Dow Stock Market Trend Forecast To December 2023

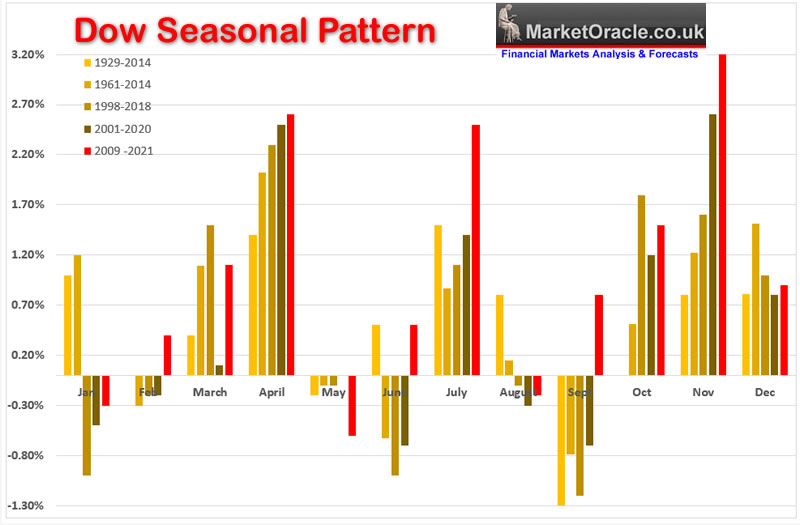

The seasonal pattern suggests after a pause in Feb, higher into late April, then correct from early May into late June. This is followed by a volatile summer terminating in a swing low during September that should set the scene for a bull run into the Christmas Holidays, with of course, intra month volatility during October. That resolves to the upside just as the perma-bears are crowing at their loudest that the end is neigh.

As we have a bear market thus it is a case of SWINGS rather than TREND i.e. we had a down swing into early March, rally into Mid April, a down swing into Mid June and then a strong rally into Mid August, i.e. July was strongly higher, and then down hard into the September low. So seasonal analysis in hindsight looks remarkably accurate for 2022! Hindsight! Going forward (without hindsight) October and November should see the stock market go UP, December is still up but weaker, so suggest a peak into Christmas and down into the end of the year. So Seasonal analysis suggests that despite a volatile October after all the S&P just closed at 3585! Putting my neck on the chopping block to say Friday is the bottom! Nevertheless, October strongly higher, November strongly higher, December weakly higher.

As for 2023, a December peak sets the scene for a correction into February, rally into late April / Early May. Summer is going to be volatile with a downwards bias, probably all the way into early October, so maybe a mini bear market from Early May to early October, weak not on the scale of 2022., and then a powerful bull run into the end of the year for a strong up year.

