Yen Continues To Strengthen: Hopes For A Tough Stance From The Bank Of Japan

Image Source: Unsplash

The Japanese yen continues strengthening against the US dollar, with the USD/JPY pair decreasing to 156.31, marking a near 2% appreciation over the past two weeks. This uptrend initially stemmed from significant currency interventions by the Japanese government and the Bank of Japan, with estimates suggesting the purchase of around 6 trillion yen on 11-12 July to bolster the yen.

Additionally, Japan sold approximately 22 billion USD worth of US bonds in May to fund these interventions. Recent market speculations indicate a potential interest rate increase by the Bank of Japan in the upcoming week. Toshimitsu Motegi, a senior Japanese official, has called for the central bank to communicate a clear plan for monetary policy normalization, including rate hikes, noting that the yen's excessive weakness adversely affects the economy.

Prime Minister Fumio Kishida also commented that a more transparent and stable monetary policy from the BoJ would facilitate Japan's economic growth.

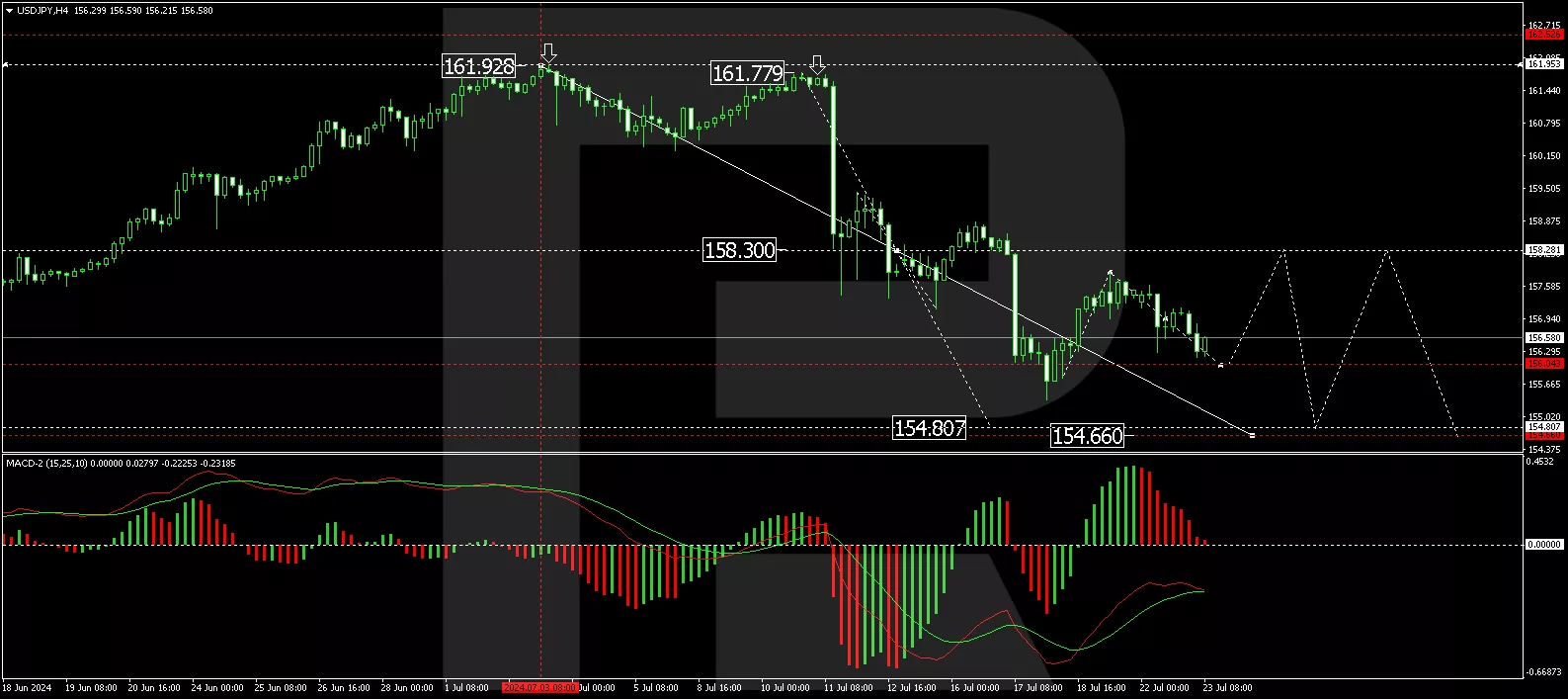

USD/JPY technical analysis

(Click on image to enlarge)

The USD/JPY pair recently surged to 157.81 but is now undergoing a correction toward 156.15. Once this correction concludes, the potential for a new growth wave up to 158.28 is anticipated. Subsequently, another decline might target 154.80, with a possible extension down to 154.66. The MACD indicator supports this bearish outlook, with the signal line positioned below zero and upwards.

