Despite CPI Surprise To The Downside, Higher For Longer Interest Rate Outlook Holds

Interest rate odds still imply no rate cut by the Fed until March of 2024 despite year-over-year CPI inflation falling to 3.0 percent.

Higher for Longer

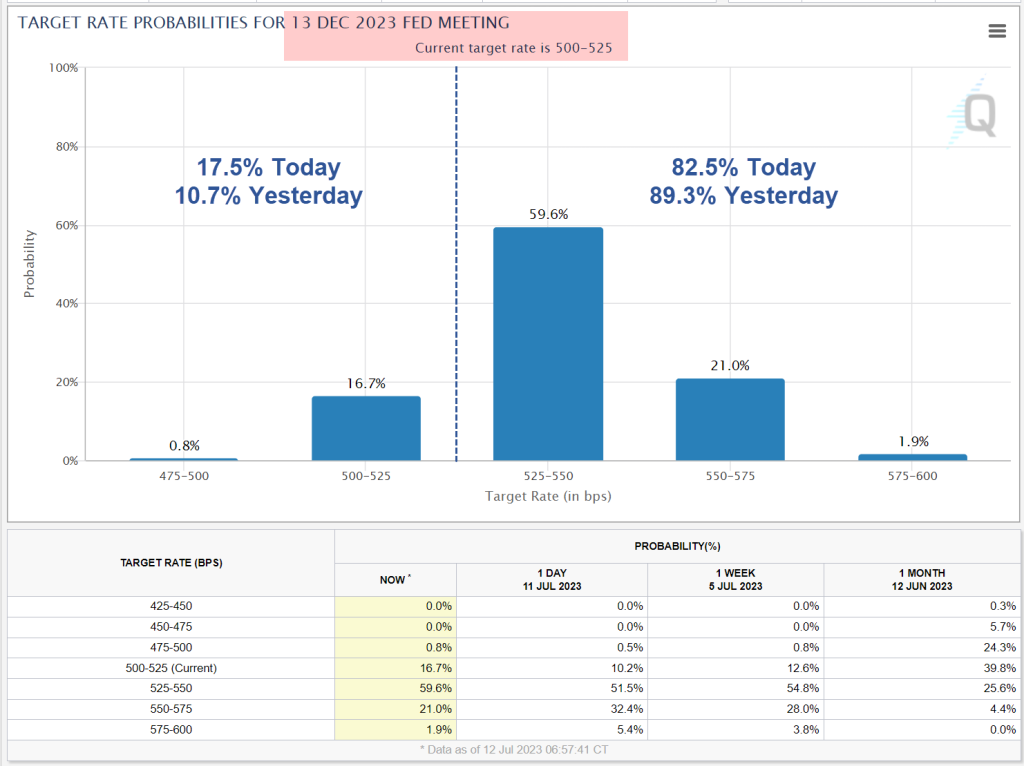

According to CME Fedwatch, the first rate cut will not be until March of 2024. CME data represents the futures and options positioning of traders. Only recently did the Fed’s message of higher for longer sink in.

The above chart is for the December 13 FOMC meeting. It is little changed from yesterday, despite rapid cooling in the year-over-year increase in the CPI.

CPI Year-Over-Year

In May, the year-over-year increase was 4.0 percent. This month, the year-over-year increase fell to 3.0 percent according to the BLS.

This is the smallest 12-month increase since the period ending March 2021.

Year-over-year CPI data from the BLS, chart by Mish

Weighted Average CME Interest Rate Projection

Data from CME Fedwatch, calculation by Mish

Steady Until March 2024?

Compared to a month ago, two months ago, even 4 months ago, expectations of rate hikes kept increasing. Not until March of 2024, does CME data reflect a rate cut.

Yesterday, the weighted average expected rate for March of 2024 was 5.26. Today, it’s 5.15 percent. That’s a change of less than an eighth of a point.

Nonetheless, it’s about a quarter-point cut vs the September and November outlook.

CPI Month-Over-Month

CPI data from BLS, chart by Mish

The CPI Broken Record Continues, Rent Keeps Rising, Otherwise Inflation Is Cooling

Two things on the Fed’s mind are the core rate of inflation (all items excluding food and energy) and rent. Both have proven stubborn.

Despite constant talk of falling rent prices please note that Rent of primary residence has gone up at least 0.4 percent, every month for 23 straight months!

The falling rent meme has been wrong for at least a full year.

For more details and discussion, please see The CPI Broken Record Continues, Rent Keeps Rising, Otherwise Inflation Is Cooling

What the Fed thinks it can do about rent remains a mystery. My guess is that the Fed is going to overshoot and it’s likely to be sudden. Timing unknown.

More By This Author:

Global Export New Orders Fall 16 Straight Months Led By Goods

The CPI Broken Record Continues, Rent Keeps Rising, Otherwise Inflation Is Cooling

Spotlight On Mortgage Rates: Where Are They? Where Are They Headed?

Disclaimer: The content on Mish's Global Economic Trend Analysis site is provided as general information only and should not be taken as investment advice. All site content, including ...

more