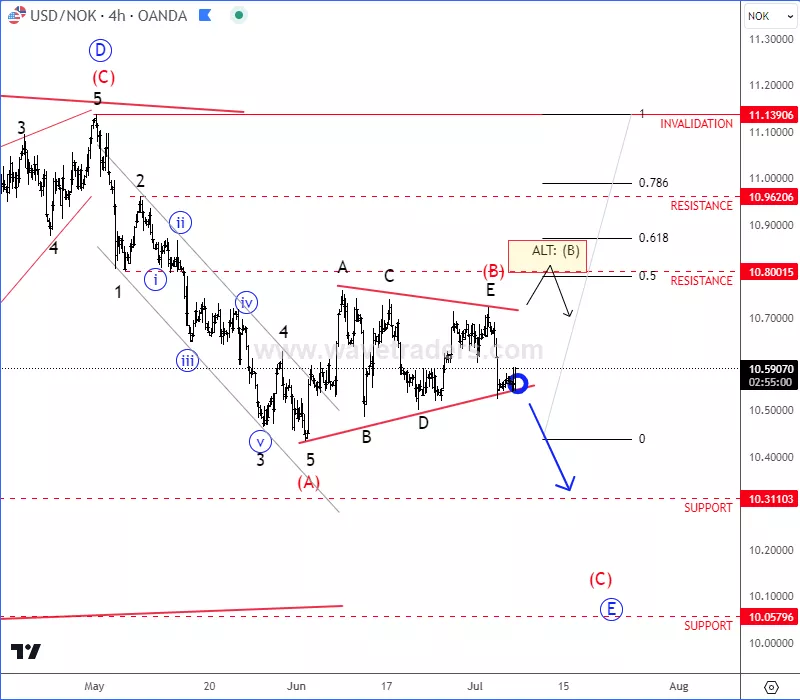

USD/NOK Is Looking For More Short-Term Weakness

Image Source: Unsplash

USD/NOK is sideways for the last two years which looks like a larger triangle within uptrend. It's an ABCDE pattern where wave E can be in play as pair stops at the upper side of this contracting range.

(Click on image to enlarge)

Ideally, the market is coming down for a pullback within higher degree wave E, where pair can complete the sideways price pattern. So for now, seems like there is room for more weakness within a three-wave (A)-(B)-(C) decline to the lower side of a range.

Wave (B) looks to be a bearish triangle pattern unless it's going to be more complex, but sooner or later it can send the price lower within wave (C) of E towards to 10.30/10.00 support area.

One of the reasons why USD/NOK could face more weakness is also bullish-looking Crude oil, which can boost the Norwegian Krone.

More By This Author:

AUDNZD: Aussie Outperfoms Kiwi As Australian Inflation Gets Hot

SP500 Has An Unfinished Five-Wave Bullish Rally

Cardano Steps Into A Higher Degree Corrective Setback

For more analysis visit us at https:/www.wavetraders.com and make sure to follow us on Twitter https://twitter.com/GregaHorvatFX