Do The Right Thing On The Airline Bailouts

I’m angry that I have to write this note.

I’m angry that when we have people dying left and right in this country, when there is an urgent need for ALL of us to spend ALL of our time helping our families, helping our neighbors, helping our emergency responders and healthcare workers and social service providers to DO THEIR JOBS … that I have to write a note about the airline industry and how to structure the bail-out of United (UAL), Delta (DAL), American (AAL), Southwest (LUV), and Boeing (BA).

But I do have to write this note, because of course the raccoons and the high-functioning sociopaths are out in force on this, looking to get their private losses socialized and their private gains locked in. Looking to get their 30 pieces of silver.

So I’m not going to spend a lot of time on this. I’m just going to give all of you the facts and let you all take it from here. Because if this goes down anywhere near where I think it’s going to go down … well, one day when we’ve passed through this valley there’s going to be a reckoning, and we will visit our righteous anger on those who abused the public trust.

Like Disney (DIS):

This was Disney World ... last night.

— Ben Hunt (@EpsilonTheory) March 16, 2020

One day there will be a reckoning for this, and the righteous anger we will level at companies like Disney will be a wonder to behold.#BITFD pic.twitter.com/XGWgYVkIpq

Like Tesla (TSLA):

Yeah, well, CV-19 is the lung-killer.

— Ben Hunt (@EpsilonTheory) March 17, 2020

Alameda County has declared Tesla an “essential business” and Elon wants you to come in and work. Unless you’re already sick.

But this disease spreads from asymptomatic carriers in a crowd. Like a factory shift.

Sociopath. https://t.co/dvdZdP4gW2

But that’s for another day.

Today we’re going to talk about airlines, their CEOs, and their major shareholders. Trust me, there will be plenty of righteous anger to go around.

You know, back in the day, my hedge fund owned a chunk of Ryanair, the cut-rate Irish airline. We didn’t own it for long, because … Michael O’Leary … but it was actually a Michael O’Leary quote (he’s Ryanair’s founder and CEO) that got me interested in the company and the industry in the first place. I’ll try to paraphrase this to avoid the profanity.

You think airlines are a service industry? You *$#@ idiots. Airlines are a UTILITY.

So right. Airlines are exactly the same thing as an electrical generation plant. They provide the transportation outcome, the getting-from-point-a-to-point-b-in-a-short-time that our modern economy depends on just as much as it depends on electricity. Or banking. Or healthcare.

Commercial air travel isn’t a luxury. It isn’t a service that we can purchase or not, upgrade or downgrade as we like. Sure, the airlines present themselves as a service because they get you to pay more money if you think of them like that, but they are not a service.

Airlines are a utility.

While we’re at it, here’s another quote. You’ll never guess who said it.

Airlines are a public utility, and they should be regulated as such.

Sounds like something Bernie Sanders would say, right? Nope. That was George Will. Yes, ur-conservative free marketeer George Will. Know who passed the Airline Deregulation Act? Jimmy Carter.

Here’s one more quote.

Q. If you actually fire these people, won’t it put your air traffic control system in a hole for years to come, since you can’t just cook up a controller in — [inaudible]?

The Secretary of Transportation. That obviously depends on how many return to work. Right now we’re able to operate the system. In some areas, we’ve been very gratified by the support we’ve received. In other areas, we’ve been disappointed. And until I see the numbers, there’s no way I can answer that question

Q. How long are you prepared to run the air controller system — [inaudible]?

The Secretary of Transportation. For years, if we have to.

Q. How long does it take to train a new controller, from the waiting list?

The Secretary of Transportation. It varies; it depends on the type of center they’re going to be in. For someone to start in the system and work through the more minor office types of control situations till they get to, let’s say, a Chicago or a Washington National, it takes about 3 years. So in this case, what we’ll have to do if some of the major metropolitan areas are shut down or a considerable portion is shut down, we’ll be bringing people in from other areas that are qualified and then start bringing people through the training schools in the smaller cities and smaller airports.

