US Dollar Trims Losses Following Better-Than-Expected US Consumer Confidence Data

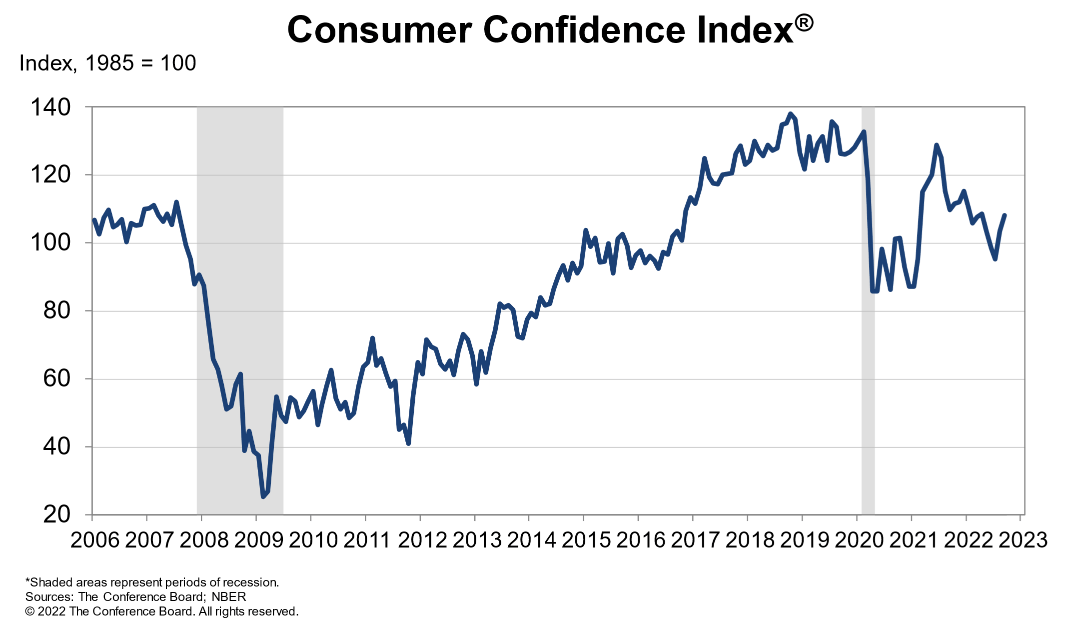

A popular gauge of U.S. consumer attitudes extended its recovery this month and climbed to its best level since April, as falling gasoline prices, coupled with strength in the labor market, served to offset concerns about the slowdown and persistently high inflation in some areas of the economy.

According to the Conference Board, consumer confidence in September rose to 108.00 from 103.02, beating expectations for an advance to 104.06. While the gain is not significantly large, it is still a step in the right direction and represents a positive sign for future consumption, the main driver of U.S. economic activity.

Source: Conference Board

Delving deeper into today's numbers, the present situation index, based on the current business and labor market outlook, jumped to 149.6 from 145.4 on perceptions that hiring conditions are still healthy. This strong gain is consistent with stabilizing activity, a scenario that reduces the likelihood of an imminent downturn.

Elsewhere, the expectations index, which tracks short-term prospects for income, the business environment, and the jobs market surged to 80.3 from 70.1, exceeding the 80.00 level that is indicative of improved growth prospects.

