Do As Buffett Does, Not As Buffett Says

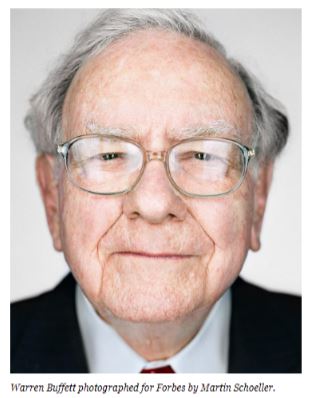

The majority of investors will recognize this man and have at least a general understanding of his investment approach – buy great businesses at a reasonable price. Following this strategy, Warren Buffett, CEO, and Chairman of Berkshire Hathaway (BRK-A )(BRK-B) has become one of the most successful investors, stock pickers, and asset allocators of all time. Almost anything Buffett says regarding investing is published in mainstream financial news everywhere. There have been over 50 books published discussing Buffett’s life and his investment philosophy, and tens of thousands of people flee to Omaha, Nebraska every year to hear Buffett and his counterpart, Charlie Munger, speak for hours at the Berkshire Hathaway Annual Shareholders Meeting.

One of Buffett’s most famous quotes is, “[I] simply attempt to be fearful when others are greedy and to be greedy only when others are fearful." This appears to be the philosophy he is following with his portfolio currently, but not quite what he is telling the public.

Buffett has told multiple financial news outlets that he believes stocks are reasonably priced, given current interest rate levels. According to USA Today Buffett said, “low borrowing costs have been a ‘powerful factor’ in equities values.” Similar quotes have appeared in the Wall Street Journal, Forbes, Yahoo! Finance and CNBC. On CNBC’s Squawk Box in October Buffett stated, “[Stock] valuations make sense with interest rates where they are. In the end, you measure laying out money for an asset in relation to what you’re going to get back, and the number one yardstick is U.S. government [bonds].” All of Buffett’s recent interviews have had a similar premise. However, if you look at Berkshire Hathaway’s most recent quarterly filing and annual shareholder letter, his portfolio asset allocation would prove otherwise.

As of September 30, 2017, Berkshire Hathaway has $109 billion in cash and cash equivalents on their balance sheet. This is up approximately $10 billion from their June 2017 10-Q filing, and up about $24 billion from their cash holdings just a year ago as of their September 2016 10-Q filing. According to The Motley Fool, “Buffett has said that he prefers to keep at least $20 billion on hand, so this represents nearly $90 billion of excess capital.” In his most recent annual shareholder letter, Buffett wrote, “every decade or so, dark clouds will fill the economic skies, and they will briefly rain gold. When downpours of that sort occur, it’s imperative that we rush outdoors carrying washtubs, not teaspoons. And that we will do.”

Sure, once you reach the size of Berkshire Hathaway it is difficult to deploy that much capital. But, more cash could certainly be invested if Buffett felt there were bargains to be found.

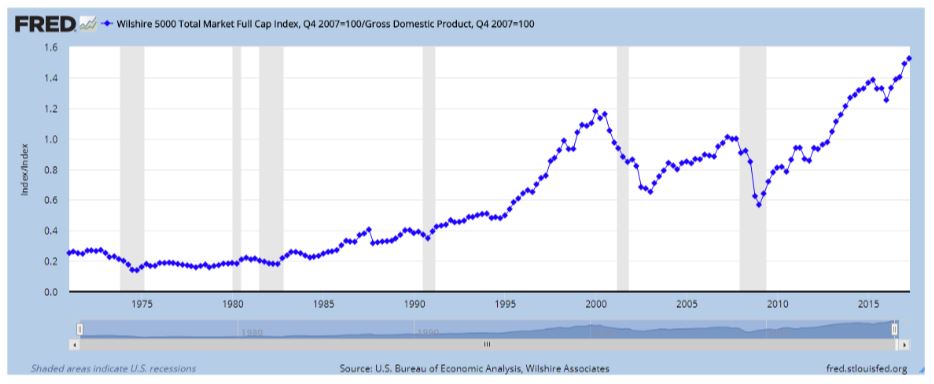

One of Buffett’s favorite valuation metrics is the total market capitalization of all publicly traded companies in the US, as measured by the Wilshire 5000 Index, versus the US GDP. The higher the percentage, the more overvalued the market is as a whole. The Federal Reserve Bank of St. Louis publishes this data and ratio in a graph format, based on data from US Bureau of Economic Analysis and Wilshire Associates. This chart can be seen below.

(Click on image to enlarge)

As you can see, markets are currently at valuation levels never seen before for US equities (VTI) (USMV) (ITOT) (SCHB) (IWV) (SPY) (DIA) (QQQ). It is very likely Buffett knows this current relationship and is watching it closely.

It would appear that Buffett is piling away cash; “being fearful when others are greedy,” and preparing for “dark clouds to fill the economic skies.” By saving as much as cash as possible now, Buffett will have more capital to deploy at significantly lower valuations, if and when the market has a downturn. He is known for not participating in irrational markets, as he avoided much of the destruction during the Dot Com Bubble and the Housing Crisis; is Buffett now doing the same thing? Is he avoiding US equities at these valuations?

Why would Buffett tell mainstream financial news outlets one thing, and do the opposite?

Stocks receive significantly higher valuations when interest rates are low, as individuals are forced to look at riskier assets – stocks – in low-interest environments in order to receive any substantial gains. With the Federal Reserve artificially keeping interest rates historically low, stocks have traded at abnormally high valuations as this bull market charges on for 8-9 years and counting. Buffett is a long-term bull, as he has said that betting against American business is a losing game. It is unlikely he has doubts about American businesses in the long-term, but it would seem that he has doubts of current interest rate levels remaining this low for much longer. He has famously said that he’d prefer to know future interest rates over any other financial metric when trying to determine where equity prices will go. It seems Buffett is expecting the Fed to raise interest rates quite a bit higher than they are now, which could deflate US equity prices, and provide him more, and better, opportunities to deploy the capital he has been saving.

What does this mean for other investors? Although it is very difficult to reliably time the market, investors may want to consider taking some profits off the table, lower their US equity exposure and start building a significant cash position. Similar to Buffett, if you have large gains that would have tax implications, you may want to consider holding those positions. For example, Buffett will likely never sell his positions in Wells Fargo (WFC), Kraft Heinz (KHC), Coca-Cola Co. (KO), and American Express (AXP) because he’d have a significant tax bill. If you’re in a tax-deferred retirement account, you may consider selling overvalued positions and holding the capital until better opportunities arise (consult a tax professional for specific advice). It is likely that markets will have a correction in the near future, providing investors with a much better investment opportunity. At this point, you will be able to use the large cash position you have saved, as Buffett is doing, but unlike he is recommending. This situation also provides investors with a reminder that we must always think deeper than just the financial news headlines.

Disclosure: Everything included in this article is not to be taken as investing advice because we are not investment advisors. Also, we have not considered your specific situation as your fiduciary. ...

more

I always try to emulate #Buffett when investing. No one knows the market better.

What're your thoughts on his current actions versus what he's telling the media?

Equity valuations are definitely out of line with reality I can definitely understand why #Buffet would be skeptical about deploying capital in this market.

But why tell people one thing, and then do another?

Charles, my question exactly.

Absolutely - I just found in interesting that he'd be telling news outlets one thing, and doing something different.

It's easy to see what #Buffett is saying. How do we find out what he's privately doing in reality?

You can view Berkshire Hathaway's filings with the SEC, or other internet sources that provide this information. I personally really enjoy using www.dataroma.com

Thanks Robert!