Crypto Trading Strategy In A Volatile Market

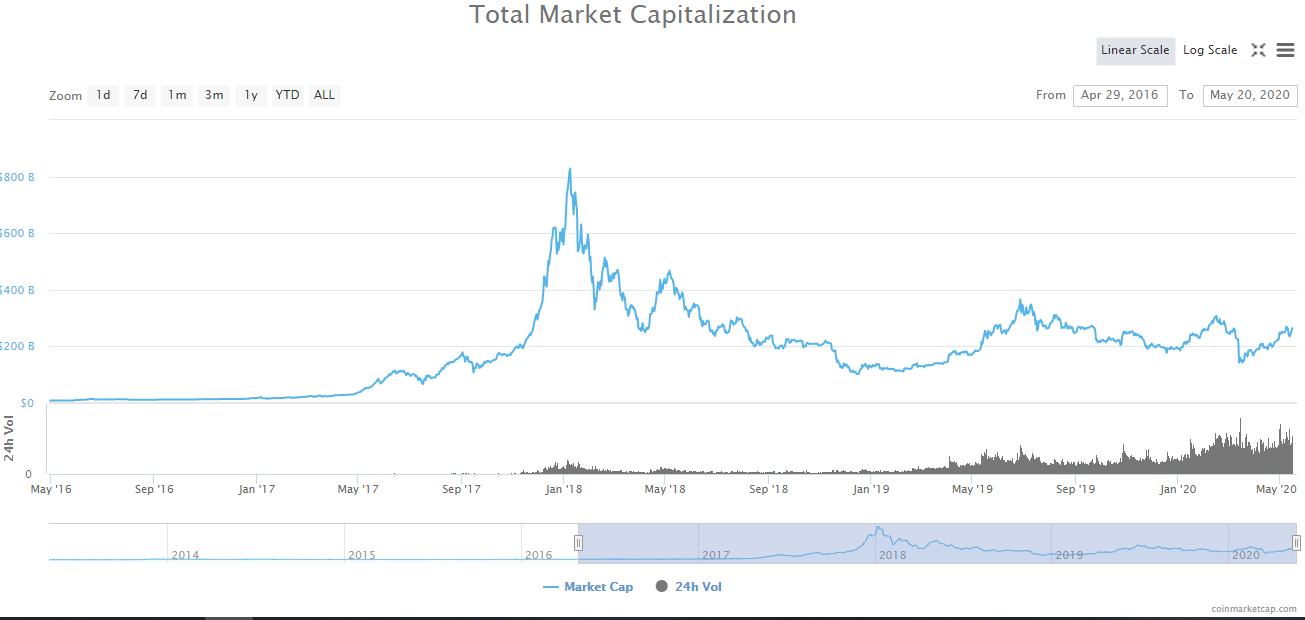

According to Statista, the cryptocurrency industry was valued at about $17.7 billion in 2016. In 2017 through January 2018 the market rallied to a value of about $828 billion only to later that year fall to $134 billion. Last year, it gained again to top $190 billion in a relatively slow period. Currently, the industry is valued at about $266.88 billion according to CoinMarketCap but a lot could change before the end of the year.

Overall, this demonstrates the volatile nature of the cryptocurrency market. The ‘buy and hold’ strategy popularized as ‘HODLing’ in the cryptocurrency space may not be ideal for all crypto investors.

The volatility of the market means that there will be significant drops in the value of investments over extended periods of time, which could be shortly followed by a sharp gain. This cyclical transition from a bull market to a bear market could continue to repeat in the foreseeable future until the uncertainties and risks that continue to circle around cryptocurrency investing are eliminated.

As such, it is important to come up with a crypto trading strategy that capitalizes on the volatility of the market while at the same time reducing the risk of loss. To successfully begin making money from a highly volatile market, it is important to point out what an effective crypto trading strategy entails.

It is imperative to consider the main factors that affect cryptocurrency trading. This guide on crypto trading for beginners has more comprehensive coverage of the topic. Next, a trader must factor in their risk threshold and capital they are ready to commit.

