US Payrolls May Pour Cold Water On The Dollar’s Momentum

Our economist expects June’s headline payrolls to come at 550-600k, below market consensus. In 2021, NFP releases have generally generated an asymmetrically negative USD reaction when data missed expectations and a positive response in equities. Tomorrow, we could see the USD give up some gains in favor of the high-beta NOK, CAD, AUD, and NZD.

We expect a below-consensus NFP

The recent hawkish shift from the Fed has pushed the notion of a data-dependent approach to future policy moves, and data releases are playing an increasingly larger role in driving market moves. From an FX perspective, positive data surprises should benefit the dollar through the rate expectations channel, as further signs that the US economy is indeed overheating should fuel expectation of earlier action by the Fed.

Tomorrow’s US jobs report for the month of June should set the tone for markets and the Fed’s rate expectations for the rest of July. Our US economist estimates the headline non-farm payrolls (NFP) print to fall within the 550-600k range. While arguably a fairly solid read, consensus is centered for a stronger headline figure (around 710k): should our estimates prove correct, the data miss should provide enough reasons to the market to a) believe the Fed’s hawkishness has reached a peak for now, and b) settle for a “quiet”/low-volatility summer.

Dollar’s response to payrolls asymmetrically tilted to the downside in 2021

A look at previous NFP releases can provide some guidance on what reaction to expect in the FX market tomorrow. As shown in the second column of the table below, there has been a tendency in 2021 by the dollar (measured by the DXY index) to show an asymmetrical reaction to payrolls, so that an NFP miss generated more USD downside compared to the upside generated by a stronger-than-expected release.

Source: ING, Refinitiv

*percentage price change in SP500 from 1 April close to 5 April open (US markets were closed on 2 April)

The third column of the table shows how the reaction has been generally positive for risk sentiment (as gauged by the S&P500) in recent payroll releases. The rationale there appears to be, once again, related to the Fed’s rate expectations, so that a below-consensus release suggests that the Fed can continue to put off its tightening cycle, allowing stocks to keep benefiting from lower rates for longer.

We expect the dollar to lose some ground against pro-cyclicals tomorrow

Should our economist’s projections for a positive but below-consensus NFP read prove accurate, we expect the price action in FX to prove broadly negative for the dollar as some of the Fed’s hawkish expectations are scaled back, while the recovery story remains intact. Any dollar weakness should, however, be more pronounced against those currencies that can benefit from a repetition of the positive equity (risk sentiment) reaction seen in previous instances.

Source: ING, Refinitiv

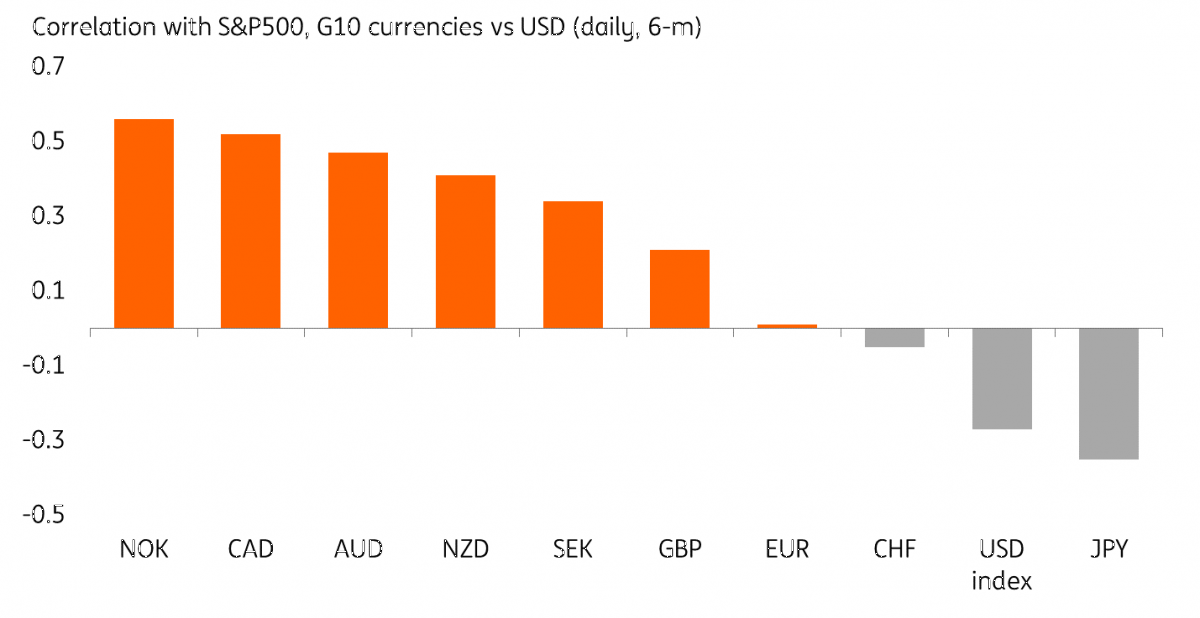

A look at the correlations with the S&P500 (used for consistency with the table above), shows how NOK is set to be the biggest beneficiary of a positive equity response, followed by CAD, AUD, and NZD.

Among those, NOK, CAD, and NZD – which can count on hawkish central banks – may also benefit from expectations of a low-volatility FX market in the coming weeks which offers some breeding ground for carry trades. However, such impact may be more visible against currencies that have a more attractive funding character, such as JPY, CHF, and the euro.

While the OPEC+ meeting is still in progress at the time of writing, reports suggest that the members might be opting for a slightly lower-than-expected supply increase (400k b.p.d.), which could also lend support for oil-exporting FX.

Disclaimer: This publication has been prepared by the Economic and Financial Analysis Division of ING Bank N.V. (“ING”) solely for information purposes without regard to any ...

more