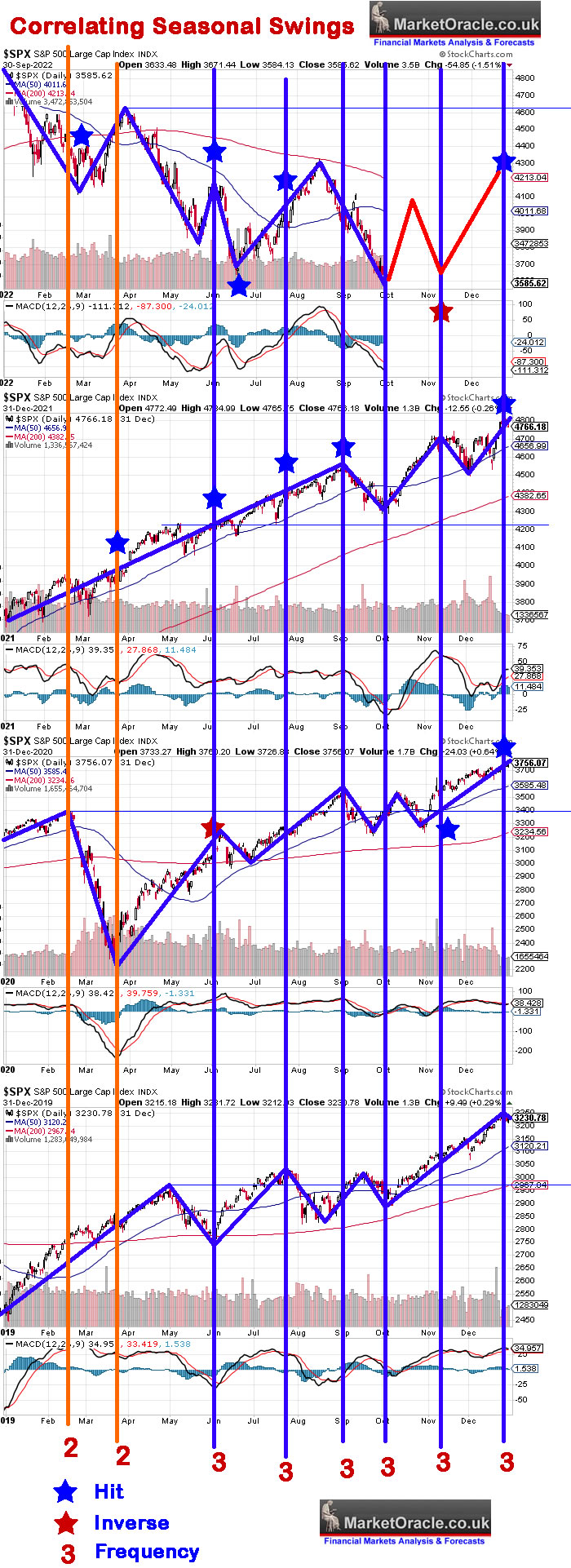

Correlating Seasonal Swings

Not satisfied with seasonal swings I've continued last years near term years seasonal analysis by comparing the year on year change which suggests that the market IS at BOTTOM and thus due a rally into Mid October for a higher low retest into early November, though October should end higher than where it began, where an early November low sets the scene for a powerful rally into at at least Christmas, 2023 bull into September, down into October start.

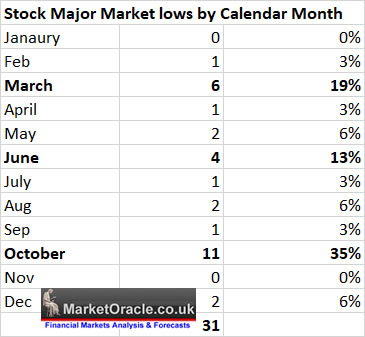

Major Market lows by Calendar Month

Some 80 years of stock market history resolves in the following table for when major stock market lows tend to occur, as one can see there are three clusters, March, June, and October, which is another reason why I thought that the June low was highly probably THE LOW. But now we have SEPTEMBER, we made a NEW Low in September which is not probable, and therefore despite Monday's rally it looks like we will trade to a new low during October albeit a marginally lower low foe that is what this table implies. The Dow currently stands at 29490, barely 2.7% above it's bear market low, so yes sitting where we are the stock market looks set to make a new low in October and thus comply with what this table strongly suggests should happen, else September becomes an outlier new low, for which there is an approx 10% chance.

US Presidential Cycle

This is what I concluded a year ago in my September 2021 analysis -

So the election year cycle favours a strong up year as Uncle Biden prints plenty of dollars for everyone to party, which is basically what we are experiencing. Though next year that Democrat performance slumps to just +0.6%! Which suggests this rally is a time to take profits and de risk, because 2022 according to the Presidential cycle could be weak!

So far so good, what next? Well for 8 straight decades stock market indices such as the Dow and S&P have headed higher after the ,mid-terms with the average gain being 15%.

That is a 100% probability that stocks will be higher than where they end in October. Whilst the average gain is 15%, the spread tends to be quite large in the range of +10% to +15% which therefore suggests that 2023 will be an up year for stocks. In fact we could see a powerful pre-emptive rally ahead of the Mid-terms from the current state of extreme pessimism. as illustrated by the MACD and sentiment indicator,

Best Time of Year to Invest in Stocks

Statistically the best time of year to buy Stocks is during late October and then hold all the way through to the end of April, for an early May top, whilst the subsequent 6 months tend to be the weakest of the year. What happened this year ?

The Dow ended October 2021 at about 35,750, and traded to a 2022 high of 34,100 early May, which is down 5%. Obviously with the signs of a bear market brewing one would be vary of this pattern for this year. Whilst the subsequent 6 months have turned out to be WEAK, down 18% from early May so at least that part came true. However it is probable that 2023 will see the Buy October Sell in May pattern come good to some degree.

Formulating a Stock Market Trend Forecast

The character of this bear market has been changing since the June low, first came the break above 33.3k into the August FOMO peak. and then came the decline to 28.7k that whilst a new bear market low was weak in trend channel terms.

so what is going on?

