Weekly Waves: EUR/USD, GBP/USD And Bitcoin - Monday, May 23

Our weekly Elliott Wave analysis reviews the EUR/USD 4-hour chart, GBP/USD 4-hour chart, and the Bitcoin cryptocurrency weekly chart.

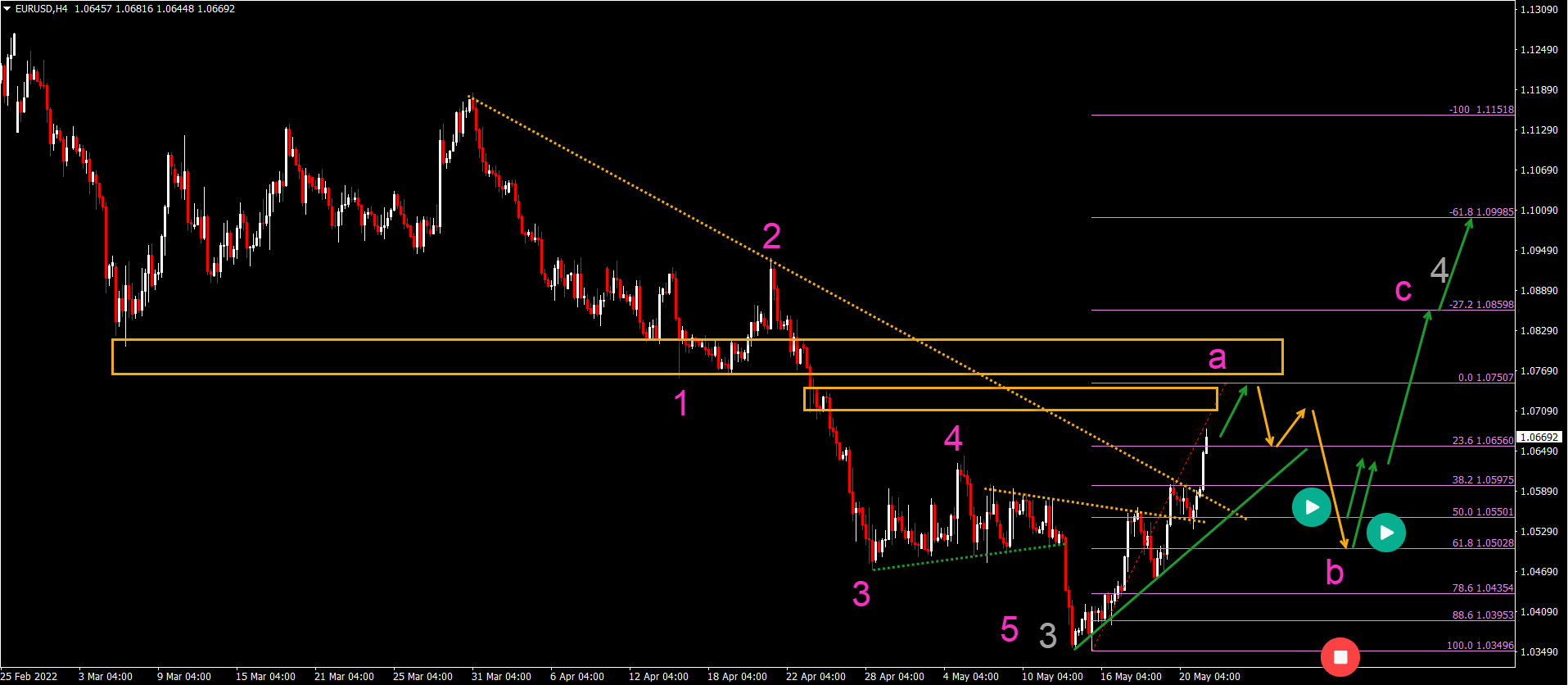

EUR/USD Aiming for 1.10 Bullish Target

The EUR/USD is breaking above the resistance trend lines (dotted orange). Let’s review what this means for the EUR/USD:

- The EUR/USD bullish breakout is indicating the end of the current downtrend and the bearish price swing (wave 3 gray).

- A bullish ABC (pink) pattern is expected. This is probably within wave 4 (gray).

- The wave A (pink) is expected to aim and stop at a resistance zone around 1.0750-1.08.

- A bearish ABC pullback (orange arrows) should take price back down again to the 50-61.8% Fibonacci support zone.

- A bullish bounce (green arrows) at the 50-61.8% Fibonacci level should see another bullish swing take price up to the Fibonacci targets as high as 1.10.

