Deregulation Of Dodd-Frank Is Causing Mortgage Credit Expansion

“Davidson” submits:

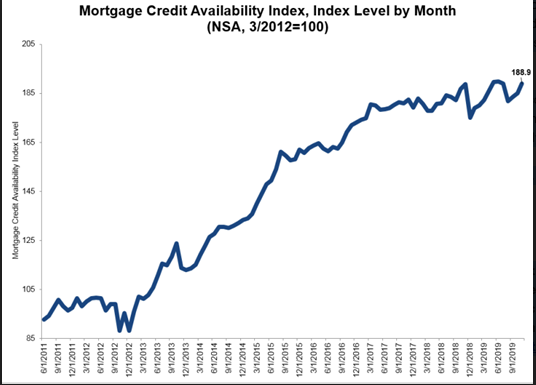

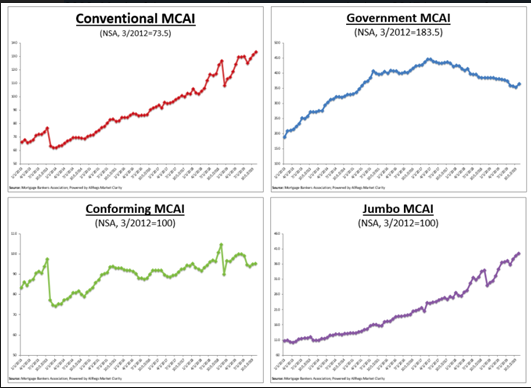

The MCAI (Mortgage Credit Availability Index) is reported at 188.9. May 2019 was the previous high reported at 189.5. Since then we experienced a sharp yield curve inversion when global capital shifts drove 10yr Treasury yields dramatically lower resulting in a sharp drop in MCAI to 181.7. Despite the negative T-Bill/10yr Treasury yield spread of 0.51% slowing lending activity, we have seen a decent recovery in MCAI which appears poised to reach new highs this cycle. Recent policy initiatives by the current administration began this summer and implemented new rules meant to lessen onerous Dodd-Frank restrictions which had treated traditional community lenders and Money Center banks alike. That we are seeing this effect is inferred by the rise in Conventional MCAI despite a still very narrow 0.25% spread between T-Bills and 10yr Treasury yields which historically force lending to slow dramatically.

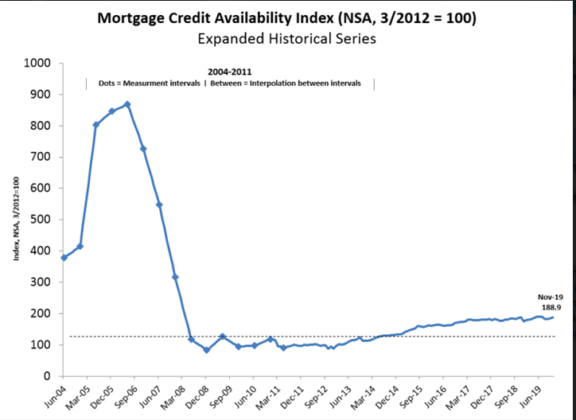

The MCAI is shown for the current cycle from its first publication in 2012. The historical data on which it is based begins June 2004 and indicates we are still roughly 50% below a normal level of 400 last seen in 2004 prior to the explosion in lending leading to the Sub-Prime Crisis of 2008-2009. Much of the current robust economic growth since 2017 has come from a combination of tax cuts and the drop of Federal regulation of 31%. A similar impact was witnessed in the Reagan Miracle economy when he reduced the Federal regulatory burden by 41% over 8yrs. The current administration has already achieved a 31% in 2yrs. The next Federal Register report is Jan 2020 and likely to reveal additional deregulation.

(Click on image to enlarge)

(Click on image to enlarge)

(Click on image to enlarge)

It is important to note that eliminating excessive regulation provides substantial economic stimulus and is likely to reduce governmental cost. It is much more cost-effective for regulation reduction than to attempt to stimulate economic activity via additional government spending which requires additional taxation. The importance of policy actions of this type are widely missed in economic forecasts.

Regulation reduction is the best cost-effective fiscal stimulus in my opinion. Economic expansion is likely to continue followed by higher equity prices.

EXTRACT FROM THE CURRENT MCAI REPORT:

“Credit availability rose for the third straight month in November, with an increase in supply across all loan types,” said Joel Kan, MBA’s Associate Vice President of Economic and Industry Forecasting. “Most notably, the jumbo index climbed to yet another record high, as investors increased their willingness to purchase loans with lower credit scores and higher LTV ratios. Additionally, the government index saw its first increase in nine months, driven by streamlining refinance programs.”

Disclosure: The information in this blog post represents my own opinions and does not contain a recommendation for any particular security or investment. I or my affiliates may hold positions or ...

more

Interesting. It seems like building is increasing, but that may or may not affect equities if holiday sales are weak.