USD/CAD Weekly Forecast: Stronger Dollar Amid Geopolitics

The USD/CAD weekly forecast is bullish as the dollar climbs amid increased geopolitical tensions and economic uncertainties. However, Friday’s downbeat US NFP erased some weekly gains.

Ups and downs of USD/CAD

The loonie had a bullish week despite weaker-than-expected US data. At the same time, the Fed took on a more dovish tone at the meeting on Wednesday. Notably, the US manufacturing PMI fell from 48.5 in June to 46.8 in July. Consequently, there were fears that the economy was slowing down at a fast rate.

Meanwhile, US jobs growth eased in July, with the unemployment rate spiking to 4.3%. In the last week, Fed rate cut bets soared, and policymakers opened the door to a September cut. However, the dollar remained strong due to safe-haven demand. Middle East tensions increased with the killing of a Hamas leader, pushing investors to buy the dollar.

Next week’s key events for USD/CAD

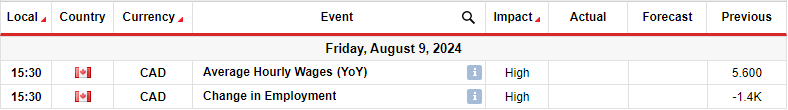

(Click on image to enlarge)

Next week, Canada will release its monthly employment figures, shaping the outlook for rate cuts. Last month’s report showed a sharp slowdown in the labor market that raised fears of further economic deterioration. Canada lost 1,400 jobs when economists had forecasted an increase. These figures increased pressure on the Bank of Canada to cut rates. Consequently, investors bet heavily on rate cuts, weighing on the Canadian dollar.

At the July meeting, the BoC cut rates and took on a more dovish outlook. Economists expect another rate cut at the September meeting. Therefore, if the employment report shows further weakness, the September rate cut bets will rise. On the other hand, if employment recovers, there will be less pressure on Canada’s central bank to cut rates.

USD/CAD weekly technical forecast: Solid bullish swing

USD/CAD daily chart

On the technical side, the USD/CAD price has broken above the 1.3802 resistance level to make a higher high. The break comes after a sharp bullish move from the 1.3601 support level. Initially, bears and bulls were equally matched. The price made strong bearish, and bullish candles.

However, the last swing had only bullish candles, indicating one side was stronger. Consequently, the price easily breached the 1.3802 resistance level. It retested the 1.3802 level as support to confirm the break before making a higher high. This indicates a new bullish trend that might continue next week, with a break above the 1.3901 key level.

More By This Author:

AUD/USD Weekly Forecast: RBA Cut Odds Rise Amid Cooling CPIUSD/JPY Price Analysis: Yen Soars After BoJ, Economic Turmoil

GBP/USD Outlook: Pound Plummets As BoE Lowers Rates

Disclaimer: Foreign exchange (Forex) trading carries a high level of risk and may not be suitable for all investors. The risk grows as the leverage is higher. Investment objectives, risk ...

more