USD/JPY Soars As Yen Weakens On BoJ Policy Concerns

Image Source: Pixabay

The USD/JPY pair climbed to 148.31 on Monday, extending its gains from the previous week as the US dollar strengthened across the board. The yen faced additional pressure from heightened anticipation around upcoming comments from Federal Reserve officials and the release of critical US inflation data.

Last week, the Federal Reserve delivered a widely expected 25-basis-point cut – its first since December. The central bank's projections indicated two further reductions before the end of the year.

This contrasts sharply with the Bank of Japan's (BoJ) stance. Last Friday, the BoJ held its key rate at 0.5% per annum for a fifth consecutive meeting, a decision that was squarely in line with market forecasts. In its accompanying statement, the central bank described a moderate economic recovery but pointed to persistent weak spots and warned of risks stemming from global trade policy.

In a more significant step, the regulator unanimously approved plans to begin selling ETFs and J-REITs from its vast portfolio. This detail is particularly noteworthy and can be interpreted as a cautious signal that the bank is preparing to wind down its long-standing asset purchase program.

This week, investor focus will shift to the latest PMI data and inflation figures for Tokyo, alongside the release of the minutes from the BoJ's July meeting. These documents may provide crucial insights into the timing and nature of the regulator's next policy steps.

Technical Analysis: USD/JPY

H4 Chart:

(Click on image to enlarge)

On the H4 chart, USD/JPY found solid support at the 147.20 level and is now developing a fresh upward move targeting 148.88. We expect this target to be tested today. Following this, a corrective pullback towards 147.20 is likely. Following this correction, we anticipate another upward move aiming for the 150.00 psychological level. This outlook is technically confirmed by the MACD indicator, whose signal line is positioned above zero and pointing sharply upwards.

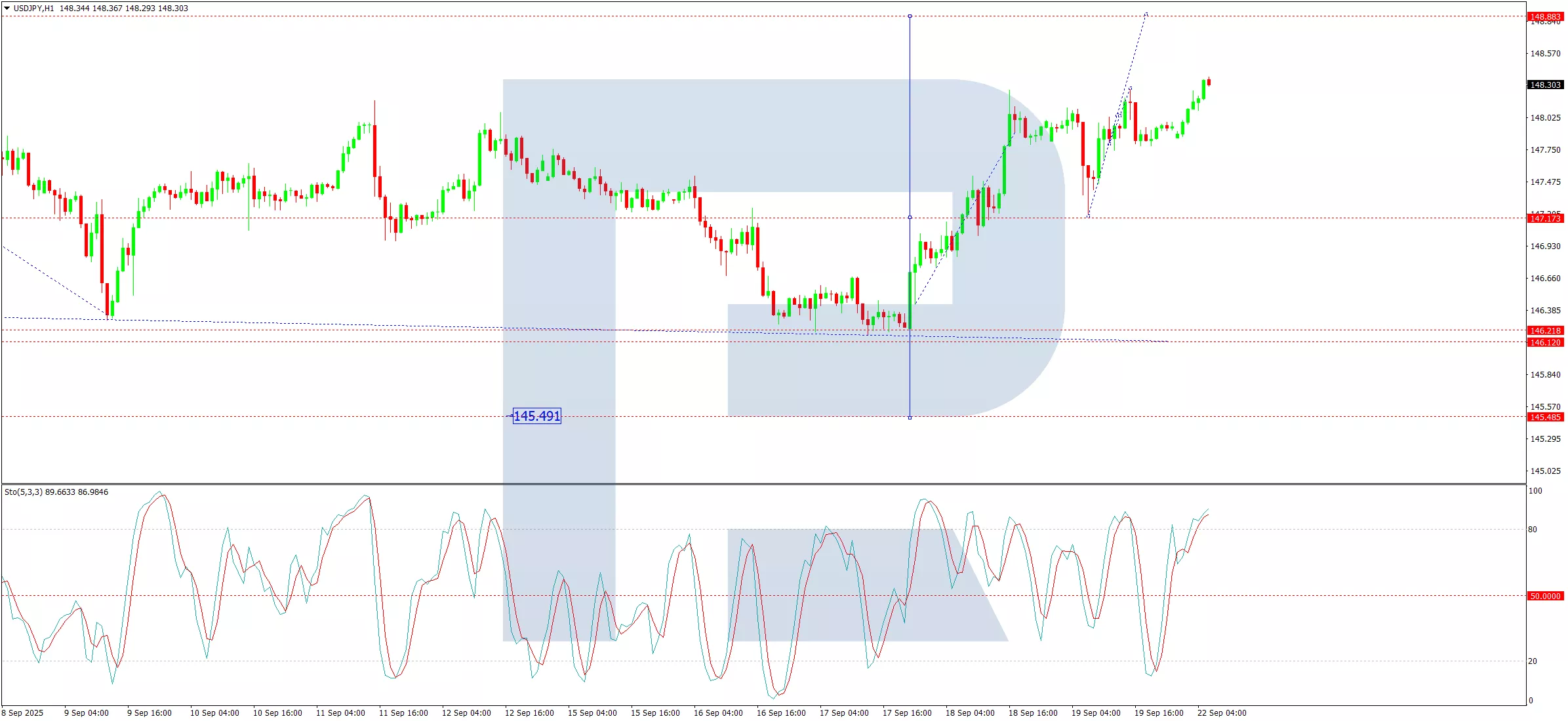

H1 Chart:

(Click on image to enlarge)

The H1 chart shows the pair completed an upward move to 148.23, followed by a correction to 147.20. The current momentum is building for a further advance towards 148.88. Upon reaching this level, a corrective pullback towards 147.20 is possible. The broader upward trajectory is then expected to resume, with a minimum target of 150.00. This scenario is supported by the Stochastic oscillator, with its signal line currently above 50 and rising firmly towards the 80 level.

Conclusion

The yen remains under significant pressure, caught between a resilient US dollar and the Bank of Japan's cautious, gradual approach to policy normalisation. The path of least resistance for USD/JPY remains higher, contingent on this week's key data releases reinforcing the current fundamental and technical picture.

More By This Author:

EUR/USD Corrects Lower In Post-Fed Pause

GBP Holds Near Highs As Market Awaits BoE Decision

EUR/USD Hits Four-Year High: All Eyes On The Fed

Disclaimer: Any forecasts contained herein are based on the author's particular opinion. This analysis may not be treated as trading advice. RoboForex bears no responsibility for ...

more