USDJPY Pulls Back: Uptrend Consolidation Or Downturn Signal?

Image Source: Unsplash

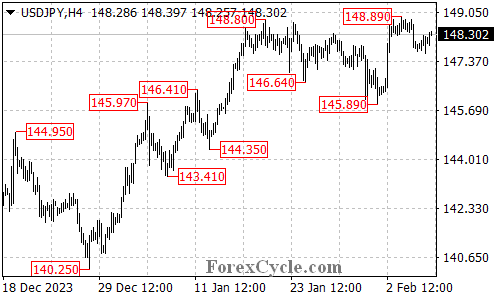

USDJPY’s recent rally encountered resistance at 148.80, leading to a pullback. But is this a temporary pause or a sign of a potential trend reversal? Let’s analyze the technicals to understand what this means for the pair’s future direction.

Pullback or Consolidation?

- Resistance Test: USDJPY reached the key resistance level of 148.80 but couldn’t break through.

- Consolidation Likely: The subsequent pullback is more likely a consolidation phase within the uptrend that started from 145.89 rather than a reversal.

Retest of Resistance Expected

- Upward Momentum: The overall bullish sentiment suggests another attempt to rise towards 148.80 resistance in the coming days.

- Breakout Potential: A decisive break above this level would be a significant bullish signal, indicating a continuation of the uptrend.

- Next Target: If the breakout occurs, the next potential target could be around the 150.00 area.

Support Levels to Watch

- Immediate Cushion: The first line of defense for the bulls is the immediate support at 147.25.

- Further Downturn: Only a breakdown below this level could trigger another decline, potentially retesting the initial support at 145.89.

Overall Sentiment

The pullback doesn’t necessarily signal a trend reversal. A consolidation phase within the uptrend is more likely. If USDJPY manages to break above 148.80, it could pave the way for further gains towards 150.00. However, a breakdown below 147.25 would raise concerns about the uptrend’s strength.

More By This Author:

USDCHF Surges Higher: Uptrend Resumed Or Brief Rally?EURGBP Downtrend Resumes: Key Support Levels To Watch

USDCHF Breaks Higher but Faces Key Resistance: Will the Uptrend Resume?

Disclaimer: Information on these pages contains forward-looking statements that involve risks and uncertainties. Markets and instruments profiled on this page are for informational purposes only ...

more