Do Stock Market Fundamentals Matter Yet - Or Ever?

The market has finally followed through on the pullback we were expecting to the 2335 region from 2400 on the S&P 500 (SPX), as we have outlined. The structure of the market over the coming week will likely tell us when the next 200-point rally to 2500SPX takes hold.

This past week, I read an article by a writer that has been decidedly bearish the stock market for quite some time. In his latest missive, he reiterated his position that the stock market is disconnected from the fundamentals of real world dynamics. And, then I read another article stating outright that this market is dangerously overpriced.

They seem to be no different than most analysts today claiming that the market is not being driven by fundamentals at this time. And, yes, I simply love that statement. It just makes me chuckle every time I hear it. It is no different than saying that the steering wheel is not driving a remote-control car. Well, of course, it isn't. It never has.

As Jeff Miller appropriately summed it up in his recent update: "Most pundits, media, "smart money," experts on valuation have been completely wrong for many years."

This situation also reminds me of one of Keynes's best lines: "Markets can stay irrational longer than you (the shorts) can stay solvent."

The problem is that most market participants and analysts view the stock market from a purely mechanical standpoint. The common belief is that if a certain event happens, then there must be a specific stock market reaction to that event. And, as we all know, this firm belief in "exogenous causation" (as termed by Robert Prechter in his latest work "The Socionomic Theory of Finance") is strongly held by almost all market participants. Here is an example of how a recent financial television show expressed its expectations based upon exogenous causation (mind you, this show has been wrong about every other major market move in the last two years based upon exogenous causation):

The problem is that market movement based upon exogenous causation is simply not true if you review market history, rather than hold fast to a commonly held market fallacy.

We have had some resounding real world examples over the last two years to poke some significant holes in the exogenous causation perspective. Remember back to the Charlie Hebdo attack in France, the Fed rate hike in December of 2015, the certain "crash" calls in February 2016, Brexit, Trump, the Fed rate hike in December 2016, etc. We have experienced many news "shocks" which were supposed to cause serious damage to the market over the last several years. Yet, the market was still able to provide us with a 600 point rally up to 2400SPX from February of last year, and this is all AFTER the Fed stopped QE.

In a 1988 study conducted by Cutler, Poterba, and Summers entitled "What Moves Stock Prices," they reviewed stock market price action after major economic or other type of news (including major political events) in order to develop a model through which one would be able to predict market moves RETROSPECTIVELY. Yes, you heard me right. They were not even at the stage yet of developing a prospective prediction model.

However, the study concluded that "[m]acroeconomic news bearing on fundamental values explains only about one-fifth of the movement in stock market prices." In fact, they even noted that "many of the largest market movements in recent years have occurred on days when there were no major news events." They also concluded that "[t]here is a surprisingly small effect [from] big news [of] political developments . . . and international events."

In 2008, another study was conducted, in which they reviewed more than 90,000 news items relevant to hundreds of stocks over a two-year period. They concluded that large movements in the stocks were NOT linked to any news items: "Most such jumps weren't directly associated with any news at all, and most news items didn't cause any jumps."

For those that have been looking for that elusive stock market crash for the last two years, has any of the reality of the market made you question your thesis about news, fundamentals or "real world dynamics" controlling the market?

But, no matter how many times investors see evidence that the market is not as mechanical as they believe, they simply shrug it off by claiming that "the stock market is just not trading based upon the fundamentals at this time." The question one has to ask themselves is if the market continually does not make sense based upon fundamentals, why would you not change your premise to something that consistently does make sense?

Consider a recent study of 2600 investment recommendations made by technicians and fundamentalists. The conclusion of the study stated: "Technicians display stock-picking skills, while fundamentals reveal no value."

In an article by Caroline Baum in Bloomberg on September 15, 2010, entitled "Rearview Mirror Is Where Economists See Future," she termed a forecast based upon fundamentals a "Hindcast."

Within the same article, she quotes Bob Barbera, chief economist at Mt. Lucas Management Co., as saying "allowing the pace of economic growth in the last three to six months to dictate the next three to six months beats most forecast - except when it matters."

That is an amazing statement if you take the time to understand it. It means that using fundamentals to attempt to forecast the future only works in a trend. It will never be able to identify a trend change, which is "when it matters." Ultimately, this suggests that following fundamentals is no different than following a trend channel. As long as the trend continues, the fundamentals will seemingly be aligned with the market. But, once the price trend ends, the fundamentals are usually still entrenched in the prior trend for quite some time.

In fact, most analysts' forecasts lag the market by as much as a year. This is simply due to the nature of the linear extrapolation in which most analysts engage when coming up with their "hindcasts," er, I mean forecasts.

