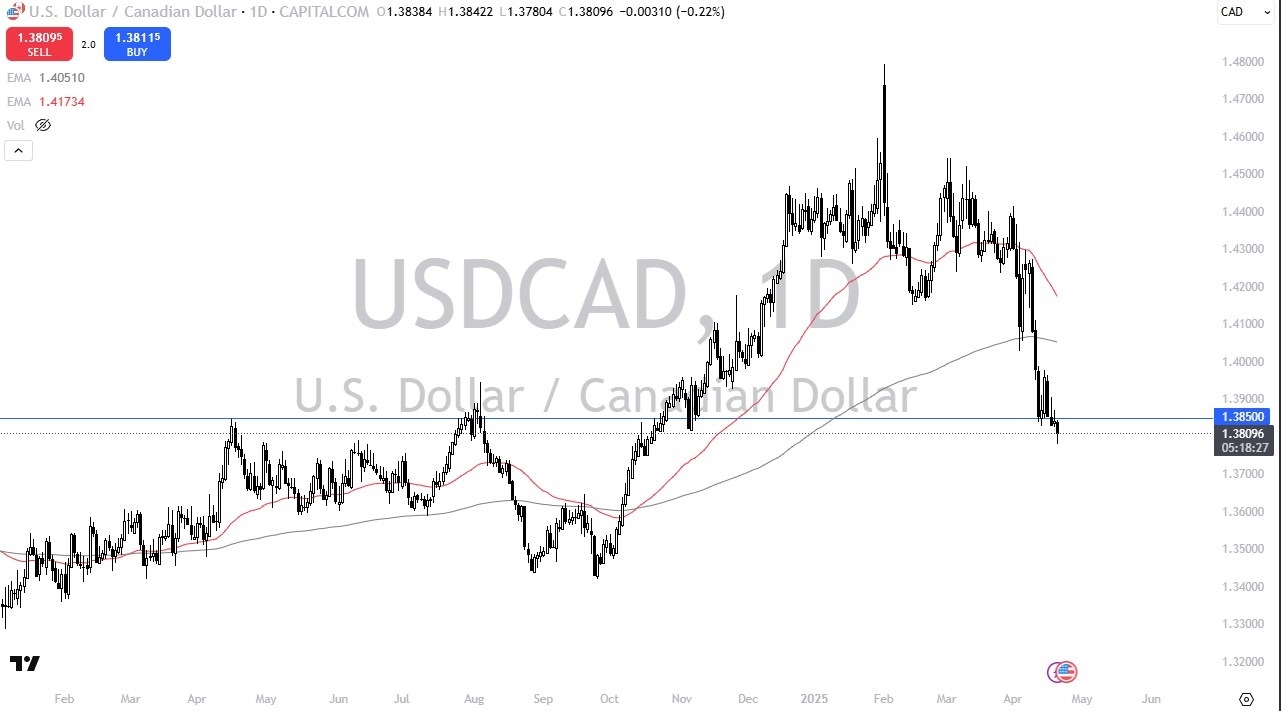

USD/CAD Forecast: Tests Support As Traders Eye Reversal

- The US dollar initially plunged against the Canadian dollar during the session here on Monday, but it does look like it's trying to recapture some of its momentum to the upside.

- \The 1.3850 level now ends up being an area of interest.

- Ultimately, this is a market that will be paying close attention to this region.

The fact that we have formed a couple of inverted hammers and now possibly a hammer sets up a real battle here. This makes a lot of sense because this is a market that is still dealing with a tariff war situation. Canada does not have a lot of good economic data at the moment and relies on the United States to... buy 80 to 85 percent of its exports.

(Click on image to enlarge)

So, the longer this goes on, the more likely we are to see a lot of trouble with the Canadian economy overall. With this, I believe you have a situation where traders are going to probably have to ponder where to go next here.

If We Break Even Lower

The market breaking down below the lows of the day does open up a move to the 1.37 level, but if we can break up on the top of the Thursday candlestick, then the 1.40 level will be targeted next. There is the argument to be made that quite frankly, the US dollar is just oversold, and a bounce is necessary. So, whether or not this is the beginning of something bigger remains to be seen.

But I do think you have a situation where we continue to see a lot of volatility. I think it is a dangerous market right now, but it's also one that I think offers a lot of opportunity if you are quick enough. So, with that being said, keep your position size reasonable, your stops tight, and recognize that we may get a lot of fake outs in both directions.

More By This Author:

AUD/USD Forecast: Hits The BarrierPairs In Focus - Sunday, April 20

USD/CAD Forecast: Consolidates Near Crucial Support

Disclosure: DailyForex will not be held liable for any loss or damage resulting from reliance on the information contained within this website including market news, analysis, trading signals ...

more