USD/JPY: Looking Heavy Ahead Of Big Macro Events

Photo by jun rong loo on Unsplash

The USD/JPY has started to trend slightly lower, turning negative on the week, ahead of big macro events starting in the latter half of this week.

With the first policy meeting under the leadership of the new Bank of Japan Governor to come this week, and not to mention a shed load of data releases throughout the week from the US ahead of next week’s FOMC meeting, the USD/JPY outlook could be in for a wild ride.

The Fed is in the blackout period ahead of next week’s FOMC meeting, so we won’t be hearing any surprising comments from FOMC officials this week. This means all the focus will be on incoming data from both the US and Japan, as well as the BOJ rate decision itself.

Top 3 macro events to watch this week for USD/JPY

Here are the top three events of the week that could impact the USD/JPY outlook this week:

Advance US GDP

Thursday, 27 April

13:30 BST

We have seen some rather weak economic pointers of late, although the nonfarm payrolls report still surprised to the upside. But what about GDP? If we see weakness in the economy then investors may start betting that the Fed will not only stop hiking interest rates past May, but soon it may even start loosening monetary policy again. Analysts expect US first quarter GDP to come in at +2.0% annual pace vs. +2.6% in Q4.

In addition to the GDP, we have lots of other key data releases from the US this week.

In recent weeks, we have seen some cracks starting to appear in US data, including in the housing market, while business sentiment remains in depression mode. That being said this week’s housing market data has been decent. House prices showed surprising strength judging by the latest S&P/CS Composite-20 HPI (0.4% y/y vs. -0.1% expected) and New Home Sales data (683K vs. 633K annualized rate). However, the closely-watched Consumer Confidence index from Conference Board (CB) showed weakness (101.3 vs. 104.1 eyed). Let’s see what GDP and the rest of this week’s macro data will print.

The potential for US economic activity to drop more sharply than expected means the Fed may respond later in the year by being more aggressive in cutting interest rates, just like how they were (very late) when tightening policy in response to soaring inflation. If this is what the market starts to price in, in response to this week’s macro events, then the US dollar index could break to a new low for the year and start heading towards 100.00.

BOJ monetary policy decision

Friday, 28 April

04:00 BST

This will be the first policy meeting under the leadership of the new Bank of Japan Governor, Kazuo Ueda. Given that Ueda has already mentioned that he will continue with the BOJ's current policy stance, the yen has weakened across the board in recent times, before starting to show renewed strength this week, especially against commodity dollars (AUD, NZD, and CAD). But be mindful of any potential surprises with regard to the BoJ’s yield curve control (YCC) settings. Any policy change would likely trigger a sharp rally in the yen and a sell-off in yen crosses like USD/JPY and AUD/JPY.

One reason why the BOJ might avoid altering its policy is concerns about Japan returning to deflation. This means it may postpone any plans to change the YCC policy until next year.

US Core PCE Price Index

Friday, 28 April

13:30 BST

As we found out recently, US CPI cooled to a 5% annual rate, which was more than expected. There have been more signs of inflation heading lower. Yet the hawks at the FOMC camp want to see more evidence before pausing rate hikes. The Core PCE Price Index is the Fed’s favorite measure of inflation, and the last inflation gauge before the Fed’s meeting next week. So, it could tilt policy decision if it deviates significantly from expectations. A weaker print could send the dollar plunging.

USD/JPY Economic Calendar

Here’s a list of upcoming data on the economic calendar, showing all the key data releases that could impact the USD/JPY this week:

