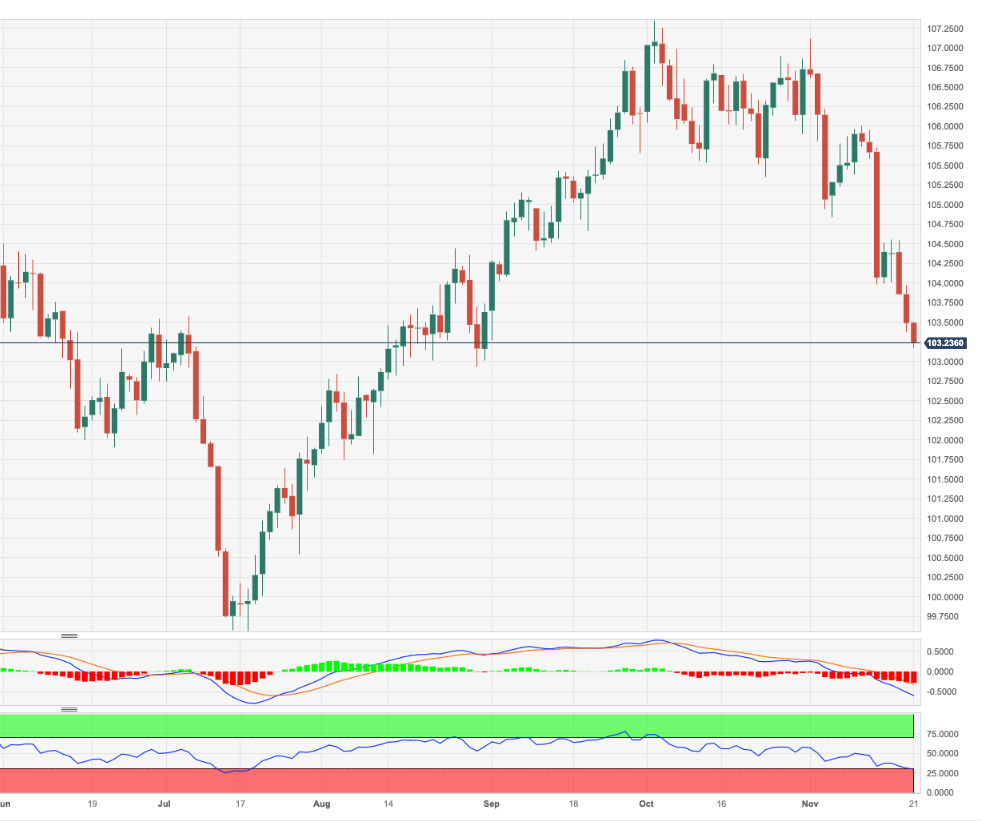

USD Index Price Analysis: Further Losses Target 103.00 And Below

- DXY accelerates its losses and approaches 103.00.

- Immediately to the downside comes the weekly low of 102.93.

DXY retreats for the third session in a row and trades at shouting distance from the key 103.00 support, or three-month lows.

In case bears push harder, the breakdown of the November low of 103.17 should leave the door open to further retracements in the short-term horizon. That said, the next support emerges at the weekly low of 102.93 (August 30) prior to the psychological 100.00 threshold.

In the meantime, while below the key 200-day SMA at 103.61, the outlook for the index is expected to remain bearish.

DXY daily chart

(Click on image to enlarge)

Dollar Index Spot

| OVERVIEW | |

|---|---|

| Today last price | 103.31 |

| Today Daily Change | 29 |

| Today Daily Change % | -0.17 |

| Today daily open | 103.49 |

| TRENDS | |

|---|---|

| Daily SMA20 | 105.53 |

| Daily SMA50 | 105.79 |

| Daily SMA100 | 104.2 |

| Daily SMA200 | 103.62 |

| LEVELS | |

|---|---|

| Previous Daily High | 103.97 |

| Previous Daily Low | 103.38 |

| Previous Weekly High | 105.96 |

| Previous Weekly Low | 103.85 |

| Previous Monthly High | 107.35 |

| Previous Monthly Low | 105.35 |

| Daily Fibonacci 38.2% | 103.61 |

| Daily Fibonacci 61.8% | 103.75 |

| Daily Pivot Point S1 | 103.26 |

| Daily Pivot Point S2 | 103.02 |

| Daily Pivot Point S3 | 102.66 |

| Daily Pivot Point R1 | 103.85 |

| Daily Pivot Point R2 | 104.21 |

| Daily Pivot Point R3 | 104.44 |

More By This Author:

Natural Gas Futures: A Deeper Drop Seems UnlikelyCrude Oil Futures: Further Recovery Not Favoured

Gold Futures: Rebound Could Extend Further

Disclosure: Information on this article contains forward-looking statements that involve risks and uncertainties. Markets and instruments profiled on this page are for informational purposes ...

more