A Fed Pivot While Lamborghini Sees Full Order Books Doesn't Compute

Did the Federal Reserve jump the gun on the pivot?

Last month, investors cheered after the Fed announced that interest-rate cuts are coming in 2024. Since then, the S&P 500 has powered to new record highs, and technology stocks have gone bananas.

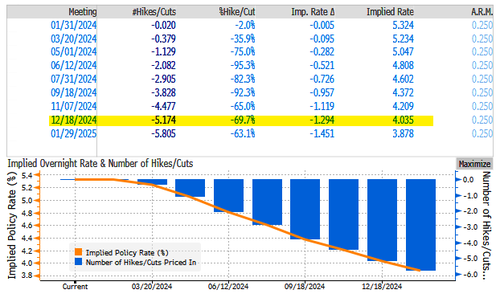

The latest swap contracts tracking Fed meeting dates for the full year 2024 showed 70% odds for 5.2 cuts.

The unexpected pivot (as outlined earlier) might be premature and may have been a gift to the Biden administration in an election year.

An example of a premature pivot and no impending economic doom could be news from Lamborghini on Tuesday that supercars are sold out until 2026.

"It's a bit early to give a prognosis, but we have no sign of weakness in the market," Chief Executive Officer Stephan Winkelmann told reporters on a call.

According to Bloomberg, the Italian supercar maker logged over 10,000 vehicle sales last year. Its first plug-in hybrid model, the Revuelto, was a massive hit with the rich, with two years of backlog orders.

The trend of ultra-wealthy elites splurging on supercars indicates that the economy isn't slowing down as quickly as thought, suggesting that an imminent need for rate cuts might be unnecessary.

More By This Author:

Google Tumbles After Ad Revenue, Operating Income MissMSFT Shares Unimpressed By Big Top- & Bottom-Line Beat

US Home Prices Rose For 10th Straight Month In November, But Gains Slow Significantly

Disclosure: Copyright ©2009-2024 ZeroHedge.com/ABC Media, LTD; All Rights Reserved. Zero Hedge is intended for Mature Audiences. Familiarize yourself with our legal and use policies every ...

more