USD/JPY Update: BoJ And Fed Chair Powell’s Comments Form Perfect Cocktail For Yen Gains

USD/JPY Fundamental Backdrop

USD/JPY demonstrated its sensitivity to US data and the dollar index with a 420-odd pip decline over the US and Asian sessions. The move lower was given a boost in the aftermath of the speech by Federal Reserve Chair Jerome Powell last night before continuing during the Asian session as comments from Bank of Japan policymaker Asahi Noguchi took a hawkish tilt. The pair has found some support following the European open this morning to trade around the 136.40 handle, up 70-odd pips from its lows.

The Bank of Japan's policy of low-interest rates looks set to continue till the end of Governor Kuroda’s term in April 2023. However, overnight comments from BoJ policymaker Noguchi were the first signs that the central bank is keeping an eye on data in a bid to exit the low-rate environment. Noguchi stated that inflation expectations must rise in order to raise wages with a wage rise of around 3% needed if the inflation target is going to be met. The BoJ could withdraw stimulus pre-emptively if underlying inflation perks up higher than expected according to Noguchi. These comments and more were positively received by markets pushing USD/JPY to a three-month low print around the 135.70 handle.

The US dollar index faced renewed selling pressure following Fed Chair Powell’s speech at the Brookings Institue which covered inflation, employment, and the economic outlook. The Fed chair all but confirmed a 50bp hike for the Fed's December meeting while warning the inflation fight isn’t over. Following the speech, the probability of a 50bps rate hike in December has increased from 66% on Monday to 81% as of this morning. This leaves the dollar index on the back foot as the index also recorded its worst monthly loss in 12 years to close out November.

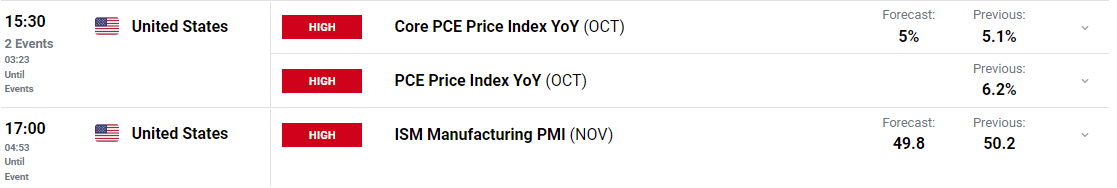

Customize and filter live economic data via our DailyFX economic calendar

Looking ahead we have US Core Personal Consumption Expenditure (PCE) data later today which is the Fed’s preferred guide on inflation as well as the NFP report on Friday. The hope for dollar bulls today rests with an increase from last month’s PCE print of 5.1% YoY which should temporarily restore some dollar strength.

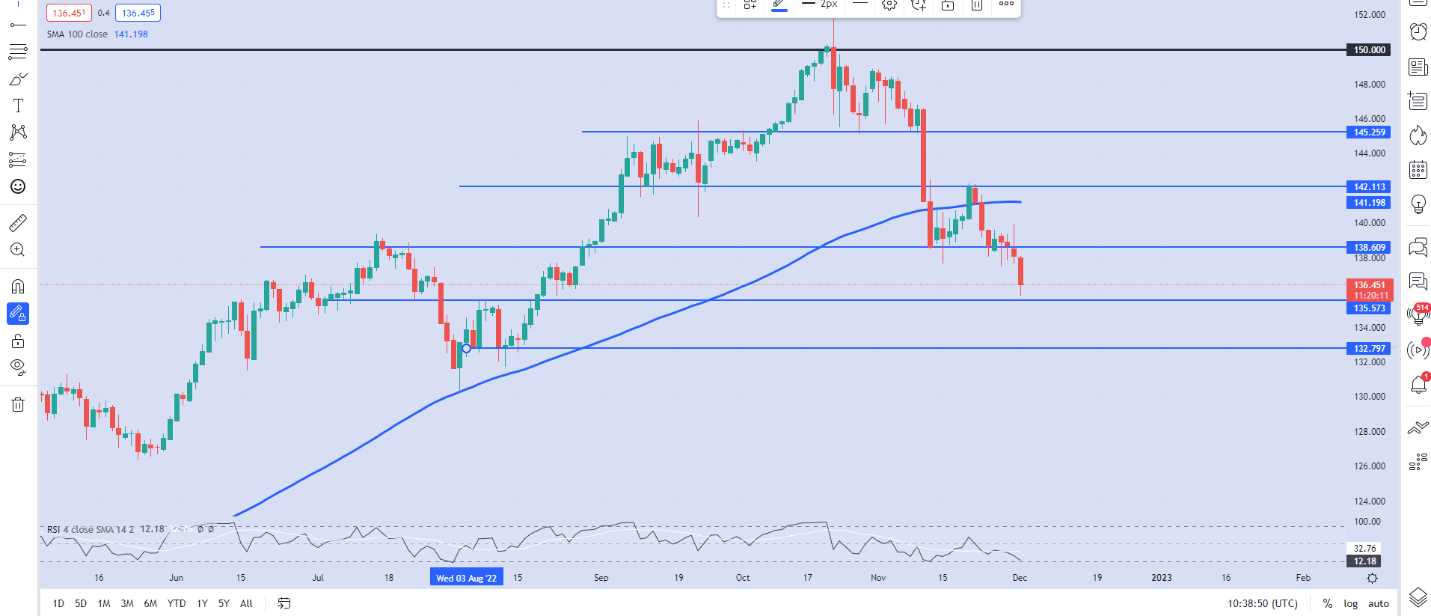

USD/JPY Daily Chart

(Click on image to enlarge)

Source: TradingView

From a technical perspective, USD/JPY has bounced just shy of a support area of around 135.50. Continued dollar weakness today could see the price revisit the daily lows and possibly break lower eyeing support around the 132.800 handle. Any move is likely to be driven by the dollar index which at this stage looks just as vulnerable as USD/JPY to further downside pressure. The only positive for an upside bounce is that the 4H and daily timeframe shows the RSI in oversold territory.

More By This Author:

Crude Oil Rises A Third Day From 76 Support As Risk Appetite Adds To Supply DataUSDJPY Outlook Particularly Prone To Fed Messaging

Crude Oil Price Looks Lower On China Lockdown Fears Ahead Of OPEC+. Where To For WTI?

Disclosure: See the full disclosure for DailyFX here.