USDJPY Stalemate: Uptrend Continuation Or Reversal Looming?

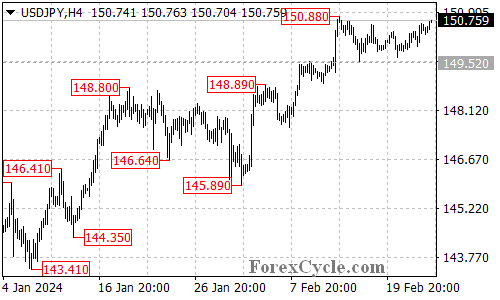

USDJPY faces a critical juncture, hovering around the 150.88 resistance level. This key hurdle will determine whether the recent uptrend from 145.89 continues or if a reversal is on the horizon. Let’s delve into the technicals to understand the potential scenarios.

Uptrend in Question: Can the Bulls Break Through?

- 150.88 Resistance Hurdle: A decisive break above this level would be a bullish signal, suggesting the uptrend from 145.89 remains intact. This could pave the way for further gains towards the next resistance at 151.90.

Support Levels to Watch for Downturn Signs:

- 150.35 Initial Support: If the bulls fail to conquer 150.88 and the price dips below 150.35, it could indicate a loss of momentum. This might lead to a retest of the 149.52 support level.

- 149.52 Crucial Support: A breakdown below this critical support would be a significant development. It could signal the completion of the uptrend from 145.89 and potentially trigger a decline towards the 147.50 support zone.

Overall Sentiment:

The technical picture presents mixed signals. While breaking above 150.88 would favor continued bullish momentum, a breakdown below 149.52 would suggest a potential trend reversal. Monitoring the price action around these key levels will be crucial in determining USDJPY’s next move.

More By This Author:

AUDUSD Breaks Free: Uptrend Resumption Or False Dawn?USDCHF Retreats: Trend Reversal Or Consolidation Test?

AUDUSD At A Pivotal Point: Uptrend Resumption Or Downtrend Continuation?

Disclaimer: Information on these pages contains forward-looking statements that involve risks and uncertainties. Markets and instruments profiled on this page are for informational purposes only ...

more