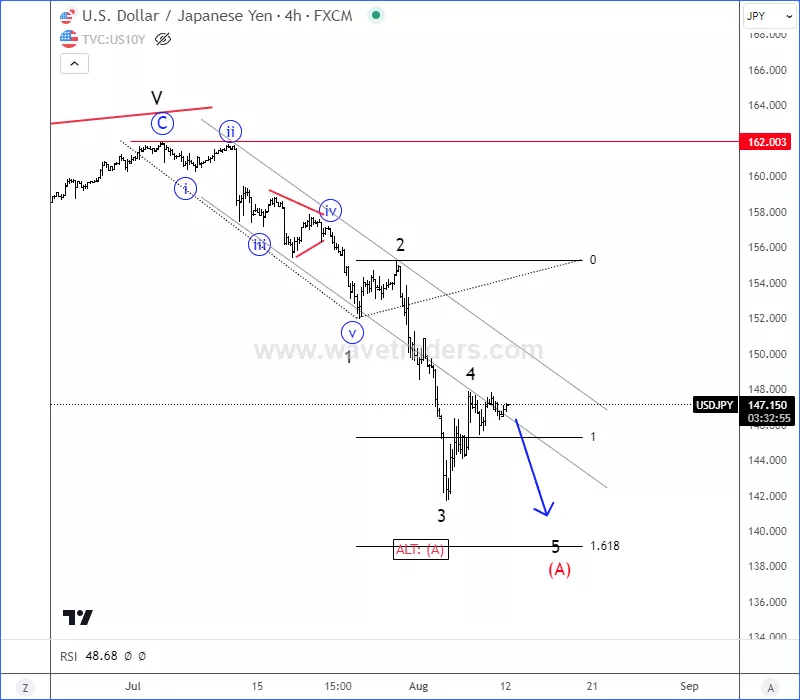

USDJPY Is Unfolding A Five-Wave Bearish Impulse

USD/JPY is finally topping out this year at our 162-164 resistance area, where we called the end of a big ending diagonal on the daily chart. Notice that the price is now falling sharply and impulsively through the lower trendline support and straight, all the way down to the starting point of the wedge pattern, which we see it as first leg (A) of a minimum larger three-wave A-B-C reversal down.

USDJPY Daily Chart

USDJPY is in an impulsive decline from the highs, which is now even extended in the 4-hour chart, so it’s probably wave 3 of a five-wave bearish impulse within higher degree wave (A). It recovered a bit, but it looks like a three-wave corrective pullback in wave 4 only, touching base channel support line as a resistance, so be aware of a bearish continuation for wave 5 of (A) towards 140 – 137 area before we will see a bigger corrective recovery within wave (B).

USDJPY 4H Chart

More By This Author:

Crypto Market Still Shows Correction Within Uptrend

Solana Is Still Bullish, Eyeing All-Time Highs

German Bund Is On The Rise, So As EURUSD Pair

For more analysis visit us at https:/www.wavetraders.com and make sure to follow us on Twitter https://twitter.com/GregaHorvatFX