USD/CAD Bounds Over 1.35 As Greenback Pushes Up Across The Board

Image Source: Unsplash

- The USD/CAD had cleared the 1.3500 handle in Tuesday trading.

- The oil-backed Loonie is unable to find gains as the DXY captures the broader market.

- US data to feature heavily in the back half of the week.

The USD/CAD has decisively reclaimed the 1.3500 major handle for Tuesday. The US Dollar Index (DXY) is pumping higher across the entire market, bolstered by a hawkish Fed and risk aversion taking a bite out of the market's appetite for riskier assets.

The broad US Dollar Index (DXY) is at its highest levels since last November, and the Greenback (USD) is taking a step higher. Even with oil prices rising for Tuesday which would normally prop up the Loonie (CAD), the USD is still the clear winner on the charts.

US Treasury yields are knocking on multi-year highs with the 10-year Treasury yield holding above 4.5%, pushing the USD higher. US markets are increasingly concerned about a potential US government shutdown looming, knocking risk appetite even further back.

Economic calendar: US figures in focus

On the data docket it's notably CAD-thin, leaving investors to focus almost entirely on US data for this week.

Tuesday saw US Housing Price Index figures cleanly beat expectations, printing at 0.8%, leaping over the forecast 0.5% and doubling the previous reading of 0.4%.

Wednesday will bring US Durable Goods Orders (forecast: -0.5%, previous -5.2%), and investors will be focusing on US Gross Domestic Product (GDP) figures due on Thursday. Median market forecasts are anticipating a steady print at an annualized 2.1% for the second quarter.

The trading week will close out with US Personal Consumption Expenditure (PCE) Price Index data on Friday. PCE, the Federal Reserve's (Fed) preferred US inflation measure, is expected to hold steady at 0.2% for the month of August.

A data beat could see the Greenback clear even further ground with Fed policymakers already leaning towards the potential for further rate hikes in the future if inflation refuses to bed down.

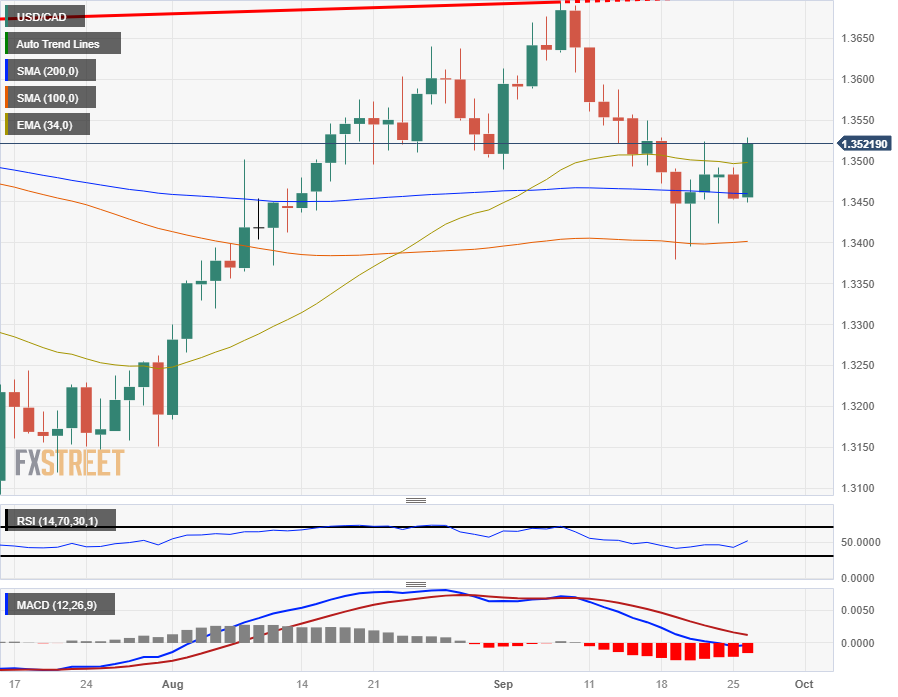

USD/CAD technical outlook

The Greenback is up 0.3% against the Loonie in Tuesday's market session, vaulting the 1.3500 mark and poised to extend further beyond the 200-hour Simple Moving Average (SMA) currently chalked in near 1.3480.

Near-term resistance is coming from last week's swing high near 1.3525, and intraday bullish momentum might find a covering pullback from here.

On the daily candlesticks, the USD/CAD is geared for a decisive split from the 200-day SMA, which has constrained price action for several days and is currently settling just north of 1.3450. An extended bull run will see the pair set for a re-challenge of early September's peak of 1.3695.

USD/CAD daily chart

(Click on image to enlarge)

USD/CAD technical levels

USD/CAD

| OVERVIEW | |

|---|---|

| Today last price | 1.3524 |

| Today Daily Change | 0.0070 |

| Today Daily Change % | 0.52 |

| Today daily open | 1.3454 |

| TRENDS | |

|---|---|

| Daily SMA20 | 1.3545 |

| Daily SMA50 | 1.3446 |

| Daily SMA100 | 1.34 |

| Daily SMA200 | 1.3461 |

| LEVELS | |

|---|---|

| Previous Daily High | 1.3492 |

| Previous Daily Low | 1.3453 |

| Previous Weekly High | 1.3528 |

| Previous Weekly Low | 1.3379 |

| Previous Monthly High | 1.364 |

| Previous Monthly Low | 1.3184 |

| Daily Fibonacci 38.2% | 1.3468 |

| Daily Fibonacci 61.8% | 1.3477 |

| Daily Pivot Point S1 | 1.3441 |

| Daily Pivot Point S2 | 1.3428 |

| Daily Pivot Point S3 | 1.3402 |

| Daily Pivot Point R1 | 1.3479 |

| Daily Pivot Point R2 | 1.3505 |

| Daily Pivot Point R3 | 1.3518 |

More By This Author:

NZD/USD Looking To Stabilize Near 0.5950 Ahead Of US Data Heavy WeekUS Dollar Steady As Markets Digest Monday's Punch

USD/JPY Surges To 11-month High Around 148.90 On Market Caution, Upbeat US Treasury Yields

Disclaimer: Information on these pages contains forward-looking statements that involve risks and uncertainties. Markets and instruments profiled on this page are for informational purposes only ...

more