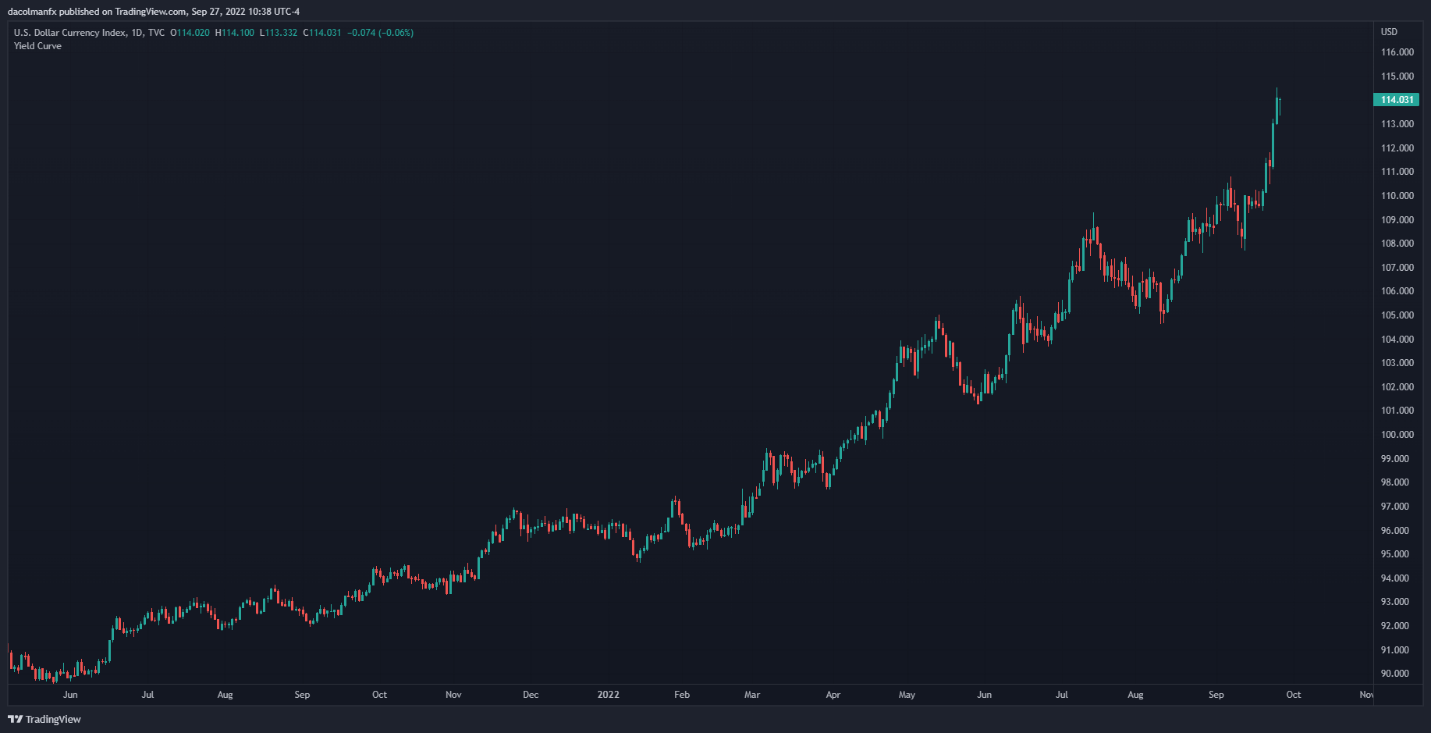

The U.S. dollar, as measured by the DXY index, trimmed most of its early session losses to trade around 114.05 after the survey results were released, as brightening sentiment among Americans bodes well for spending in the final months of 2022, which could add to inflationary pressures and prompt the Fed to continue aggressively raising interest rates.

With the American consumer holding up well despite sky-high inflation and tightening financial conditions, the U.S. central bank will have to slam on the breaks even harder to bring about the kind of demand destruction needed to knock inflation down and force it back to the 2.0% target. This reduces the probability of a monetary policy pivot in 2023, a situation that will bias U.S. Treasury yields to the upside. In this environment, the U.S. dollar is likely to retain strong momentum in the FX market, paving the way for the DXY index to keep conquering fresh multi-decade highs in the near-term.

US DOLLAR (DXY) DAILY CHART

(Click on image to enlarge)

Source: TradingView

More By This Author:

Euro Price Forecast: EUR/USD Looks To Test 20-year Lows, Central Bank Speakers In FocusS&P 500, Nasdaq 100 And Dow Fall Amid Soaring US Treasury Yields.

EUR/USD At Multi-Decade Lows Amid Broad USD Momentum, Sterling Crisis Weighs

Disclosure: See the full disclosure for DailyFX here.