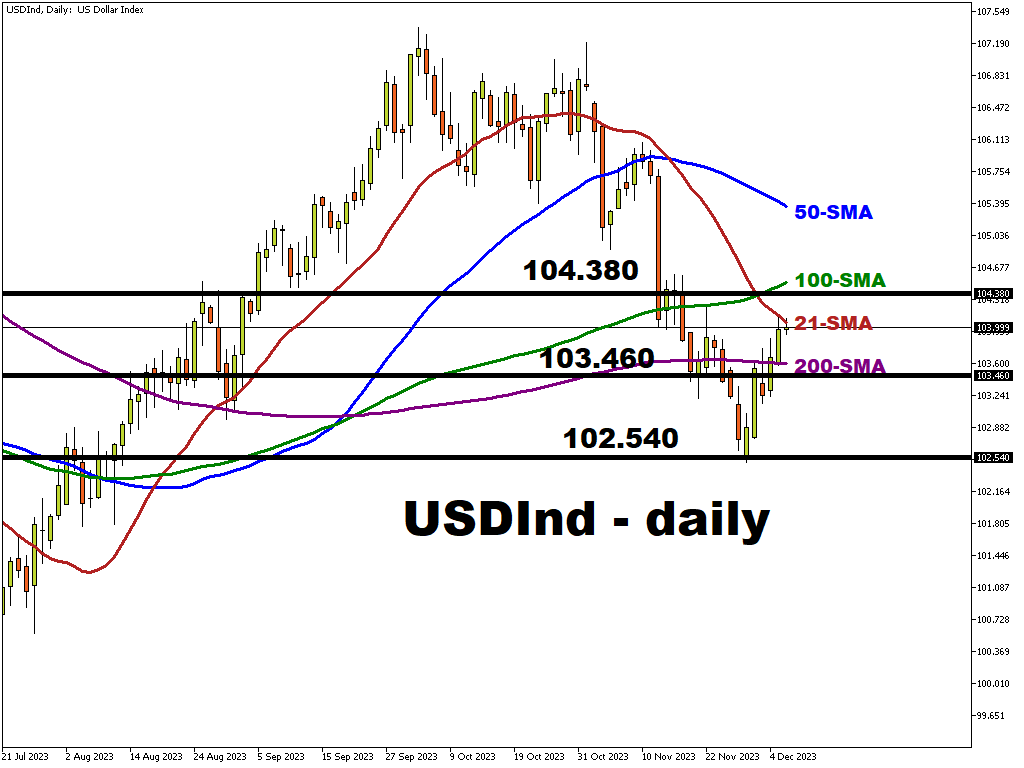

USD Rebounds Towards 21-SMA

It’s a big next few days for economic data releases in the world’s biggest economy, with jobs numbers to the fore.

Of course, next week sees the final FOMC meeting of the year with markets primed, locked, and loaded for over 120bps of rate cuts in 2024.

Certainly, the data is rolling over, potentially closer to a soft landing but there is a high chance that Chair Powell doesn’t quite signal the all clear on inflation just yet, or at least policy easing.

Data is key, and yesterday’s release of the October JOLTS job openings, which slowed more than expected, suggested that labor markets have continued to cool and are becoming better balanced without clear signs of a growth slowdown.

That is what can be described as a “soft landing”.

US ISM Services figures also published yesterday actually slightly increased more than expectations and continue to point towards more modest growth for this sector.

Overall, this helped the dollar rebound for a second day this week and off the 200-day simple moving average at 103.56.

The next upside level in the DXY is a major Fibonacci retracement point of the summer rally at 104.38.

ADP and NFP to come…

ADP payrolls are notoriously a poor predictor of Friday’s much more important monthly non-farm payrolls data. Still, markets have moved on outsized ADP prints, with today’s forecast at 130k.

The consensus headline print for NFP is around 180k which would be slightly cooler than the recent three- and six-month averages around 200k.

An unchanged unemployment rate below 4% is expected along with modest wage growth.

It seems markets will need to see a big beat in the headline to rein in the rate cut bets that have built up in money markets recently.

EUR/USD sinks on ECB comments…

As well as the recent dollar resilience, EUR/USD has dropped for five straight days as some of the ECB hawks have changed their tune this week.

The hardliners are now suggesting that another rate hike is off the table and the discussion has moved to rate cuts.

A big slump in factory orders in the region’s biggest economy doesn’t bode well for any near-term rebound in activity.

EUR/USD is trading close to its 100-day simple moving average at 1.0770. The 200-day simple moving average sits above at 1.0820.

CAD hoping for a hawkish hold by the Bank of Canada…

The BoC meeting today will leave rates unchanged. The key question is whether policymakers will keep their hawkish bias or acknowledge more explicitly the slowdown in the economic outlook.

Inflation is cooling but the job market may still be too tight for any shift.

With around 100bps of rate cuts priced in, there is plenty of room for this to be reduced if the bank is still relatively hawkish. The 200-day moving average at 1.3515 should offer support in USD/CAD.

More By This Author:

BTC Pierces $42,000Week Ahead: USD To Test 200-Period SMA Resistance?

BRN Is Trying To Stabilize Above $80/Bbl

Disclaimer: Forecasts which are made in the review constitute the personal view of the author. Commentaries made do not constitute trade recommendations or guidance for working on financial ...

more