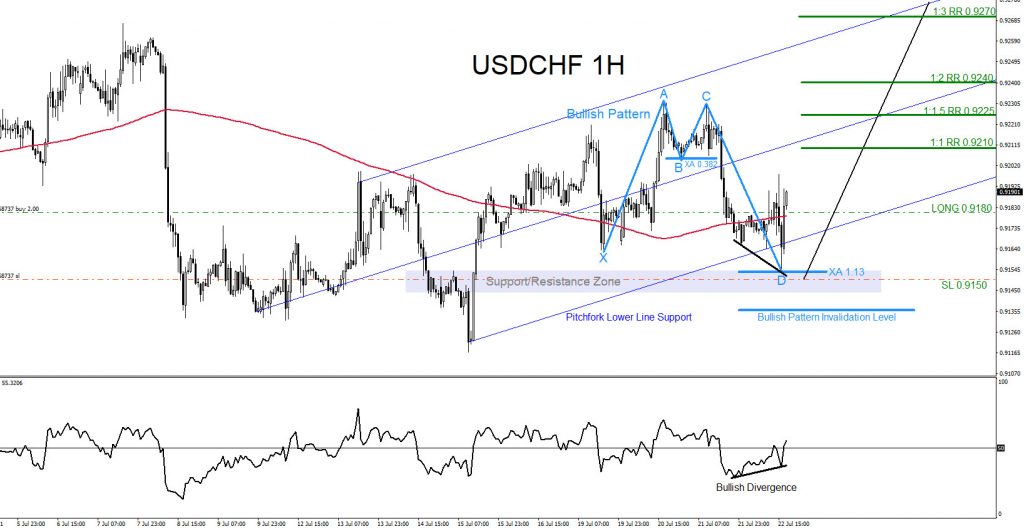

USDCHF: Will The Pair Continue Higher?

There are visible bullish patterns on the USDCHF 1 Hour time frame that can be signalling traders of a move higher.

The light blue bullish market pattern already triggered buyers at the XA 1.13% Fib. retracement level and the pair has reacted with a push higher from this level. Price also found support from the pitchfork lower line and bounced higher off a support/resistance zone adding to the bullish scenario. USDCHF has already hit the minimum 1:1 RR Target from the 0.9180 buy entry and has since pulled back lower.

At the moment more confirmation of upside momentum will be if the pair continues higher and breaks above the 0.9216 level. A break above this level will send the pair higher towards the 0.9240 - 0.9270 area for a 1:2 RR to 1:3 RR. Expecting for price to tag the pitchfork upper line (dark blue) for an ultimate target.

For now USDCHF needs to stay above the July 22 2021 low at the 0.9154 level for the bullish view to remain valid. If price breaks below the July 22 2021 low then the pair can extend lower to retest and possibly break below the July 15 2021 low. Only time will tell what USDCHF will do but at least now you know what to expect if the pair breaks higher or dips lower.

USDCHF 1 Hour Chart July 22

Of course, like any strategy/technique, there will be times when the strategy/technique fails so proper money/risk management should always be used on every trade.

Disclaimer: Futures, options, and over the counter foreign exchange products may involve substantial risk and may not be suitable for all investors. Leverage can work against you as well as for ...

more