Banks' Usage Of The Fed's Bailout Facility Soars To New Record High

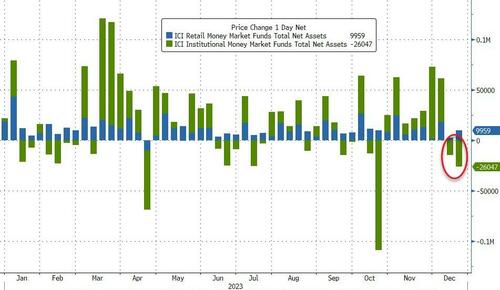

For the second week in a row, money-market funds saw outflows, down $16.1BN this week,

Source: Bloomberg

Once again, institutional funds were responsible for all the outflows (-$26BN) while retail funds continued their streak on inflows (+$10BN) that is unbroken since April...

Source: Bloomberg

In a breakdown for the week to Dec. 20, government funds - which invest primarily in securities like Treasury bills, repurchase agreements and agency debt - saw assets fall to $4.79 trillion, a $24 billion decline.

Prime funds, which tend to invest in higher-risk assets such as commercial paper, meanwhile, saw assets rise to $955 billion, a $7.66 billion increase.

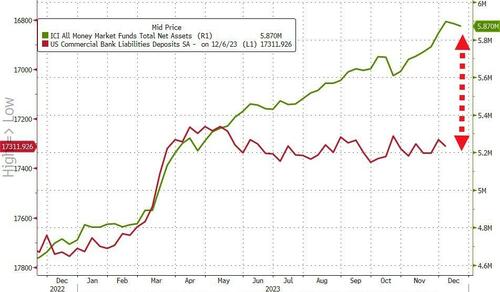

“This is a turning point and you do start to see money move out of money markets, into riskier assets, into term rates to lock in higher rates,” Jeffrey Rosenberg, a portfolio manager at BlackRock Financial Management said in a Bloomberg Television interview.

“As cash rates start to come down, you’re penalized in 2024 for holding cash because the rates and the prospect of the rates is to go lower.”

So, is this divergence starting to narrow?

Source: Bloomberg

Notably, the exodus from The Fed's reverse repo facility has stalled in recent days

Source: Bloomberg

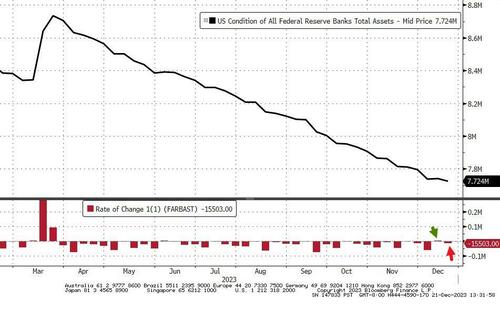

Following the prior week's unexpected $2.2BN rise, The Fed's balance sheet resumed its shrinkage, down $15.5BN last week to a new cycle low...

Source: Bloomberg

Usage of The Fed's BTFP bank bailout facility soared again last week, jumping $7.5BN to $131BN...

Source: Bloomberg

But Regional Bank shares still don't care...

Source: Bloomberg

While this is, at first glance, a worry - bans are borrowing more to fill their balance sheet loss holes - there is another possibility.

An arbitrage for banks is growing more attractive thanks to traders who are betting the Fed will aggressively cut interest rates in 2024.

Finally, equity market caps continue to soar after recoupling with bank reserves at The Fed (though the stalling in the drawdown of the RRP has slowed the expansion this week)...

Source: Bloomberg

Of course, with The Fed's massive pivot yesterday, sending yields plummeting, regional bank balance sheets may be rescued... for now. Until the next wave of inflation hits...

More By This Author:

Initial Jobless Claims Near Record Lows, Continuing Claims At 2-Year-Highs

International Tourism Approaches Pre-Pandemic Levels

36 Million Customers Affected In Massive Comcast Data Breach

Disclosure: Copyright ©2009-2023 ZeroHedge.com/ABC Media, LTD; All Rights Reserved. Zero Hedge is intended for Mature Audiences. Familiarize yourself with our legal and use policies every ...

more