USD/CHF Price Accelerates Rally, Bulls Aiming For 0.93

The USD/CHF price rose as high as 0.9294 level today, and it may attempt to acquire the 0.93 psychological level. Technically, the price is strongly bullish as the Dollar Index is bullish.

DXY’s further growth may force the pair to approach fresh highs. We have a strong correlation between the US Dollar Index and the USD/CHF.

In the early morning, the price fell a little because the Dollar Index retreated after reaching dynamic resistance. Still, the bias is bullish after better than expected US retail sales data. Furthermore, the USD could accelerate its rally if the Prelim UoM Consumer Sentiment comes in better than expected today. Also, the Prelim UoM Inflation Expectations indicator will be released as well.

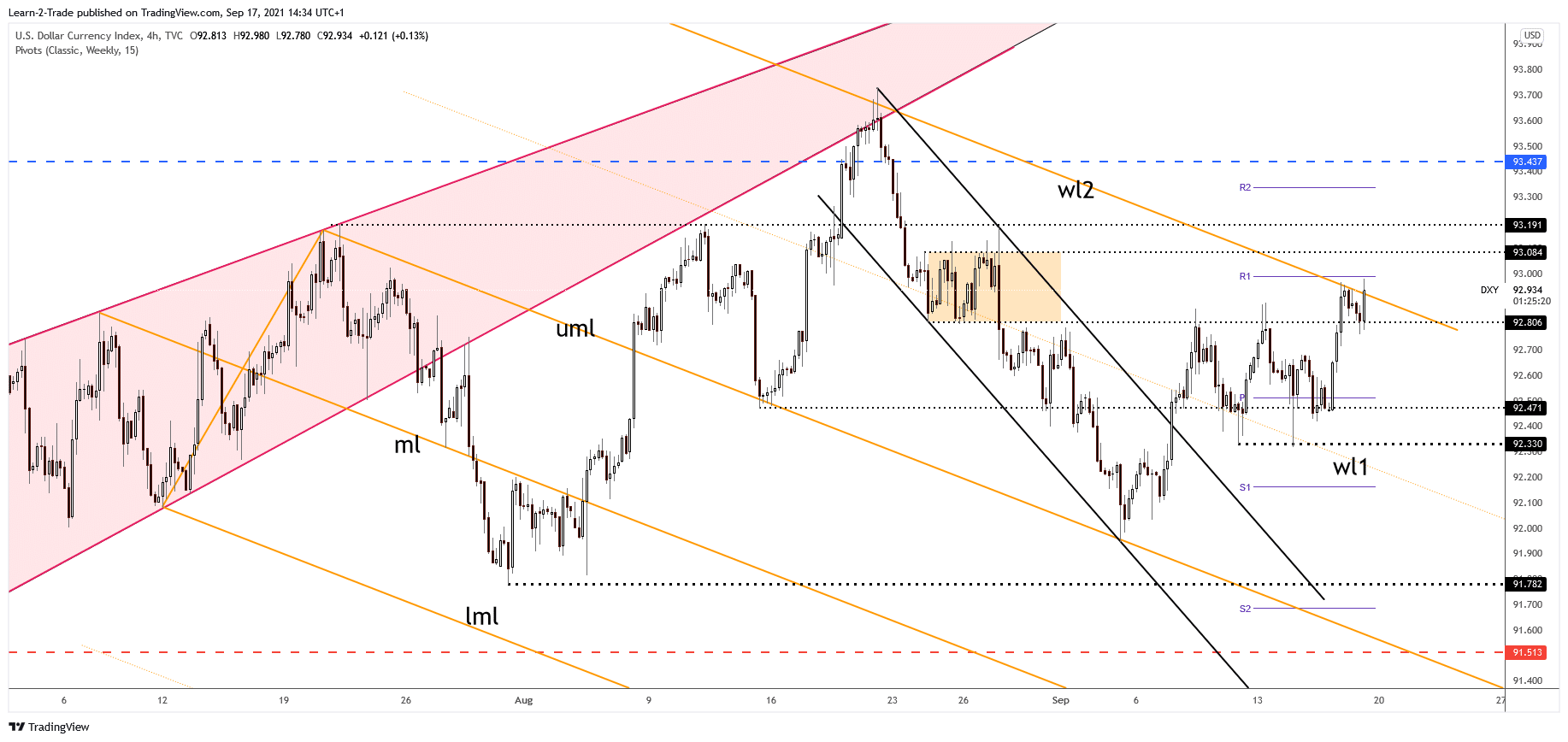

Dollar Index price technical analysis: Bulls gaining ahead

Dollar Index 4-hour price chart

The Dollar Index is trading in the green at 92.94 level, and it’s pressuring the second warning line (wl2), which represents strong dynamic resistance. Making a valid breakout through it could activate further growth.

