Deep Tariff Angst – Where Now For US Rates?

Image Source: Pexels

Some weeks back, we identified some key drivers for lower Treasury yields. This update brings in tariffs as the latest influencer. They are forcing yields further lower, with likely more to come. But tariffs are a double-edged sword. There are perception risks to take into account, too. This thing could easily swing in the other direction in due course.

The mood music for the US rates changed a few weeks back and has only intensified since

A few weeks back, we alerted to a change in the mood music for US Treasuries. We pointed to unexpectedly assertive Department of Government Efficiency plans and Treasury Secretary Bessent's open and clear preference for a lower 10-year yield. It's here. Since then, we've moved deeper into the tariff-walled regime that the Trump administration has consistently championed, all the way from the ballot box to actual policy enactment post-inauguration. There should be no surprise that this is happening, as it was promised. But still, actual application is quite the eye-opener.

As the markets think this through, there is a clearer realization that tariffs are not just transactional. They in fact need to be applied in a structural sense, else there is no credible stick to beat the external manufacturing sector with. Also, the revenue-generating aspiration is only a thing where tariffs go on and stay on. This can be negated by future events. But based off what we see to date, this is the only logical way to view the unfolding saga.

The consequent sell-off in risk assets makes complete sense given this uncertain backdrop, and especially as that cloud of uncertainty shows no signs of let up.

The impact reaction is for lower Treasury yields

In a way, Treasuries don’t know what to do with themselves here. Additional tariffs on Canadian imports (just announced), and more threatened from 2 April, have acted to intensify the war of words between the two. It’s also an illustration of what’s to come elsewhere, including Europe. US Treasuries see the price rise and inflation threat front and center, which is a rationale for higher yields. However, they also see the threat to economic activity as at least an intermediate factor. This latter effect is given further urgency through the associated sell-off in risk assets. This allows Treasuries to park the inflation risk and really focus on the growth threat. This translates to downward pressure on yields.

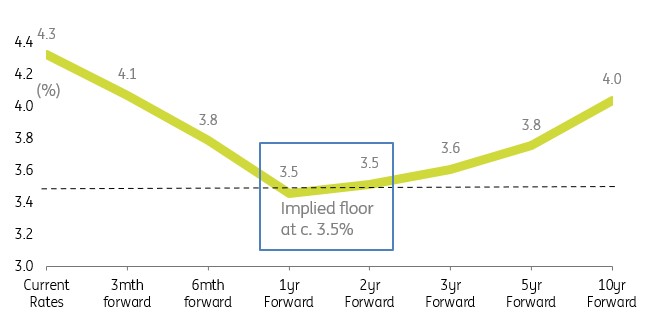

The 10-year has an excuse to head towards 4% (versus 4.2% currently) based off this. However, there are two key constraints to the downside for yields. The first is the expectation for the Fed funds rate into the future. Right now, that floor is in the range of 3.25% to 3.5%, and the 1-month SOFR rate floors at 3.5%, as can be gleaned from 1-year and 2-year forward rates. On top of that, we must add the swap spread in the 10-year, which is currently at around 45bp. That places an implied all-in rate in the area of 3.95%, which is only just below are aforementioned 4% target for the 10yr yield.

In turn, it makes it difficult for the 10-year yield to get below 4% unless the 3.5% floor gets shunted lower. That could happen should we get closer to an actual recession. But barring that, the downside potential for longer tenor yields is limited. Put another way, the current forward profile already discounts at least 75bp of rate cuts. So we'd need much more rate cutting in order to get the 10-year yield materially lower.

1-month SOFR rate "floors" at 3.5% in 1-year to 2-year forward space

Current market discount

Source: ING Estimates, Macrobond

But note that things can easily swing in the other direction

Now, here's where things get a tad more complicated. There will, in all probability, be a subsequent negative kickback for Treasuries coming from a more elevated inflation risk. Higher prices erode the value of fixed rate coupons, whether the Fed cuts or not. Right now, Treasuries are not focused on this, as the risk-asset-sell-off acts to focus minds on activity worries. But down the line, and certainly in the current calendar year, the impact on consumer prices will become a factor to take into account. And that's not good for Treasuries.

