USD/CAD Outlook: Dollar Pauses Rally Amid Profit Taking

The USD/CAD outlook points to a temporary downtrend as investors take profits on their long dollar positions. Moreover, the Canadian dollar strengthened as oil prices recovered from a massive decline in the previous session. However, recent data from Canada points to further declines in the loonie.

The dollar retreated as investors paused after a steep rally. The recent rise came from hawkish Fed remarks that changed the outlook for rate cuts in the US. Fed officials have shifted their outlook for interest rates after recent upbeat data. As a result, they have called for patience, with Powell stating that the country will need restrictive monetary policy conditions for longer. This has led to a decline in rate-cut bets, with the first cut likely to come in September.

Meanwhile, recent inflation data from Canada revealed a decline in price increases. Inflation rose by a weaker-than-expected 2.8% in March, confirming a consistent downtrend to the BoC’s target. Therefore, there is more pressure on the central bank to start implementing rate cuts in June, well before the Fed. After the inflation report, markets bet a 55% chance of a BoC cut in June, up from 44% before the news.

The divergence in monetary policies between the US and Canada keeps growing with each new economic report. At the moment, there is a high chance that the USD/CAD pair will resume its rally, especially since the recent decline in oil prices might continue. Oil traders have reversed the recent rally as demand concerns outweigh supply worries.

USD/CAD key events today

- US jobless claims

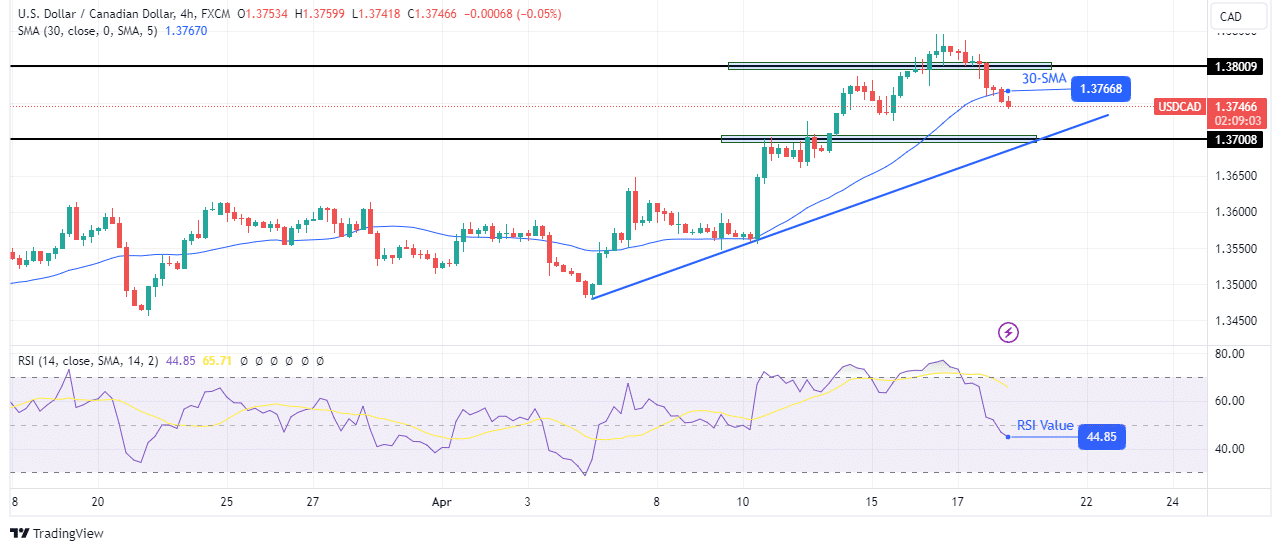

USD/CAD technical outlook: Bears challenge bullish momentum at the 30-SMA.

(Click on image to enlarge)

USD/CAD 4-hour chart

On the technical side, the USD/CAD price has fallen after failing to sustain a move above the 1.3800 key resistance level. The decline has broken below the 30-SMA support. At the same time, the RSI has fallen below the pivotal 50 mark. Consequently, there has been a shift in sentiment to bearish.

However, bears will only reverse the trend if the price breaks below the 1.3700 key level. Moreover, to confirm a new trend, the price must break below the bullish trendline and start making lower highs and lows.

More By This Author:

AUD/USD Price Analysis: Picks Up Amid China’s Economic GrowthUSD/JPY Price Analysis: Yen Marks 3-Decade Lows Against Dollar

EUR/USD Price Fails to Recover Amid Upbeat US Retail Sales

Disclaimer: Foreign exchange (Forex) trading carries a high level of risk and may not be suitable for all investors. The risk grows as the leverage is higher. Investment objectives, risk ...

more