USDJPY : 1:6 Risk/Reward Target Hit

Image Source: Pixabay

On May 9 and May 11, 2024, I posted on social media @AidanFX two USDJPY BUY setup charts. The pair formed bullish patterns (Blue & Red) in the demand/buy zone (Pink and 15M Gray) where the 1st buy entry (Green) was triggered.

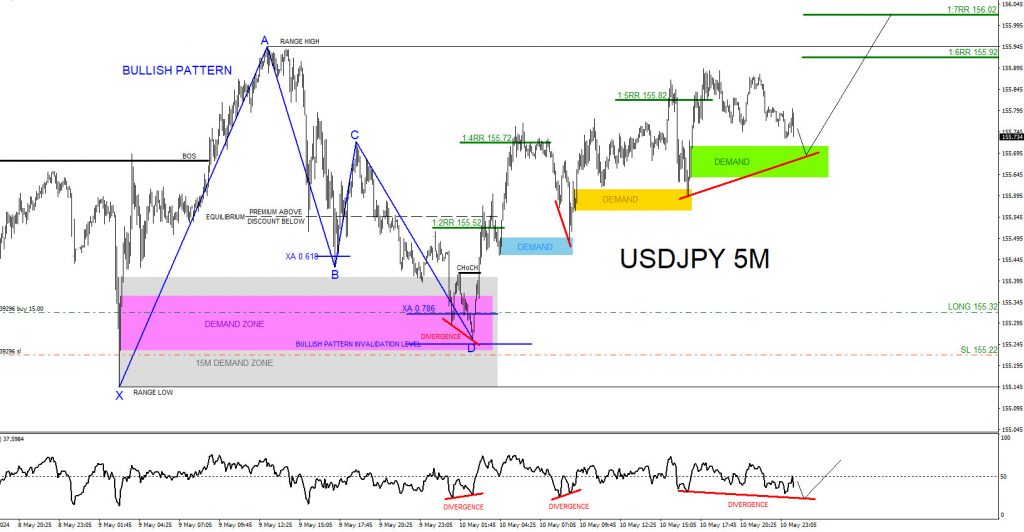

USDJPY 5 Minute Chart May 9, 2024 (1st Entry <Green>)

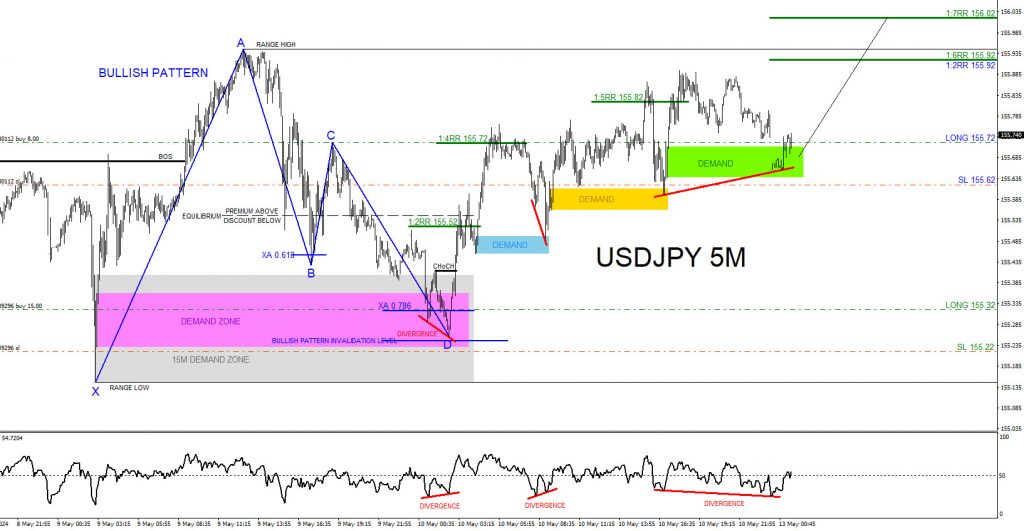

USDJPY 5 Minute Chart May 11, 2024 (Posted the 2nd BUY set up during the weekend)

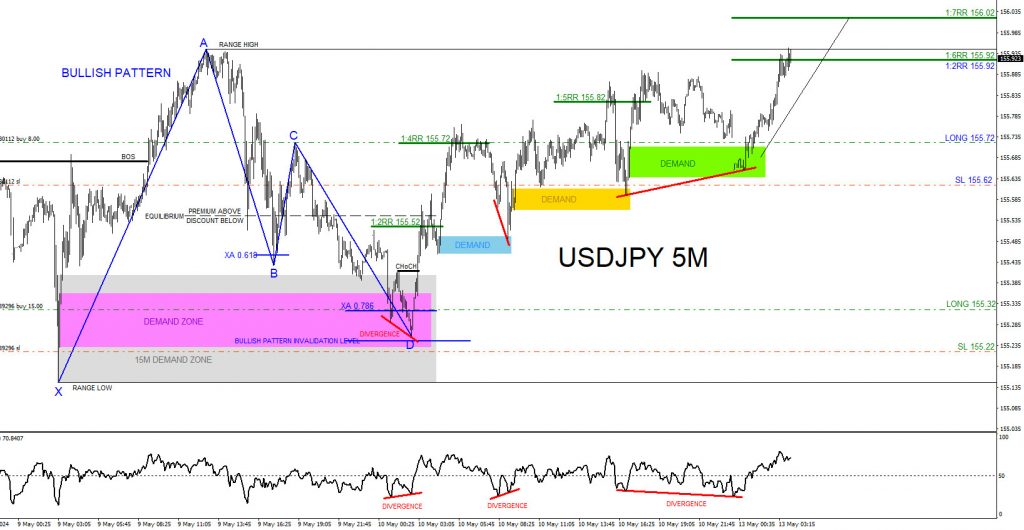

USDJPY 5 Minute Chart May 12, 2024 (2nd Entry <Blue>)

USDJPY 5 Minute Chart May 12, 2024 (Targets Hit)

Entered the 1st BUY trade at 155.32 with a 10 pip stop loss at 155.22. Entered the 2nd BUY trade at 155.72 with a 10 pip stop loss at 155.62. On May 12 2024 USDJPY moves higher to the proposed targets. The 1st entry 1:6RR target at 155.92 and the 2nd entry target at the same 155.92 level hits and is where I closed both buy trades for a total of +80 pips +7% gain (Risked 1% on 1st BUY trade Green and risked 0.5% on 2nd BUY trade Blue).

A trader should always have multiple strategies all lined up before entering a trade. Never trade off one simple strategy. When multiple strategies all line up it allows a trader to see a clearer trade setup.

More By This Author:

Elliott Wave Expects AUDUSD To Break HigherElliott Wave Analysis On USDJPY Recovery Post BOJ Intervention

COST Favors Rally To Continue In Bullish Sequence

Disclaimer: Futures, options, and over the counter foreign exchange products may involve substantial risk and may not be suitable for all investors. Leverage can work against you as well as for ...

more