USD Index Fades The Uptick To The 100.00 Region

- The index remains under pressure near the 100.00 zone.

- Risk appetite trends appear mixed at the beginning of the week.

- The NY Empire State Index will be the sole release on Monday.

The greenback, in terms of the USD Index (DXY), navigated a tight range close to the key 100.00 neighborhood at the beginning of the week.

USD Index is cautious ahead of the FOMC and looks at risk trends

The index appears to have met some initial resistance around the 100.00 region so far on Monday, regaining little composure following Friday’s lows in the 99.60/55 band, an area last traded in late April 2022.

The persistent offered bias in the dollar has been particularly magnified in the wake of the release of US inflation figures for the month of June (July 12), in tandem with rising speculation that the Fed might end its current hiking cycle sooner rather than later.

In addition, mixed results from Chinese fundamentals published during early trade also collaborated with the vacillating price action in the FX universe on Monday.

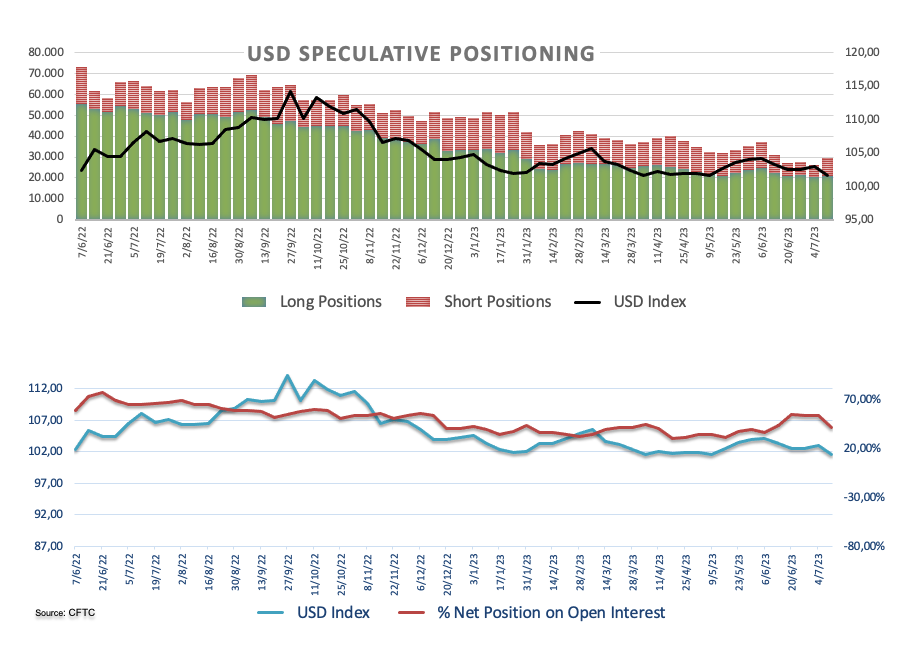

On the speculative front, USD net longs dropped to levels last seen in late May, according to the latest CFTC Positioning Report for the week ended on July 11.

In the US data space, the NY Empire State Manufacturing Index will be the only publication later in the NA session on Monday.

What to look for around USD

The index remains under heavy pressure and attempts a tepid recovery with immediate target at the 100.00 region.

Meanwhile, the likelihood of another 25 bps hike at the Fed's upcoming meeting in July remains high and supported by the still tight US labor market and despite the persevering disinflationary pressures.

This view was further bolstered by comments from Fed Chief Powell at the June FOMC event, who referred to the July meeting as "live" and indicated that most of the Committee is prepared to resume the tightening campaign as early as next month.

Key events in the US this week: New York Empire State Manufacturing Index (Monday) – Retail Sales, Industrial Production, Business Inventories, NAHB Housing Market Index, TIC Flows (Tuesday) – MBA Mortgage Applications, Building Permits, Housing Starts (Wednesday) – Initial Jobless Claims, Philly Fed Manufacturing Index, CB Leading Index, Existing Home Sales (Thursday).

Eminent issues on the back boiler: Persistent debate over a soft/hard landing of the US economy. Terminal Interest rate near the peak vs. speculation of rate cuts in late 2023/early 2024. Geopolitical effervescence vs. Russia and China. US-China trade conflict.

USD Index relevant levels

Now, the index is down 0.10% at 99.85 and faces immediate support at 99.57 (2023 low July 13) followed by 97.68 (weekly low March 30) and 95.17 (monthly low February 10, 2022). On the other hand, the breakout of 100.00 (round level) could open the door to 102.68 (55-dat SMA) and then 103.54 (weekly high June 30).

More By This Author:

Natural Gas Futures: A Deeper Retracement Seems On The TableEUR/USD Price Analysis: The 1.1200 Barrier Is Just Around The Corner

Natural Gas Futures: Potential Extra Losses In The Near Term

Disclosure: Information on this article contains forward-looking statements that involve risks and uncertainties. Markets and instruments profiled on this page are for informational purposes ...

more