All Of The Biggies Want Inflation

Image Source: DepositPhotos

The US owes $34.7 trillion. What if debt holders realized that the Fed was not really going to fight inflation... and that they were just going to ‘print up’ trillions in pieces of green paper?

Like a depressed person at an open window, last week, we left an important question unanswered:

‘Why can’t we just muddle through the debt problem? Why does it have to end in crisis and disaster?’

Talk about muddled! The question was put to Jared Bernstein, Joe Biden’s top economic advisor. In an interview, painful to watch, he seemed to be doing an impersonation of Leslie Nielson’s inimitable Frank Dribben:

"The US government can’t go bankrupt because we can print our own money... The government definitely prints its own money. The government definitely prints money and lends that money... The government definitely prints money...It then lends that money by selling bonds. Is that what they do? They sell bonds and then people buy the bonds and lend the money. Yeah...”

Yeah, that’s what they do. But why? Stephanie Kelton, proponent of Modern Monetary Theory, wonders:

‘Why does the federal government have to borrow its own money?’

A talk show host, interviewing her, leaped to the obvious absurdity:

Why don’t we just print up $1 trillion coins? We give one to China. One to Social Security, etc. We just pay off our debts in one fell swoop. Heck, we print the money anyway.

It seems like a no-brainer. Debt problem solved. Stamp the invoice PAID... and move on.

This is not just a ‘theoretical issue.’ Here’s the head of the Committee for a Responsible Federal Budget, Maya MacGuineas:

‘We’re less than a decade away from a massive solvency crisis that would slash benefits for over 67 million seniors and severely limit their access to health care soon after. But instead of running to fix this problem, our politicians are running away from it. Social Security’s retirement trust fund will be insolvent when today’s 58 year-olds reach the normal retirement age and today’s youngest retirees turn 71.’

Note to Kelton, Bernstein et al: Retired people don’t eat paper.

Right now, the Fed is balancing itself on the ledge. It wants inflation... to stir animal spirits and repress the real level of US debt. But it would be suicide to jump off and lower rates immediately, with the whole world watching.

The US owes $34.7 trillion. What if debt holders (and retirees) realized that the Fed was not really going to fight inflation... and that they were just going to ‘print up’ trillions in pieces of green paper?

All the people who put their faith in the Fed and the US dollar with their lifetime wealth... what would they think? The Fed is supposed to be guarding the value of America’s IOUs — from its venerable 30-year Treasury bonds... to its green walking around money, in 1s, 5s, 10s... and more.

Even our own housekeeper in Argentina, who lives in a mud hut up in the Andes mountains, a six-hour hike from our house, keeps her savings in green paper. It was an easy way to protect it from the Argentine peso. What if she knew that the US officials were no more reliable than their own jefes at the Banco Central de la Republica Argentina?

The Banking Cartel

So far, bondholders think they can trust the Fed to protect their money. Good luck. The Fed is a cartel of Big Banks. Its main purpose is to make sure the banks have enough money. If they run short, the Fed will swindle your children — with inflation — to give them more.

All of the biggies want inflation.

-

Big Government needs inflation to reduce the real value of its current debt... and allow it to continue confiscating the wealth of the nation.

-

Big Money wants inflation because it owns the nations’ assets; ultra-low interest rates and deficits cause inflation, but they increase prices for their stocks and bonds.

-

Big Business, too, thrives on inflation. Upstart competitors can’t get funding. Small businesses go broke. Big Businesses get bailouts.

Even Big Media prefers inflation to ‘austerity.’ Inflation is a way to fund the wars and boondoggles that it loves so much.

All of them want to survive and grow... concentrating wealth and power in the big, here and now, institutions of the entrenched elites.

But the real key to the feds’ embrace of inflation is this: They have no other choice. TINA. Politically, There Is No Alternative. These powerful groups would never accept the drastic cutbacks needed to reduce US debt (budget surpluses!)

You can’t muddle through a debt crisis. As in a train wreck or old age, muddling through won’t take you to the other side. The adventure has to end before a new one can begin. Social Security and Medicare are going broke. US debt is rising faster than inflation can cut it down. In another spell of high inflation, the Fed would be unable to raise rates sufficiently to bring it under control.

The feds’ only option is inflation... more inflation... sustained inflation at levels high enough to reduce the real value of US debt.

Wait for it.

Regards,

Bill Bonner

Research Note, by Dan Denning

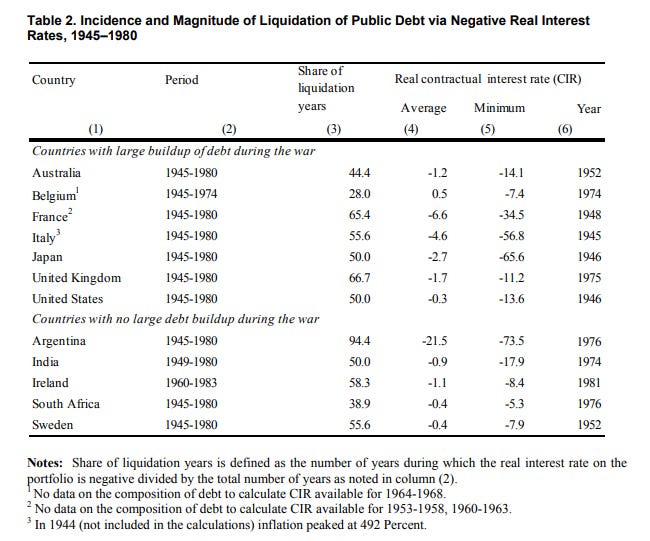

How many years of ‘sustained inflation’ does it take to reduce the value of government debt through ‘Financial Repression?’ About 17.5 according to the table below.* It’s taken from the textbook report on using negative interest rates to ‘pay down’ government debt. A revised version of the 2011 report was published by the International Monetary Fund in 2015 and titled The Liquidation of Government Debt.

At the end of World War II, the United States had a debt-to-GDP ratio of 112%. Over the next 35 years, inflation was higher that official interest rates. ‘Real interest’ rates were negative for half of those three and half decades. This helped the US government pay off the war-time debt in inflated dollars.

Today, total public debt as a percentage of GDP is 120%—higher than the peak level in war time. The Congressional Budget Office estimates that public debt will be 166% of GDP by 2054, in just thirty years. For investors, decades of negative real interest suppress the total return on stocks as an asset class, even stocks held ‘for the long run.’

More By This Author:

Scrambling for Survival

Hardwired For Disaster

Joyride to Catastrophe