USDJPY Jumps Above 150 Following The BoJ’s Interest Rate Decision

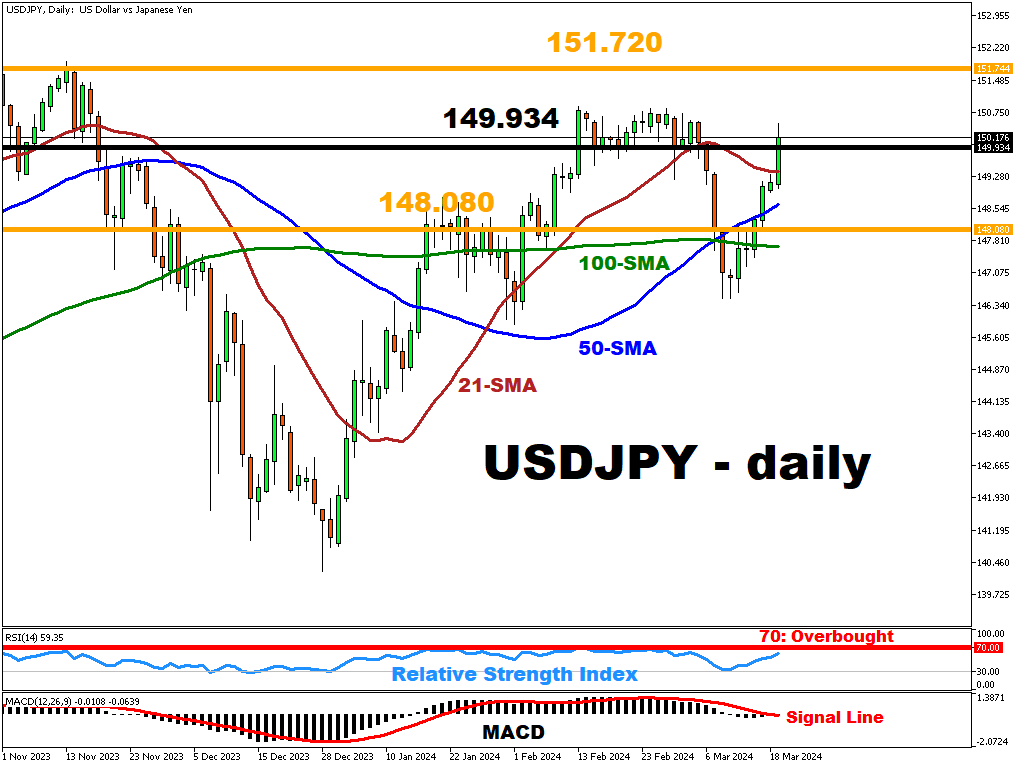

USDJPY is currently trading at 150.086, hovering near a key support level of 149.934.

While three key moving averages (21,50 & 100-period SMAs) underscore a bullish momentum, momentum indicators may suggest a more cautious outlook.

The price is currently trading above the 21-period, 50-period, and 100-period moving averages, indicating an upward trend.

The key support level is located at 149.934. A break below this level could drag the FX pair lower towards the next support level at 21-period SMA.

The 14-day Relative Strength Index (RSI) sits in neutral territory (59.35).

The MACD (-0.0108) is slightly positive compared to its signal line (-0.0639), indicating some bullish momentum, but the closeness of the lines may suggest weakness.

The Bloomberg FX model suggests a 74.9% probability for the USDJPY to trade between 148.080 and 151.720 during the next 7 days, which aligns with the current price action.

Overall, the technical analysis for USDJPY presents a mixed picture. The price action on the moving averages suggests an upward bias, but the momentum indicators do not offer enough support.

A break above the Bloomberg FX upper boundary (151.720) could indicate a continuation of the uptrend, while a drop below support (149.934) might signal a potential move toward the lower boundary (148.080).

More By This Author:

JP225 On The Way Back To 40000?Gold Holds Around Record High

Ethereum Consolidates Around $4k After Upgrade

Disclaimer: Forecasts which are made in the review constitute the personal view of the author. Commentaries made do not constitute trade recommendations or guidance for working on financial ...

more