US Dollar Strength Persists Ahead Of NFP

The US Dollar has gone from strength to strength as G10 currencies falter. As we highlighted earlier, USD/JPY has hit a fresh 24yr high on the back of the rally in global bond yields. Meanwhile, continued verbal intervention from the Japanese Finance Minister has done little to ease the Yen’s persistent decline, which will likely remain the case unless there is a shift from BoJ Governor Kuroda.

Elsewhere, while the Euro is hovering around parity, all things considered with continued USD strength, the Euro has held up relatively well amid the short squeeze across Euro crosses ahead of next week’s ECB meeting. However, as has been the case in the past few months the key narrative centers around the energy crisis for the Euro. Reports this morning from the FT noted that G7 countries are poised to agree on a price cap on purchases of Russian oil. The cap would be implemented at the same time as the EU’s own embargoes on Russian oil imports, with the measures taking effect on December 5th for crude and February 5th for refined products. In turn, the Kremlin has stated that should the oil cap be agreed upon, Russia would stop selling oil to those who impose price caps and thus exacerbating the terms of trade shock that the EU is facing.

EUR: On the technical front, key support is situated at 0.9900-10, while resistance resides at 1.0080-1.0100. While my bias remains a fade on rallies for EUR/USD, there is a potential for a squeeze higher into ECB next week, unless we see a strong NFP report out later.

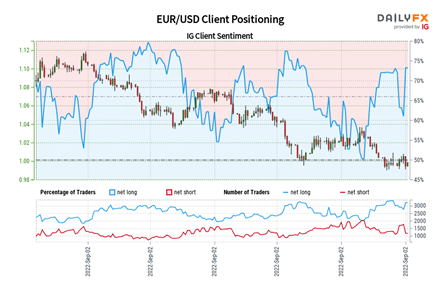

IG Client Sentiment Signals Mixed EUR/USD Outlook

Data shows 71.03% of traders are net-long with the ratio of traders long to short at 2.45 to 1. The number of traders net-long is 9.83% higher than yesterday and 6.88% lower than last week, while the number of traders net-short is 19.38% lower than yesterday and 3.68% lower than last week.

We typically take a contrarian view to crowd sentiment, and the fact traders are net-long suggests EUR/USD prices may continue to fall.

Positioning is more net-long than yesterday but less net-long from last week. The combination of current sentiment and recent changes gives us a further mixed EUR/USD trading bias.

More By This Author:

WTI Crude Oil Update: G7 Meet To Discuss Russian Oil Price Cap, WTI Rises

S&P 500, Nasdaq, Dow Bounce From Lows Ahead Of NFP

US Dollar Soars As Economic Resilience Gives Fed No Reason To Pivot, NFP Eyed

Disclosure: See the full disclosure for DailyFX here.