Weekly Waves 30 August: EUR/USD, GBP/USD And Bitcoin

Our weekly Elliott Wave analysis reviews the EUR/USD daily chart, the GBP/USD weekly chart, and the Bitcoin cryptocurrency daily chart.

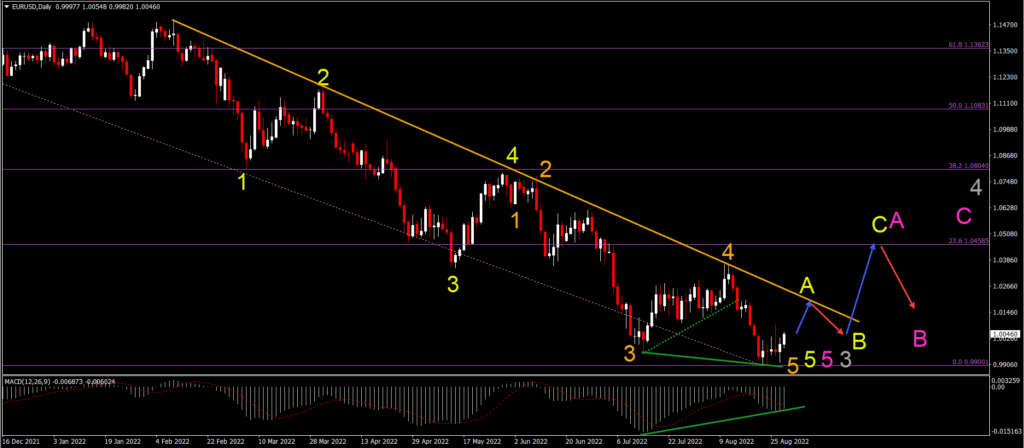

EUR/USD Retracement Towards 1.05 and 1.08

The EUR/USD made a new low but price action was finally weaker, which is the first indication that a larger bullish retracement could take place:

- The EUR/USD bullish divergence has appeared between the two recent daily bottoms (green lines on the price chart and MACD).

- The divergence pattern indicates a potential bullish reversal or retracement.

- Because price action is probably in wave 3 (gray), we expect a shallow and choppy correction within wave 4 (gray) and not a larger reversal.

- An ABC (yellow) pattern could unfold within a larger wave A (pink) of wave 4 (gray).

- The bullish targets are the 23.6% Fibonacci retracement level near 1.0450 and 38.2% Fib near 1.08 of wave 4 (gray).

- The downtrend within wave 5 (gray) could aim at 0.9750, 0.95, and 0.925.

(Click on image to enlarge)

GBP/USD Bullish Pullback to 1.2250

The GBP/USD is showing a massive bearish impulse but a strong support zone (blue) is now on its way:

- The GBP/USD is expected to build a bullish retracement, just like the EUR/USD.

- Considering the strong bearish momentum, we estimate that price action is probably in wave 3 (orange).

- This remains valid as long as the bullish retracement is not very impulsive and does not break above 1.25 and especially above 1.28 and 1.30.

- A bullish ABC (green) is expected to complete wave 4 (orange) around 1.2250.

- The downtrend within wave 5 (orange) of wave 3 (yellow) could take the price to 1.15 and perhaps 1.14 and 1.1250.

(Click on image to enlarge)

BTC/USD Bullish Bounce Aims at $30k

Bitcoin (BTC/USD) is testing the previous bottom and the main question will be whether price action will bounce or break:

- BTC/USD is expected to make a bullish bounce according to our Elliott Wave analysis.

- The current bearish price action is probably a wave B (orange).

- This means that a bullish bounce should take the price higher within wave C (orange).

- A larger ABC (orange) should complete a larger wave W (yellow) of a WXY complex correction (yellow).

- The main bullish target is the 23.6% Fibonacci level around $30k.

- A bearish bounce is expected at this strong resistance zone (red box).

- After a bearish retracement in wave X (yellow), a bullish bounce should take the price up toward the 38.2% Fibonacci level in wave Y (yellow).

(Click on image to enlarge)

More By This Author:

Key Market Insights Prior To Heading Of US Inflation NumbersWeekly Waves: EUR/USD, US30 And Bitcoin - Monday, Aug. 15

Weekly Waves 8 August: EUR/USD, GBP/USD And Bitcoin

Disclaimer: CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. On average around 80% of retail investor accounts loose money when trading with high ...

more