(Click on image to enlarge)

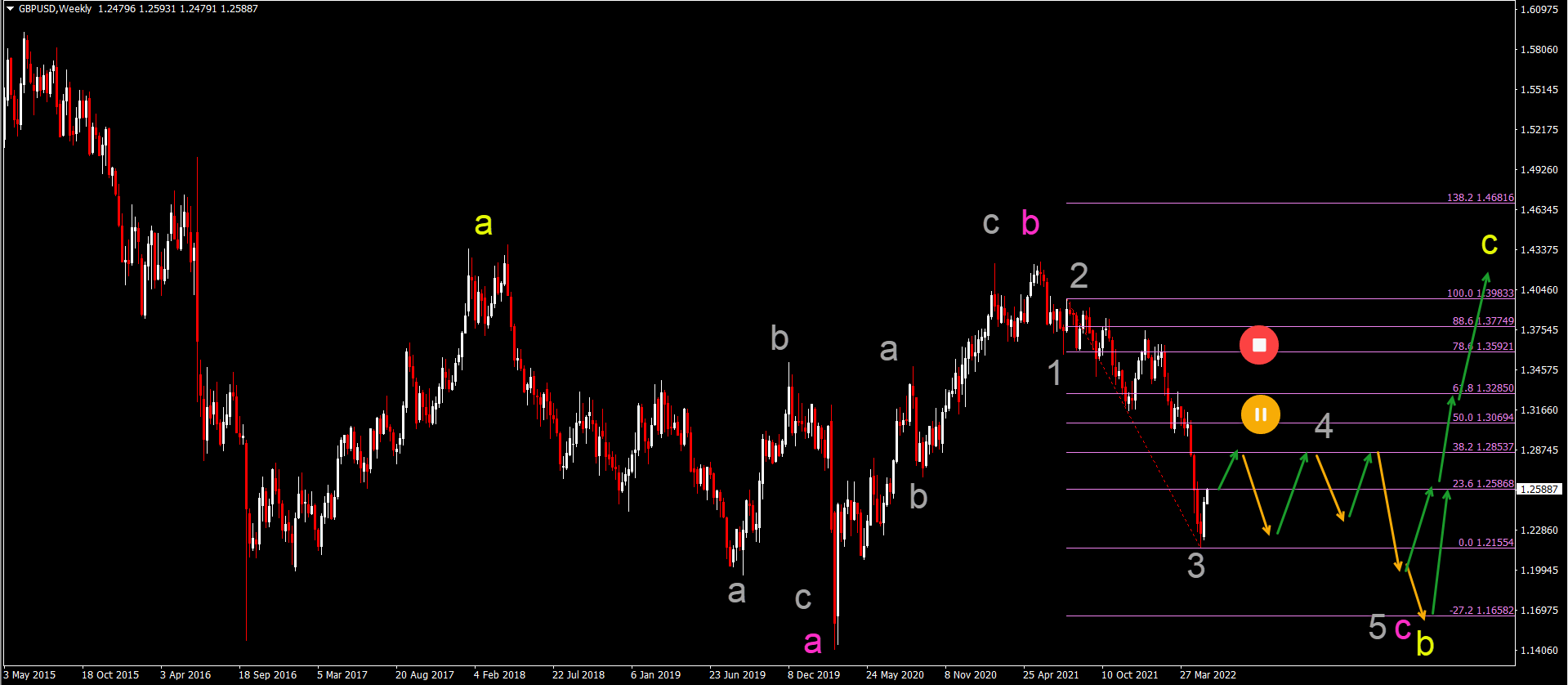

GBP/USD Bearish Wave 3 Completed

The GBP/USD is testing the historical lows and support zone:

- The GBP/USD bearish decline has been very impulsive so far.

- The recent candlestick pattern on the weekly chart shows a strong bullish weekly candle. This could indicate that the wave 3 (gray) is completed.

- If the wave 4 (gray) has indeed started, then price action could build a lengthy and choppy correction which should usually stay below the 50% Fibonacci level.

- A break above the 50-61.8% Fibonacci level makes the bearish wave 4-5 (gray) within wave C (pink) unlikely. In that case, a bullish swing is expected.

- After the correction is completed, one more bearish price swing should create a new lower low to complete wave 5 (gray) of wave C (pink).

- An ABC (pink) pattern seems to be completing a wave B (yellow) of a larger ABC (yellow).