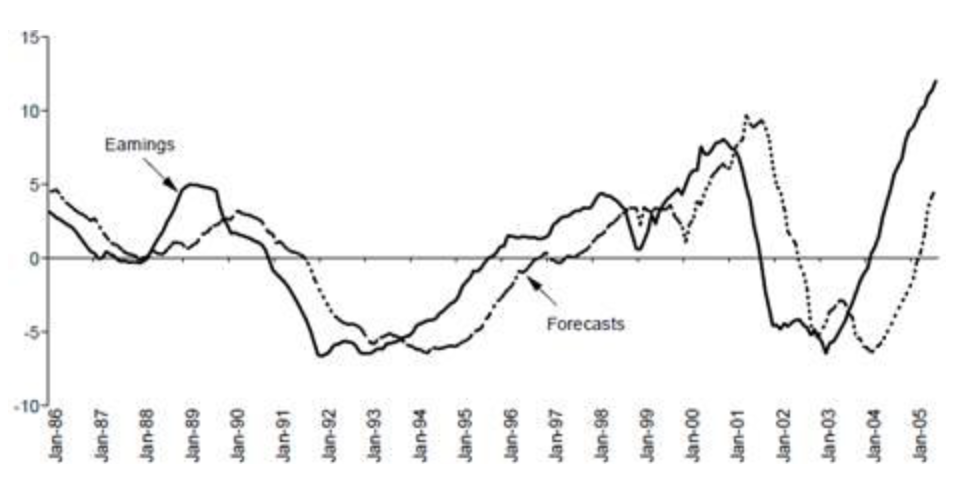

(Click on image to enlarge)

James Montier, who published this chart, commented: "The chart makes it transparently obvious that analysts lag reality. They only change their minds when there is irrefutable proof they were wrong, and then they change their minds very slowly."

In a paper written by Professor Hernan Cortes Douglas, former Luksic Scholar at Harvard University, former Deputy Research Administrator at the World Bank, and former Senior Economist at the IMF, he noted the following regarding those engaged in "fundamental" analysis for predictive purposes:

The historical data say that they cannot succeed; financial markets never collapse when things look bad. In fact, quite the contrary is true. Before contractions begin, macroeconomic flows always look fine. That is why the vast majority of economists always proclaim the economy to be in excellent health just before it swoons. Despite these failures, indeed despite repeating almost precisely those failures, economists have continued to pore over the same macroeconomic fundamentals for clues to the future. If the conventional macroeconomic approach is useless even in retrospect, if it cannot explain or understand an outcome when we know what it is, has it a prayer of doing so when the goal is assessing the future?

As Dr. Cari Bourette, of MarketMood.com, has noted to me, "maybe we should leave the fundamentals to economists and allow them to analyze the markets in their ivory towers, as they truly seem to be detached from the reality of the market. And, if you want to understand where the market is going, find a good trading tool (hint: not FA)."

So, to answer the question with which we began this discussion, at the end of the day, it seems the author I cited at the start of this article may be partially right. The stock market is certainly disconnected from fundamentals, and it will always be so at major turning points. Fundamentals have proven to lag the major turns in the market, in other words, "when it matters."

Ultimately, I think that any analyst that believes fundamentals represent "real world dynamics" is clearly "detached from the reality of the markets," as noted by Dr. Bourette. It would also make sense why those following fundamentals have been completely flummoxed by the stock market action for the last year, as Jeff Miller clearly points out. You see, market sentiment has clearly trumped fundamentals, and has been steering the remote-control car, yet, no one seems to be looking there.

For those that have followed me for years, you know that we analyze market sentiment to identify potential turning points in the market. And, it told us to be looking to the long side back in February of 2016, and it had us targeting the 2537-2611 region in the S&P 500 over the longer term.

(Click on image to enlarge)

Moreover, when we pulled back into the early November timeframe, we confidently wrote that we expected the market to strongly rally NO MATTER WHO WON THE ELECTION.

We have not been held back by any exogenous causation theories about the market, and it has kept us on the straight and narrow for years. Nothing the market did provided us any "head-scratching" moments, as market sentiment was our guiding light, rather than news or fundamentals.

Those that read me regularly know that we were expecting this pullback from the 2400SPX region. In fact, our ideal "initial" target was the 2335SPX level, which was struck this past week.

Within corrective structures, the market can often take many "unexpected" twists and turns, so I will spare you any detailed explanations of how we see things, and just provide you the meat of what we expect in the coming week or two.

As long as we hold the 2320SPX region, I am going to expect the market to rally, and potentially even make a higher all-time high. However, the specific fractal structure of that rally will tell us if we have begun our next 200-point rally to 2500+, or if it is only setting us up for one more drop in April before we begin that rally to 2500SPX. At this point in time, I cannot be certain how the smaller time frames will play out until we see the next rally structure.

Any break in the coming week below the 2320 region may suggest we test our support zone sooner rather than later. However, my preference is to see a rally first.

As far as our longer-term projections, we still remain steadfast that the market will rally to the 2500SPX region. As you can see from the attached charts below, we have significant support below the market at this point in time. And, as long as we remain over that support, the market is still in a strongly bullish posture, at least until we complete the fractal structure we have been following in almost textbook fashion, which has been pointing to levels over 2500SPX for years. That means that we expect at least one more higher high over 2500SPX, and preferably two, which can take us into late 2017, or even early 2018.

See chart illustrating the wave counts on the S&P 500:

(Click on image to enlarge)

(Click on image to enlarge)

(Click on image to enlarge)

Avi Gilburt is a widely followed Elliott Wave technical analyst and author of ElliottWaveTrader.net ( more

Good read, thanks.