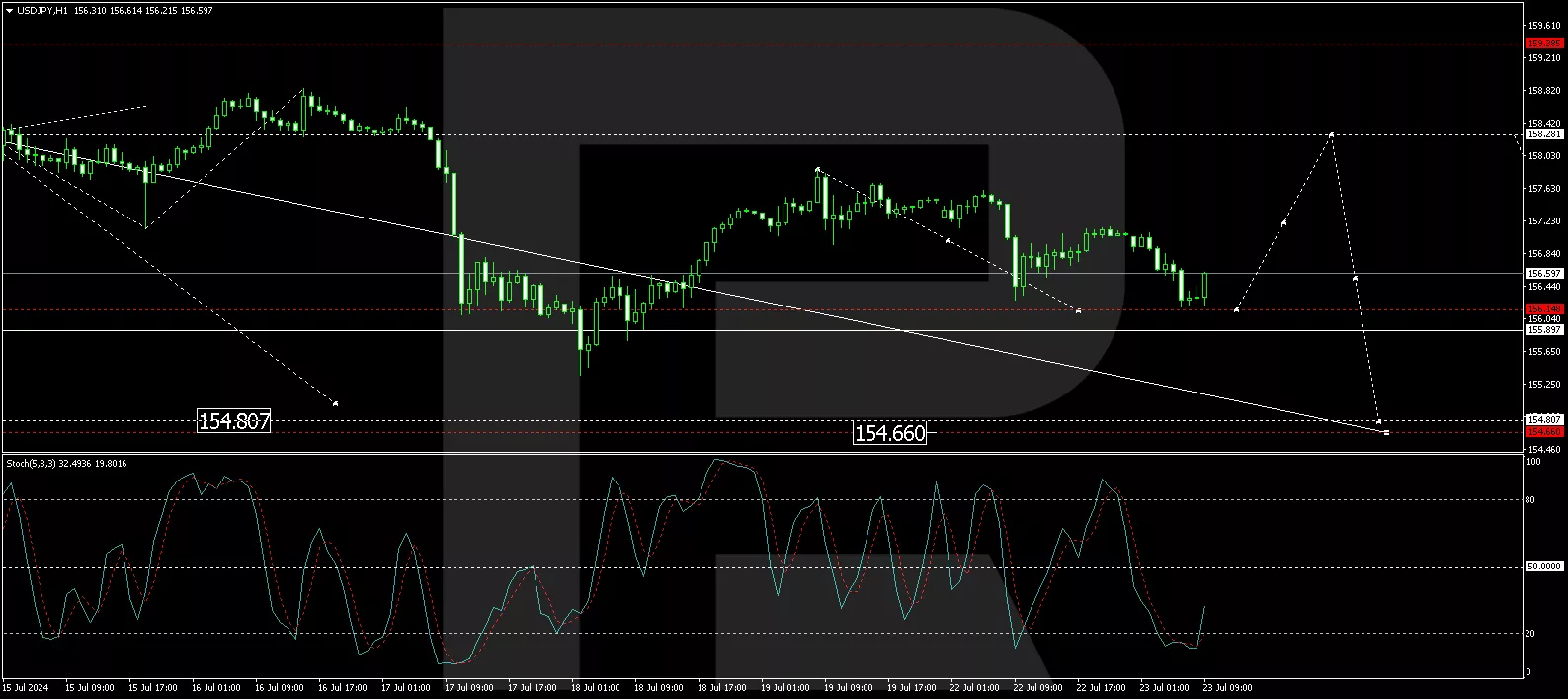

(Click on image to enlarge)

On the hourly chart, the USD/JPY is shaping a corrective wave toward 156.15. Once this level is achieved, an upward movement to at least 158.28 is expected before a potential decline to 154.80. This scenario is backed by the Stochastic oscillator, whose signal line is currently below 20 but poised to rise, indicating potential for upcoming bullish momentum.

These technical movements and macroeconomic factors highlight a period of significant volatility for the yen as the market anticipates pivotal policy shifts from the Bank of Japan.

More By This Author:

NZD/USD Faces Downward Pressure Amid US Political Developments And RBNZ Rate Speculations

EUR/USD Experiences Sharp Decline: Risk Appetite Heightens

Brent Oil Price Trends Upward Amid Positive Market Signals

Disclaimer: Any forecasts contained herein are based on the author's particular opinion. This analysis may not be treated as trading advice. RoboForex bears no responsibility for ...

more