|

Date |

Time (BST |

CCY |

Data |

Forecast |

Previous |

|

|

|

|

|

|

|

|

Wed Apr 26 |

1:30pm |

USD |

Core Durable Goods Orders m/m |

-0.2% |

-0.1% |

|

|

|

|

|

|

|

|

Thu Apr 27 |

1:30pm |

USD |

Advance GDP q/q |

2.0% |

2.6% |

|

|

|

USD |

Unemployment Claims |

249K |

245K |

|

|

|

USD |

Advance GDP Price Index q/q |

3.7% |

3.9% |

|

|

3:00pm |

USD |

Pending Home Sales m/m |

1.0% |

0.8% |

|

Fri Apr 28 |

12:30am |

JPY |

Tokyo Core CPI y/y |

3.2% |

3.2% |

|

|

|

JPY |

Unemployment Rate |

2.5% |

2.6% |

|

|

12:50am |

JPY |

Prelim Industrial Production m/m |

0.4% |

4.6% |

|

|

|

JPY |

Retail Sales y/y |

6.5% |

7.3% |

|

|

04:00am |

JPY |

Monetary Policy Statement |

|

|

|

|

Tentative |

JPY |

BOJ Policy Rate |

-0.10% |

-0.10% |

|

|

1:30pm |

USD |

Core PCE Price Index m/m |

0.3% |

0.3% |

|

|

|

USD |

Employment Cost Index q/q |

1.1% |

1.0% |

|

|

|

USD |

Personal Income m/m |

0.2% |

0.3% |

|

|

|

USD |

Personal Spending m/m |

-0.1% |

0.2% |

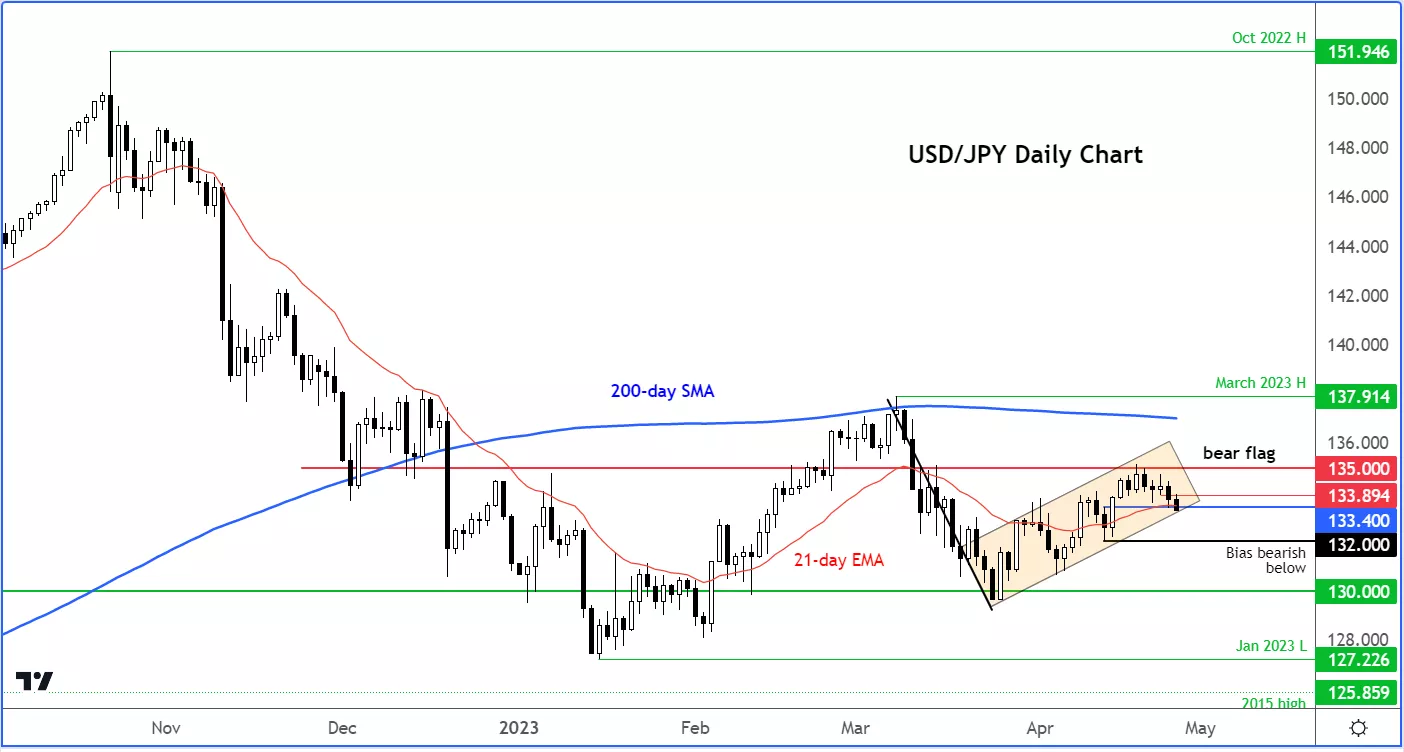

USD/JPY consolidates inside bear flag

Ahead of the above macro events, the USD/JPY remains trapped bang in the middle of its recent range. Hardly surprising. Many traders wouldn’t want to commit in either direction, given the big risk events coming up in the next week or two (see above for more).

The higher lows since the January nadir are certainly not bearish indicators. Yet, the inability of the USD/JPY to challenge its 200-day average means the longer-term outlook remains bearish. Indeed, a bear flag pattern is starting to form on the daily chart now:

(Click on image to enlarge)

I would start feeling more bearish towards this pair if support around 133.40 breaks on a daily closing basis now. A move below 132.00 would create an interim lower low, and thus a bearish signal.

But while it holds above that 133.40 support level on a daily closing basis, the bulls will remain hopeful for a recovery.

If the USD/JPY were to find support and move above 135.00 resistance, then this could trigger follow-up technical buying towards 136.00. In this case, a retest of the 200-day average around 137.00 cannot be rule out either.

All told the USD/JPY at its current state is not looking very bullish.

More By This Author:

USD/JPY Outlook: Currency Pair Of The Week

Gold Above $2k Again: What’s Next?

GBP/JPY Outlook Brightened Amid Sizzling Hot UK Inflation

Disclaimer: The information on this web site is not targeted at the general public of any particular country. It is not intended for distribution to residents in any country where such ...

more

You have those between a matchbook? :)