CP rates."

Here one should perhaps note that the short-term rates market is accelerating bets on 2020 Fed “rate cut” with EDZ9EDZ0 having adding an incremental 5.5bps of easing since Feb 21st (spread was -15bps, this morning is -20.5bps). Alongside the buying frenzy on the short-end, the Nomura cross-asset strategist highlights that JPMorgan’s US Treasury Investor Sentiment Index this week making "new highs since Sep16, a +2 Standard Deviation “bullishness” relative to the past 5 years", which may explain why on Tuesday JPMorgan initiated a tactical short in 10Y TSY Tuesday (without specifying a target or a stop). Separately, Charlie also notes that the Nomura QIS Risk Parity model $ notional allocation to USTs sits at highs last seen in May13, while the overall Global Bond $notional is at our series highs dating back to at least 2011...

... while the Nomura CTA model as of this morning shows an almost consensual “Max Long” across global DM Bonds:“+100% Long” in USD 10Y, JPY 10Y, CAD 10Y, CHF 10Y, FRA 10Y and ESP 10Y, while EUR 10Y, GBP 10Y and AUD 10Y are all “+95% Long.”

Ongoing steepening aside, McElligott brings attention to a new theme he first brought attention to yesterday, when discussing the "Ides of March", McElligott noted that there is a US equities "sequencing scenario" in-play as we head into March, where there is the convergence of a number of idiosyncratic seasonal- and supply / demand- factors which could provide the opportunity for the long-awaited US Equities reversal.

As McElligott further explains, "although it might seems like an impossibility right now with this “foaming at the mouth” market," he has recently been repeatedly asked “what could cause this Equities rally to see a reversal?"

His answer is that there is a scenario developing, timed-around:

- seasonality of the March Quarterly Options “Quad Witch” Expiry (which historically sees Equities “trade up” into then sell-off thereafter) which is ESPECIALLY notable in light of...

- current “extremes” in $Delta (SPX / SPY / QQQ) and $Gamma (QQQ) which could also align with...

- the commencement of the next Corporate Buyback “blackout” into earnings season, together with

- another “mechanical” function of Systematic Trend / CTA’s over-weighted allocation to the 1Y period model and the “pull higher” of SELL trigger levels—all of which could conspire to create a “gap lower” risk for markets on a “pure” tactical reversal in short-term “supply / demand” dynamics.

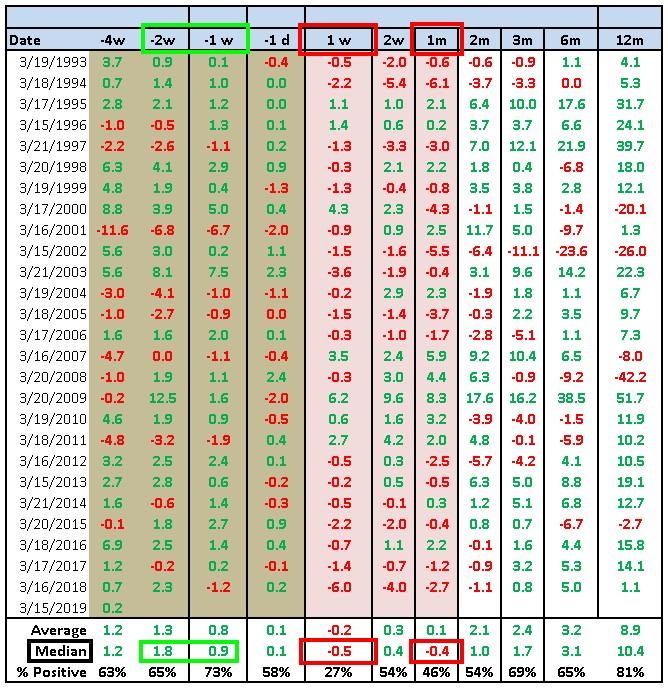

Breaking down these points further, the Nomura strategist notes that the first potential catalyst would be the SPX seasonality around March quarterly Op-Ex—where we typically see stocks “trade up” into, then “trade down” out of massive quad-witch “serial expiry” (this year on March 15th).

- In particular, last year’s Op-Ex marked the “next wave” of the fund “gross-down” following the initial “Vol Event” in the leveraged VIX ETN space and overall “negative convexity” strategy universe following January’s “inflation impulse”—with SPX -6.0% the week following Op-Ex / -4.0% out 2w / -2.7% out 1m

This is particularly important in light of the currently very high percentiles in SPX/SPY/QQQ consolidated $Delta/and QQQ $Gamma

- Consolidated SPX/SPY $Delta is currently 96th %ile (6Y lookback), while $Gamma is 68th %ile and growing

- Still very crowded “Growth” proxy QQQ $Delta is currently 97th %ile, while $Gamma is 89th %Ile

This timing into Op-Ex too coincides with Nomura's estimates that 75% of S&P corporates will have entered their “Blackout” period (discussions surrounding 10b5-1’s aside) as a potential “demand vacuum” window. This “vacuum” is then further complicated with potential outright SELL flows, as the bank's forward-looking CTA model indicates that over the next two weeks, we will see US Equities deleveraging / sell “pivot” levels being mechanically pulled-higher, as 1Y ago, we saw markets rally powerfully into March Op-Ex—as per standard seasonality

- This is due to the still-heavy “overweight” of the 1Y window (83.2% of the overall allocation) across McElligott's model

This, to McElligott, means that the “sell pivot” level from the current “Max Long” in both SPX and NDX “jumps” meaningfully higher / closer to ATM.

The punchline for a potential "Ides of March" moment is this: if we see the seasonal post-serial options expiration / quad-witch rally-then-pullback phenomenon occur (as has been the median outcome over the past 25 years), which this year could look even more exaggerated on account of the extreme $Delta / $Gamma currently seen in SPX / SPY / QQQ (Consolidated SPX / SPY $Delta is currently 96th %ile and crowded “Growth” proxy QQQ $Delta is currently 97th %ile while $Gamma is 89th %ile), it would then converge with the “demand vacuum” of the onset of the “corporate blackout” window (75% into blackout by 3/19/19) at the same time alongside a mechanically-driver “higher sell pivot” levels in the 1Y CTA model for both SPX and NDX which could potentially dictate outright SELL flows—thus, we could have the makings of a "March Surprise."

The specific SPX seasonal pattern over the past 25 years surrounding the March serial options expiration, or the "trade up" into, "trade down" out of pattern, is shown below:

Disclosure: Copyright ©2009-2019 ZeroHedge.com/ABC Media, LTD; All Rights Reserved. Zero Hedge is intended for Mature Audiences. Familiarize yourself with our legal and use policies every ...

more