(Click on image to enlarge)

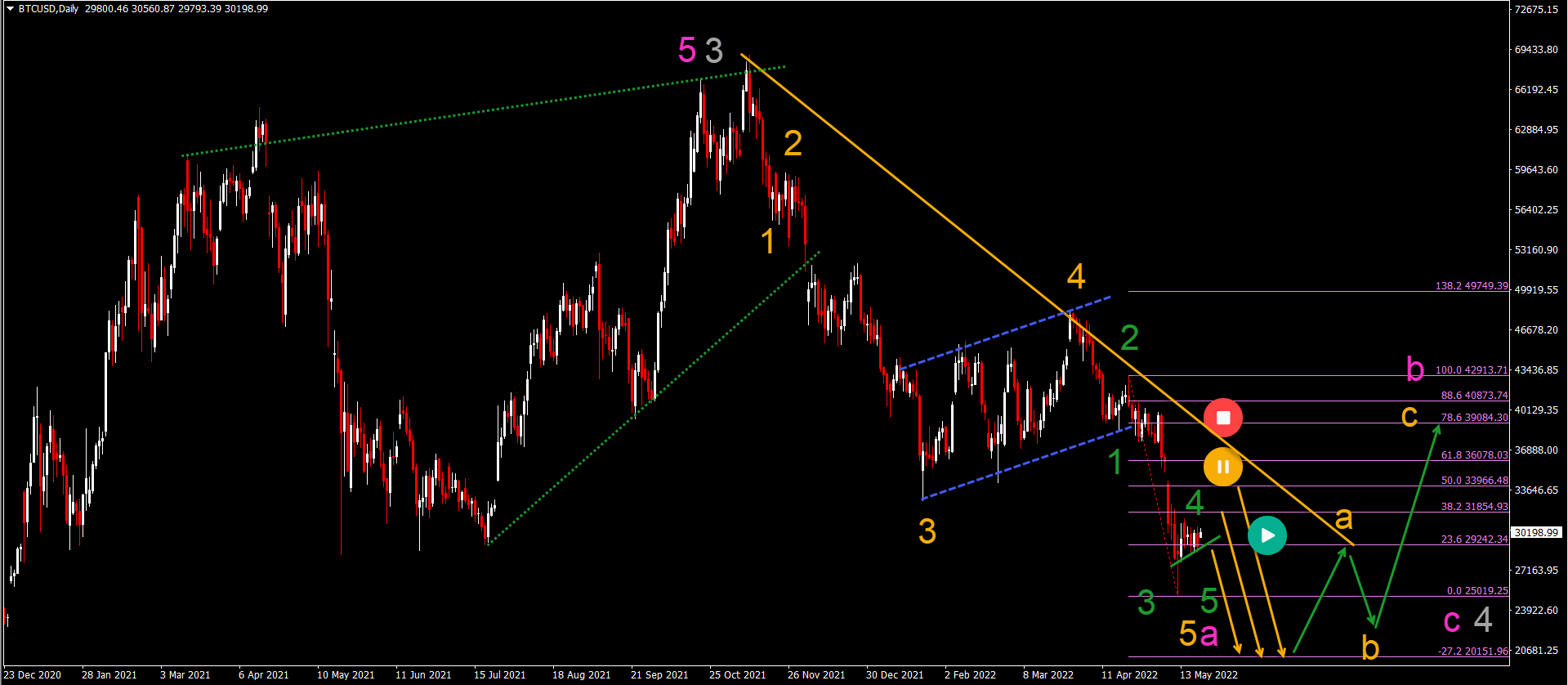

BTC/USD Approaches the End of Bearish Correction

Bitcoin (BTC/USD) is building a mild bullish correction within a strong downtrend:

- The BTC/USD topped out at the all-time high after building a rising wedge reversal chart pattern (dotted green lines).

- Since creating that top, the bearish decline has been strong. The bearish swing seems to be unfolding in 5 waves (orange).

- The recent bear flag pattern (dotted blue lines) was probably part of a wave 4 (orange).

- The current correction seems to be a wave 4 (green) of a wave 5 (orange) of a larger ABC correction (pink) in wave 4 (gray).

- Keep in mind that the ABC (pink) could be part of a wave W of a larger WXY complex correction.

- As long as price action respects the Fibonacci 38.2-50% resistance levels, one more lower low is still expected. After that, a bullish bounce (green arrows) could emerge.

- A break above the resistance line (orange) could indicate an immediate uptrend.

(Click on image to enlarge)

Disclaimer: CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. On average around 80% of retail investor accounts loose money when trading with high ...

moreComments

Please wait...

Comment posted successfully

No Thumbs up yet!