This scenario indicates that the USD should appreciate versus its rivals. Only a false breakout through the second warning line (wl2) followed by a new lower low 92.76 may invalidate an upside continuation.

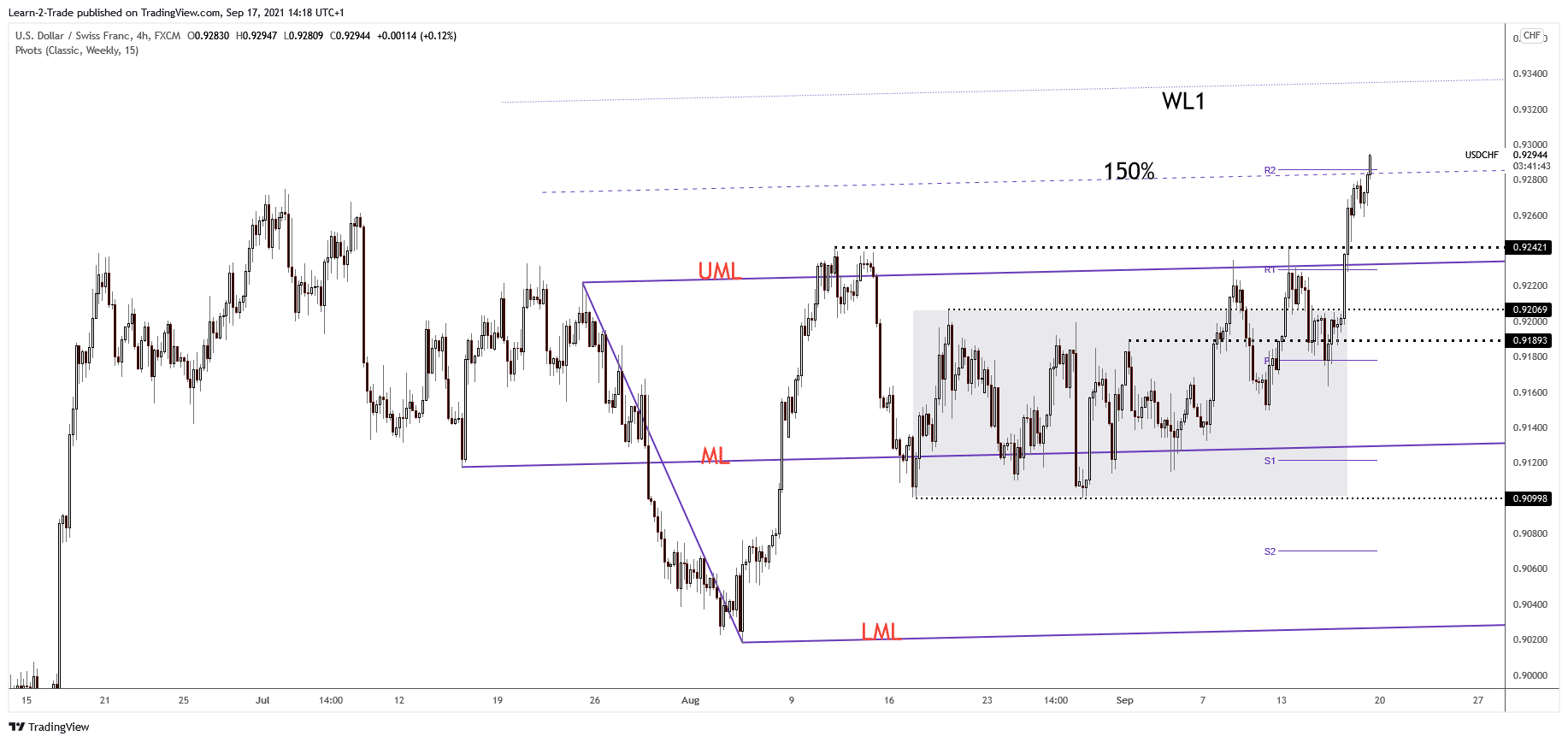

USD/CHF price technical analysis: Bullish trend intact

USD/CHF 4-hour price chart

The USD/CHF price rallies at the moment of writing, located above the 150% Fibonacci line of the ascending pitchfork and above the weekly R2 (0.9286) level. In my previous analyses, explained that the price should extend its growth if it makes a valid breakout through these upside obstacles.

In the short term, we cannot exclude a temporary decline. The price may come back down to test the broken levels before jumping higher. The 0.9300 psychological level is seen as an immediate resistance, upside target. Closing above it may signal further rise towards the first warning line (WL1). Only invalidating the breakout through the 150% line could indicate that the upside movement is over.

Disclaimer: Foreign exchange (Forex) trading carries a high level of risk and may not be suitable for all investors. The risk grows as the leverage is higher. Investment objectives, risk ...

more