Factors affecting crypto market volatility

Every effective crypto trading strategy must consider government influence on the market. One of the biggest uncertainties about cryptocurrencies is regulation. There is a big debate about whether government regulation would be good or bad for cryptocurrencies. As such, every bit of news that mentions an attempt by the government influence matters in the cryptocurrency market tends to raise the level of volatility.

Volatility in the cryptocurrency market is also caused by sporadic crypto whale activity. Crypto whales are high net worth investors and institutional investors that buy and sell cryptocurrencies. When they take a position on a given currency like bitcoin, prices tend to experience huge swings within a short period. As such, it is important to watch the activity of crypto whales on relevant platforms.

Another thing that tends to cause volatility in cryptocurrencies like bitcoin is the hash rate. The correlation between bitcoin hash rate and bitcoin price is reported to be above 90% since 2018. When the hash rate goes up, the bitcoin price goes up. As such, this also can be a good item to follow when trading cryptocurrencies.

.png)

Chart via Woobull.

As demonstrated in the chart above, the price of bitcoin has followed a similar path to the hash rate over the last two years.

Technical Indicators for trading crypto volatility

Once you have identified potential items that could affect the price of a given cryptocurrency, the next thing is to focus on the technical aspect of the market. To effectively execute a crypto trading strategy, you need to consider the best volatility tracking indicators in the market.

Average True Range (ATR) and Bollinger Bands at work

This indicator measures volatility relating to price gaps or limits moves. It does not point to where the price could be heading next, but rather shows the level of volatility in the market. It is best used in conjunction with another volatility indicator, Bollinger bands.

Take for instance the price of bitcoin in the chart above. The pioneer cryptocurrency appears to have retained a consistent upward movement over the last three days. It has remained above the median Bollinger band over the period and now is pinned closer to the upper Bollinger band.

Down below, the ATR has remained well below 100. It is currently positioned at the 80th percentile, which is below average. Between May 9th and 12th, bitcoin volatility traded within the range of the 200th percentile. The higher the reading, the higher the volatility.

When you compare that to the actual price range within the Bollinger bands, it was oscillating all over the place across the three bands within short periods of time. The current ATR reading suggests that trading bitcoin long would be reasonably safe bet now than it was between 9 and 12 this month.

Conclusion

In summary, there are several strategies that traders can use to trade cryptocurrencies. Targeting strategies that focus on crypto volatility can be a good idea because as demonstrated over the years, the industry is relatively very volatile compared to other markets.

To trade crypto volatility effectively, traders must factor in both the fundamental and technical aspects of the market. And as discussed here, using the ATR alongside Bollinger bands can be a good place to start.

Disclosure: The material appearing on this article is based on data and information from sources I believe to be accurate and reliable. However, the material is not guaranteed as to accuracy nor does ...

more

One more question is about how this currency acquires actual value. "Bitcoin Miners" use banks of computers to solve equations that somehow provide "value". But how does that actually provide any benefit to any, that equates to actual WEALTH?? The fundamental basis of currency is that it is useful for exchanging wealth in a convenient manner. So where is the actual value (wealth) attached to the various currencies? The whole concept looks a lot like monitizing the wind, but perhaps not as solid.

Embracing alternative currency schemes is always a risky thing, and considering that one of the major "benefits" is avoiding government observation it appears that one major use is hiding illegal and anti-society actions. Of course there is the ability of avoiding the manipulations of the huge banking interests, and that may be the sole actual legal benefit.

I am not a fan of #cryptocurrency for precisely this reason. It enables criminals and. Additionally it can be hacked (anyone who says it can't is kidding themselves) and then you have no FDIC insurance, or any other recourse as it can not be tracked.

I am fine with digital currently which is regulated and protected, but I've never heard valid arguments by honest people on why we specifically need a cryptocurrency.

A perfect example of why bitcoin and such are needed comes from a recent hacker incident. I was threatened with extortion based on false accusations, and the instigator demanded payment in Bitcoin, which is untraceable. So it is the perfect currency for illegal activities.

Exactly. It's untraceable with no paper trail. I recently read about an entire town's computer system was hacked - no 911, etc. They were forced to may over $600,000 in ransom money and they perpetrators got away as a result.