This is from the 1981 press conference where Ronald Reagan announced he was firing 11,345 striking air traffic controllers, bringing all commercial aviation to a halt. He didn’t just fire them. He barred each of them from ever taking a federal job again. For life.

There were no replacement air traffic controllers. They brought in some military guys where they could, and otherwise just winged it with retirees and new trainees. And it worked. It ended up being minor blip in commercial air service for most Americans.

I’m starting with these quotes to make three simple observations.

No one is talking about putting the US airline industry out of business, least of all me. This is as strategically important an industry as exists in the country. We can and we should provide emergency financial assistance from the federal government to keep the airline industry healthy and fully functioning throughout this CV-19 crisis.

There is nothing sacrosanct or natural about our current regulatory and ownership structure for the US airline industry. Nothing.

Governments can do whatever the hell they want.

As the lawyers would say, so stipulated.

Now here are the facts about the airline industry and the rampant financialization that has infected them for the past 6+ years.

There are four publicly traded companies that account for almost all commercial air travel in the United States: Southwest, Delta, American, and United. That list is in order of passengers carried, with Southwest leading the way (>165 million people transported last year), although the other three beat Southwest handily on the industry metric of revenue-passenger-kilometers (Delta, American and United each flew their paying customers a total of about 330 billion kilometers last year).

Throughout this note, these are the four airlines I’ll be talking about. They’re the only ones that are necessary to preserve in any bailout legislation (although I’m sure all the smaller guys will be covered, too).

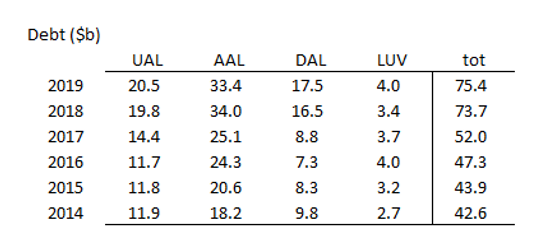

Fact #1 – Starting in 2014, each of the Big 4 airlines began a policy of massive stock buybacks, totaling $42.4 billion over the following 6 years.

Please, for the love of god, let’s not reignite the stock buyback wars of 2019 over this. I do not believe that buybacks are inherently evil or that they should be banned from existence. I DO believe, however, that they are intentionally used by management to obfuscate and sterilize ludicrous stock-based compensation schemes, so that much of the capital that is supposedly “returned to shareholders” through buybacks is not returned at all, but is hijacked directly into management’s pockets. I DO believe that this sterilization scheme is so widespread and so harmful to shareholders and to society that it is necessary to implement government restrictions on buybacks. You can read more of my thoughts on all this here, here and here.

Whether or not you agree with me on the evolution of stock buybacks into a ubiquitous instrument of management self-dealing, I hope that we can all agree on this: stock buybacks are a CHOICE.

I’m sorry that you airline management teams and boards of directors made a bad choice. I’m sorry that you and your shareholder base thought it was stupid and inefficient to hold more cash against the prospect of a global recession. Welcome to capitalism.

In any event, here are the numbers for stock buybacks in the airlines over the past six years, taken directly from their 10-K filings.

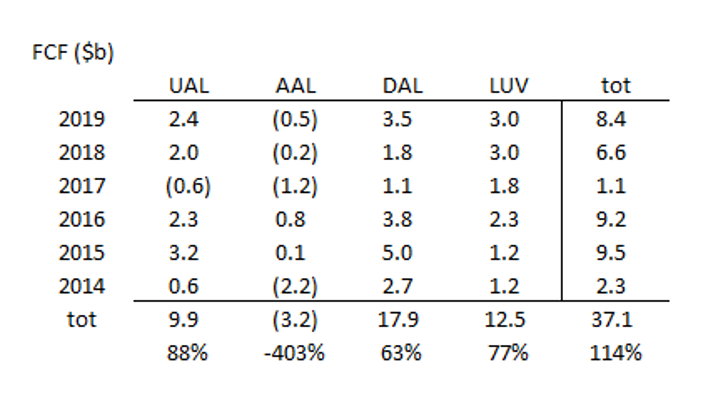

Fact #2 – These buybacks, together with increased debt (+78%), were the engine of an intentional strategy of heightened financial risk taking, such that buybacks were greater than free cash-flow for the group ($37.1 billion).

