USDJPY Analysis - Monday, May 8

Image Source: Pixabay

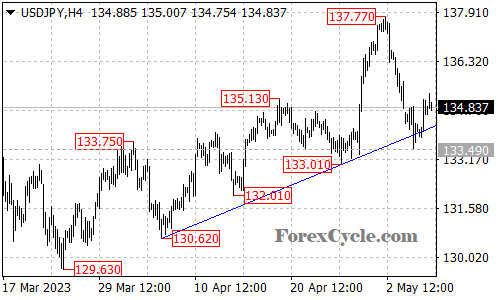

The pair rebounded from the rising trend line on the 4-hour chart, which has been supporting the price since mid-April. The rebound could signal a possible further rally for the pair, with the next target at 135.80.

If the pair manages to break above the 135.80 resistance level, it could open the door to further gains toward the 136.60 and 137.77 levels. However, traders should be aware that the bounce may be a correction for the downtrend from 137.77, and a breakdown below the 133.49 support could signal another fall toward 132.00.

Additionally, if the price falls below 132.00, the next support levels would be at 129.63. Traders should also pay attention to the trend line support, as a breakdown below this level could signal a change in the current uptrend.

In summary, while USDJPY has rebounded from the rising trend line on the 4-hour chart, a further rally could be a correction for the downtrend from 137.77. Traders should keep an eye on the trend line support and the 133.49 support level for any potential downside moves. The next resistance level is at 135.80, followed by 136.60 and 137.77.

More By This Author:

USDCAD Analysis – May 7, 2023Overseas Buyers Scoop Up U.S. Shares - Bullish or Bearish?

Natural Gas: A Look at Elliott Wave Decline and Target Area

Disclaimer: Futures, options, stocks, ETFs and over the counter foreign exchange products may involve substantial risk and may not be suitable for all investors. Leverage can work against you as ...

more