ACCUMULATION is what's going on, Accumulating since the June low. It should be fairly obvious that there is a lot of buying gone on and market manipulation so as to allow it to happen. It's as though the wolfs of wall street are leading the retail investor lambs to slaughter as the retail crowd are dealt hammer blows in either direction aimed at fleecing them of their wealth.

The smart money is accumulating! All whilst MSM and the blogosfear literally paint a perpetual picture of DOOM and FEAR that they STILL sustain despite what we witnessed earlier this week! INVESTORS have been conditioned to expect the likes of S&P 3200 as a done deal, when the reality is NOTHING is a done deal!

Furthermore even thought the purpose of this analysis is to conclude in a Dow trend forecast, I consider the indices to be a red herring, as it's all about the stocks! Many great stocks are trading at huge discounts to the indices for instance Qualcom on a PE of 10! AMD 17, TSMC 14, AMAT 11, Micron 6, Lam Research 12 and so on. This is what investing is all about, identifying good stocks and accumulating them when they are cheap, the indices are a side show, but they remain the focus of most.

Having scoured this analysis a dozen times what sticks out the most in terms of weighting are

1. that valuations HAVE moderated and will continue to do so. So gone are the ridiculous P/E's of late 2021.

2. A recession is brewing, due to hit the US during the 2nd half of 2023 in advance of which the Fed will have completed it's rate hikes to probably well below the markets worst expectations i.e. they may not even make it to 4%.

3. This is not really a bear market, to me it does not feel like a bear market. Where is the PANIC? Okay so the uK did panic, but the decline in the indices has been orderly. The swings are orderly, muted even as though engineered, this is evident by the failure of the VIX to spike instead unnaturally has remained range bound.

4. Bond markets have done their worst and look like they are bottoming..

5. Seasonal analysis and the Presidential election cycle are painting a compelling picture for a strong 2023. After all a strong down year tends to be followed by a strong up year.

Dow Stock Market Trend Forecast September 2022 to December 2023

Therefore my forecast conclusion is that the bear market has likely bottomed at the end of September, and that the Dow is likely to trend higher into Mid 2023, punctuated by the usual corrections most notable of which will be at the start of the new year as the Dow fails to break above the 34.3k high which would send the Dow significantly lower to at least 31,500 in advance of it's next leg higher into June 2023 towards a target of 35,000 beyond which the Dow will face the head winds from contracting earnings as the recession starts to bite that I expect will send the Dow lower that will be followed by shrill cries that the Bear market has resumed, which given that the Dow will have made a lower high is possible, , I expect this mini bear run to terminate during October in region of the Q1 low so around 31.500 that will set the scene for a rally into the end of the year, that I suspect will not be able to break above the earlier summer highs. Still the Dow should end of the year up about 5% and some 17% from the last close of 29490 as illustrated by my trend forecast graph.

31st December 2022

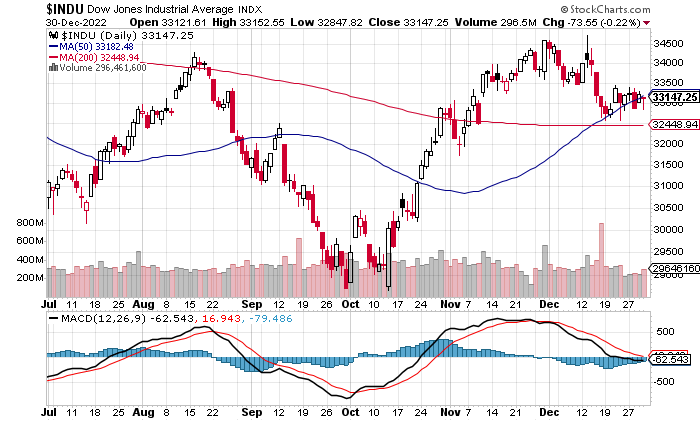

Here's how the Dow trend has played out since my analysis and concluding trend forecast was posted at a time of maximum uncertainty when expectations were rife of S&P 3200 and lower (still are!).

The trend forecast for where the Dow should be trading by now is 32850, the Dow's last close is 33,147, a less than 1% deviation against the forecast.

More By This Author:

The Inflation Monster Is Forecasting RecessionTech Stocks Bubble Valuations 2000 Vs 2021

US Economic Activity, GDP and Employment Q1 21

Disclaimer: The above is a matter of opinion provided for general information purposes only and is not intended as investment advice. Information and analysis above are derived from sources and ...

more