Speaking of choices …

Stock buybacks are only part of a corporate strategy of financialization, where leverage and capital allocation decisions are placed in service to the cartoon, market-world measurements of corporate performance – like stock price – rather than fundamental, real-world corporate performance itself.

At every turn over the past six years, management teams at the Big 4 airlines have increased debt and directed their free cash-flow towards anything they thought would prop up their stock price, at the expense of using this money to grow their core business OR protect their core business against a global recession.

This is financialization. It is the real-world hollowing out of our largest and most important private companies in order to maximize wealth generation for senior management and large institutional investors.

Here’s the data on debt and free cash-flow, as reported on Bloomberg. Debt is pretty self-explanatory. Free cash-flow (FCF) less so, so I’ll spend a moment on that.

Free cash-flow is the money you have left over after running your core business (cash-flow from operations) and after you’ve made whatever tax payments and interest payments and maintenance capital expenditures (capex) you are required to make. To be fair, different people have different ideas on how free cash-flow should be measured, particularly when it comes to these capex decisions. Your calculation of FCF for the airlines may be a bit different (I’m just taking the Bloomberg reported numbers as is), but they will be similar to what I’m reporting below.

The percentages at the bottom of the FCF chart are the percentages of free cash-flow spent on stock buybacks over the six year period. American has a negative percentage because the company bought back $13 billion worth of stock despite having negative free cash-flow over this span. As a result, American skews the overall ratio of stock buybacks to FCF for the group as a whole, but you can see that there are no choirboys here. Even the least profligate airline – Delta – spent 63% of their free cash-flow on stock buybacks.

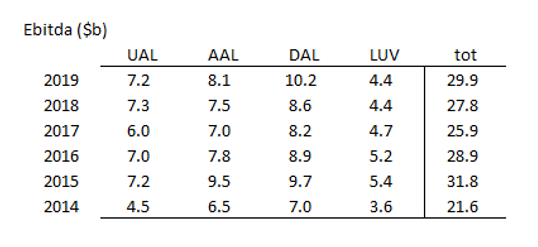

Fact #3 – The operating fundamentals of the Big 4 airlines deteriorated over this period, with EBITDA, free cash-flow and cash-flow from operations all lower in 2019 than in 2015.

You’ve got the free cash-flow chart above. Here’s what earnings before interest, taxes, depreciation and amortization (EBITDA) and cash-flow from operations look like. High watermark in 2015, and downhill from there. Again, all data taken from Bloomberg.

It’s not conjecture that every major airline shifted its management focus from operational, long-term core business issues to financial, short-term market issues. It is fact.

Know who else stopped running their company for real-world excellence in exchange for market-world rewards? This guy.

Dennis Muilenburg, Boeing CEO and centimillionaire

Here’s my take on Boeing, a case study of how weaponized financialization and management greed destroyed a crown jewel of American industry.

This is from November of last year, btw.

And here’s my take on Dennis Muilenburg himself, the poster child for our modern Zeitgeist of outrageous management self-dealing.

