US Dollar Resumes March Higher Despite Disappointing Durable Goods Data

US durable goods data for July came in flat on an MoM basis, well below expectations of 0.6%. Durable goods ex. transportation was 0.3%, in-line with Wall Street estimates. The number was weighed down by a sharp decline in military bookings, with defense aircraft orders falling 50%. Fears over slowing growth and higher borrowing costs in the near term could continue to weigh on incoming data as the economic picture in the US deteriorates. The disappointing data follows yesterday’s PMI release which saw services data sink well into contractionary territory.

This week’s data continues to set the stage for a Friday session that will see US PCE data drop and Fed Chair Jerome Powell speak from the Jackson Hole Economic Symposium. Markets have been struggling to digest the plethora of information we have received lately, as slowing economic data in the US battles with extremely strong labor market prints. If PCE data confirms the recent CPI print from July, markets could be in store for a kneejerk reaction given how far and how fast the Dollar and yields have moved of late. The battle remains over what will be the Fed’s “terminal rate,” with some recent Fedspeak suggesting it could be close to or even above 4%. Friday’s speech will hopefully offer some clarity for market participants, even though the FOMC moved away from explicit forward guidance at the July meeting.

US Economic Calendar

Courtesy of the DailyFX Economic Calendar

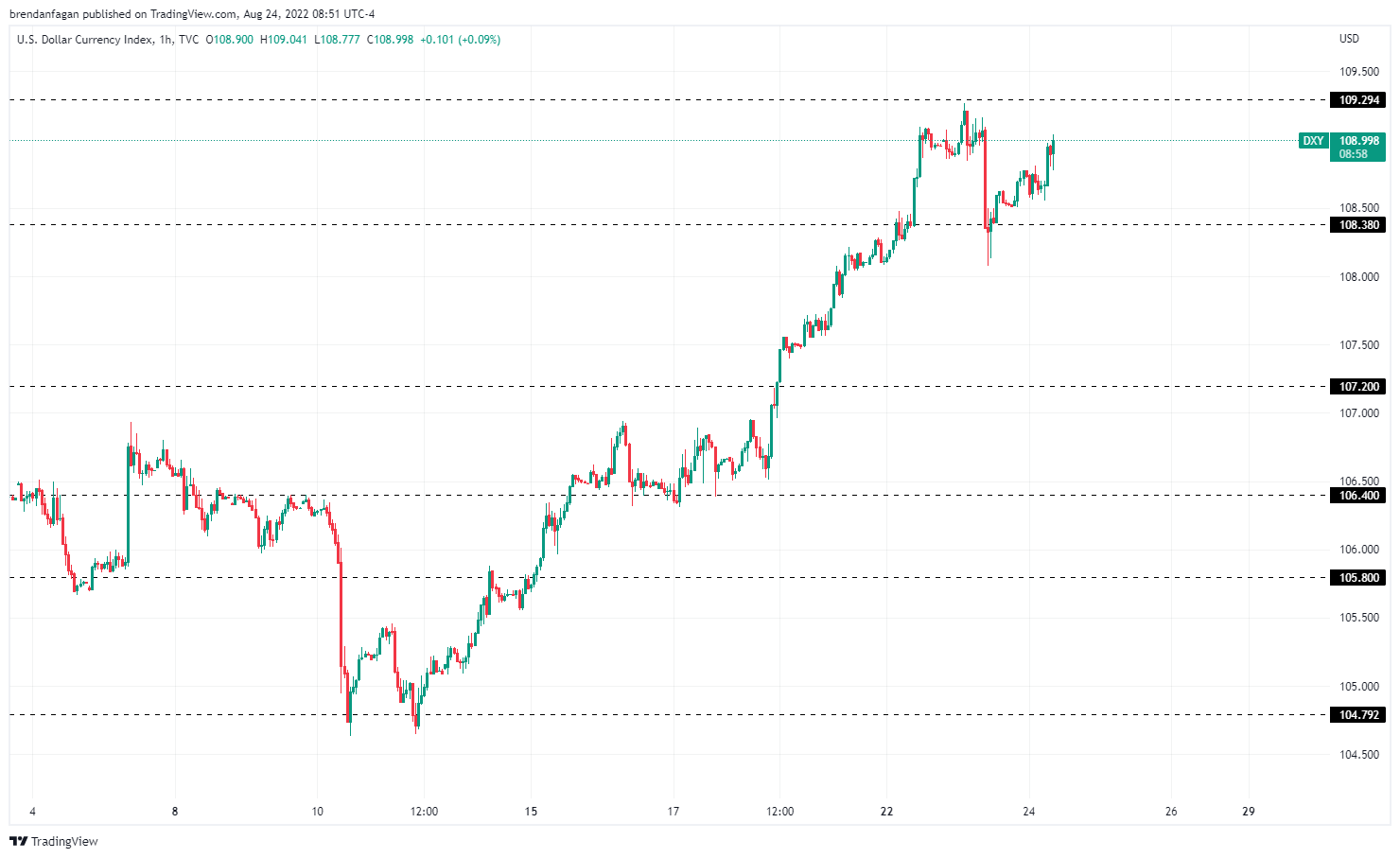

Following the sharp drop in the Greenback after Tuesday’s dismal PMI data, the US Dollar has resumed its relentless march higher, nearly retracing all of yesterday’s decline. Resistance remains ahead at 109.29, which halted yesterday’s advance and also marked the July top. The Dollar basket continues to be pushed higher by weakness in the Euro and Pound, as both economies continue to weaken significantly. With peers struggling significantly, it is hard to envision a USD reversal without a change in the macro environment or a Fed pivot. With both extremely unlikely to happen in the near term, it may be a matter of when and not if we break through resistance at 109.29. The combination of major event risk and bulls relentlessly returning the Dollar Index to resistance could make for an exciting and potentially explosive Friday session.

US Dollar Index (DXY) 1-Hour Chart

(Click on image to enlarge)

Chart created with TradingView

More By This Author:

Crude Oil Update: Brent Buoyed By Black Sea Bottlenecks, OPEC+ And API

S&P 500, Nasdaq, Dow Grind Support As Markets Weigh Disappointing Data

Gold Price Forecast: Gold Breakdown Pivots Back For Resistance Test

Disclosure: See the full disclosure for DailyFX here.