And there is another important factor – the notion of "America PLC" as a credit and the perception of it thereof. While the US dollar has global reserve status and US Treasuries are seen as the global benchmark, there is material support. It's (in part) why the US can run a large fiscal deficit and not get overly punished by the markets. In all probability, this will remain a net positive for US products.

That said, there have been some creaking negatives. The first is the re-widening in the US swap spread (10-year Treasury trading cheaper versus 10-year SOFR) – we read that as credit negative. And second, the emergence of a negative basis (albeit mild) is now attached to the USD leg on the cross currency swap versus EUR. This latter aspect is a quirky one, but still one to keep an eye on. A USD basis premium had been the norm versus EUR, reflecting, in a way, a USD gloss.

These aren’t big moves but can prove to be a metaphor for trouble. We've been considering whether we should take away our medium-term call for 5% on the 10-year Treasury yield based on the price action of recent weeks. But on balance, we've decided to leave it there, at least for now, based on some of the thinking above.

Still tactically bullish on Treasuries as a call

But let’s not confuse the overall message. Right now, the knee-jerk should be bullish for Treasuries. We've also identified a floor and how that floor could in fact shift lower.

But you can see how this could also flip the other way. Timing on the latter bit is not easy.

Practical to stick with Treasuries as a safe haven, at least for as long as that tag is applicable.

Macro backdrop points to sharp pick-up in near-term inflation

From an overall macro perspective, the Administration’s view is that tariffs don't cause inflation. The rationale being that they expect the dollar to appreciate by similar amounts to the rate of the tariff, which would leave the USD price of the imported product unchanged – the foreign country that exports to the US experiences a weaker currency so pays through a loss of purchasing power. You can just about justify that if it was 10% tariffs and the USD appreciated 10%, which was the story at the start of the year. However, with 25%-50% tariffs, we are in a very different situation, and with the dollar now, in fact, falling against most currencies, the mathematics simply don't work. Instead, there is the very real threat of substantially higher imported costs that translate into a combination of tighter US corporate profit margins and higher prices for consumers.

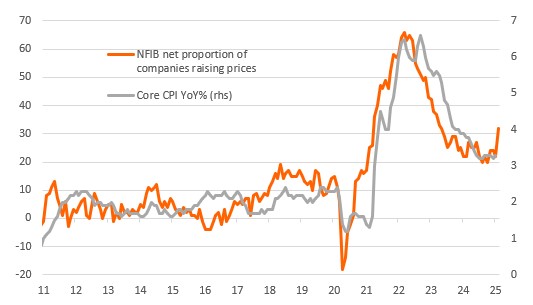

The Federal Reserve's Beige Book, published last week, stated that "contacts in most Districts expected potential tariffs on inputs would lead them to raise prices, with isolated reports of firms raising prices preemptively." This was confirmed by the latest data from the National Federation of Independent Businesses (the US small business sector), which showed a 10-point drop in the proportion of firms that expect business conditions will be better in six months' time, with a 10-point jump in the proportion of firms raising prices. The chart below shows that this is a worrying shift that points to a renewed pick-up in core inflation towards 4%, well above the Federal Reserve's 2% target. In an environment where wage growth is slowing sharply (currently 3.5% year-on-year), this implies that the squeeze on household spending power is likely to intensify.

This raises the question: Will the Fed focus on the near-term inflation threat, or will it place more emphasis on the downside risks to growth that will lower medium- to longer-term inflation concerns? For now we take the view that the Fed will be reluctant to move in the near term given the jobs market is still fairly tight and the economy is expanding, but with cooling likely to become more evident in the months ahead, we do expect the Fed to respond with rate cuts in September and December.

Small businesses are hiking prices again, pointing to another inflation wave

Source: Macrobond, ING

More By This Author:

Rates Spark: The Game Of Tariff Poker DominatesHungarian Inflation Exceeds All Expectations In February

Monitoring Turkey: Easing Bias Remains Intact

Disclaimer: This publication has been prepared by the Economic and Financial Analysis Division of ING Bank N.V. (“ING”) solely for information purposes without regard to any ...

more