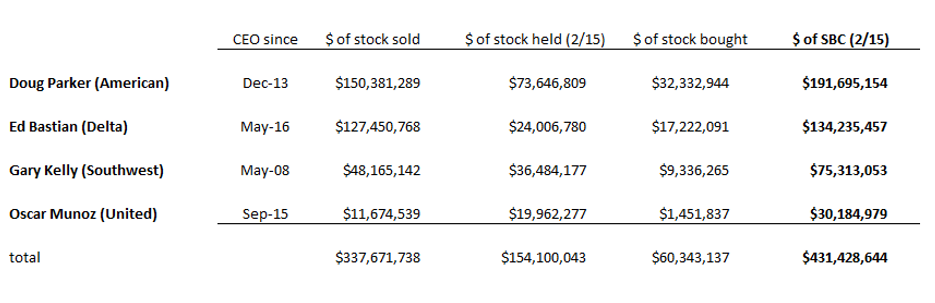

Fact #4 – The CEOs of the Big 4 airlines received $430 million in stock-based compensation over this period, separate from their cash compensation, deferred benefits, etc.

Every airline CEO is just another Dennis Muilenburg.

As with Muilenburg (and with IBM’s Ginni Rometty if you want to read that take-down), I’m not going to calculate the salary and annual cash bonuses for these airline CEOs. I’m not going to count the corporate jet. I’m not going to count the perks and the club memberships and the board seats at other companies and the deferred comp and the remaining options and RSUs and all that. Nope, cash comp and deferred comp are for suckers. Just ask JPM's Jamie Dimon.

What I’ve done is go through every SEC Form-4 (this is the form that corporate insiders must file whenever they buy or sell stock) for the four current CEOs of the Big 4 airlines. Each of these guys has more than a hundred Form-4s, and each of them has to evaluated by hand. It’s a chore, and I think that it is intentionally made to be a chore (but that’s a note for another day). If you want to check my work, the SEC filing numbers are: Doug Parker (0001249552), Ed Bastian (0001289878), Gary Kelly (0001027716), and Oscar Munoz (0001237371). In all cases, I’ve combined personal holdings and family trust holdings. I’m not including all the stock-based comp these guys have received from other companies (board seats), and I’m just going back to the start of these financialization/buyback strategies in 2014.

For each CEO, I’ve compiled a comprehensive list of every share of stock in their company that they’ve sold (and the price they sold it for), every share of stock they still hold, and the price at which they’ve acquired the stock that they have sold or currently hold (usually the acquisition price is $0, but occasionally they exercise an option). Notably on that last item, there are ZERO examples of any of these CEOs buying stock in their own company in the open market. ZERO.

From these three data points (value of stock sold, value of stock held, cost of stock sold and held), we can construct the total profit each CEO has made on their stock transactions in their respective company. Realized stock sales + unrealized stock sales – cost basis = total stock-based value received.

Here’s the compiled data.

I know that I just said each of these guys was another Dennis Muilenburg, but that’s not really true, is it? When it comes to management self-dealing and enrichment, no one tops Doug Parker of American Airlines (although Ed Bastian of Delta seems intent on making up for lost time). I do not think it’s an accident that Doug Parker is not only the CEO of American, he is also Chairman of the board.

You’re not reading this chart wrong. Doug Parker has pocketed more than $150 million through his sale of 3.6 million shares in American Airlines. These sales were particularly egregious in 2015 – 2016, not coincidentally the period of American’s greatest stock buyback activity. How egregious were the stock sales? For a twelve month period from mid-2015 through mid-2016, Doug Parker pocketed between $4 million and $11 million in stock sales per month. How large were the stock buybacks? Two-thirds of American’s $13 billion in stock buybacks over this six year period occurred over these same months.

Here’s another fun fact about Doug Parker. For a brief shining moment, American Airline’s stock price went above $50 in early 2018. Wouldn’t you know it, Doug just happened to choose that moment to sell 437,000 shares of stock, more than twice as much stock as he had ever sold before and almost 5x the usual size of his stock sales. Barf.

On the other hand, both Gary Kelly of Southwest and Oscar Munoz of United are way back in the rearview mirror of Parker and Bastian. I’d also point out that Gary Kelly has been CEO of Southwest since taking over from Herb Kelleher in 2008, and that Southwest has by far the least levered balance sheet of the Big 4. Interestingly enough, Southwest has also been by far the best stock market performer of the Big 4 since 2014, and American has been by far the worst. I know it sounds weird to say that $75 million in stock-based comp is a sterling example of CEO restraint, but that’s the effed-up world we live in today.

Fact #5 – The primary shareholders of the Big 4 airlines today, together owning about 25% of each company, are two professional investors – Warren Buffett’s Berkshire Hathaway and Primecap Management.

I’m just going to leave this here for the most part and not get into a long discussion about Saint Warren and the guys at Primecap. But I will say this: we must call things by their proper names.

Both Berkshire and Primecap are hedge funds. And good for them! You don’t think they are, because you don’t want to think of them that way (actually, you’ve probably never heard of Primecap), and because both firms have gone to enormous lengths to create an alternative narrative in the public eye.

Both Berkshire and Primecap are ruthless investors. And good for them! Again, you don’t think they are, because you don’t want to think of them that way (again, you’ve probably never heard of Primecap), and because both firms have gone to enormous lengths to create an alternative narrative in the public eye.

If the tables were turned and Berkshire or Primecap were in the government’s position of dictating terms to the airlines and their shareholders, my promise to you is that they would either wipe out the common shareholders entirely or dilute them into oblivion. I promise.

And good for them.

Capitalism is red in tooth and claw, and Berkshire and Primecap are two of the biggest, hungriest tigers in that jungle. Sure, they’ll take your bailout if you give it to them. But they do not deserve it. Seriously. Please.

So those are the pertinent facts here. As I see it, anyway. So what do we DO with those facts?

There are 1,001 ways in which the government can structure the necessary financial rescue of the necessary airline industry.

The rescue structure we choose should not reward these self-dealing management teams or the hedge fund investors who support them.

Here’s my suggestion for how this can work.

First, impose regulated caps and clawbacks on ALL senior management compensation, including stock-based compensation, for the next decade, regardless of how quickly any loan support is repaid. If these guys aren’t willing to work for $1 million or $2 million dollars per year in total comp, I’m sure we can find a perfectly good replacement CEO who will.

Second, the current board Chair for each airline should be summarily dismissed and replaced by an independent director appointed by the government. This is also a 10-year right that the government maintains, regardless of how quickly any loans are repaid.

Third, require each airline to raise new equity capital in the open market dollar-for-dollar to whatever low-interest loan facility is backstopped or made available directly by the US government. In other words, if Delta wants access to $10 billion in loans, they must raise $10 billion in new equity at whatever price the market demands to clear the equity raise. We require banks to maintain a certain level of equity capital, because we’ve judged them to be too strategically important to fail. Let’s do the same for the airlines.

Fourth, until the loan facility is repaid in full, no stock buybacks and no dividends. Duh.

I’m not naive enough to think that the bailout is going to go down the way I’m suggesting here. Oligarchs gonna oligarch. Mob bosses gonna mob boss.

But all the same I think you may be surprised what can happen if we lift our voices here. I think you may be surprised what can happen if we HOWL, if we raise holy hell about the inequity of bailing out the effin’ Doug Parkers and the effin’ Warren Buffetts of the world … again. All of these guys, and particularly Warren Buffett, play a mean meta-game. They’ll get a sense of where the political wind is blowing and move over to get in front of it. If we blow hard enough.

I believe that our nation’s response to CV-19 will be our finest hour. I believe that no nation mobilizes for war better than the United States, and I believe that this airline bailout must be implemented as part of that wartime mobilization, not as part of the I-got-mine-Jack wealth inequality Zeitgeist of the past ten years.

It’s time for all of us to Do The Right Thing. Even airline CEOs. Even Warren Buffett.

Bailout the airlines and their rank-and-file employees? You bet.

Bailout the CEOs and Warren Buffett? Not a chance.

Disney actually seemed to think everybody would welcome or understand them giving people enough time to change or cancel vacation plans or not have to cancel them. This is the Trump approach, head in the sand combined with greedy obstinance.