US Dollar Outlook: USD/CAD Volatility To Rise, Jobs Data Looms

US Dollar bears flexed their muscles during Thursday’s trading session and drove the Greenback down to weekly lows. The broader DXY Index dropped -0.4% on the day after failing to surmount the 91.40-price level. I highlighted this big area of technical resistance in my US Dollar forecast published earlier in the week. US Dollar selling pressure was primarily fueled by EUR/USD strength and USD/CAD weakness. AUD/USD had a solid session as well with a gain of 34-pips.

The US Dollar turned lower despite another round of comments from Dallas Fed President Robert Kaplan who reiterated how he thinks the Federal Reserve should start tapering discussions sooner rather than later. Markets likely overlooked these headlines seeing that Kaplan is known to be relatively hawkish, and more importantly, a non-voter on Fed policy this year.

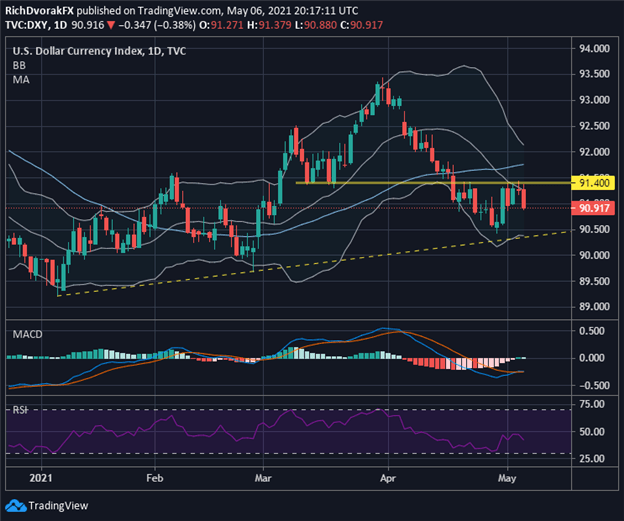

DXY – US DOLLAR INDEX PRICE CHART: DAILY TIME FRAME (24 DEC 2020 TO 06 MAY 2021)

Chart by @RichDvorakFX created using TradingView

From a technical perspective, the negatively-sloped 20-day simple moving average seems to be helping steer the US Dollar Index lower. That said, the latest stretch of downside stalled out before making new weekly lows. US Dollar bulls might try to wrestle back control of direction, but technical resistance around the 91.40-price level remains a daunting obstacle. Eclipsing this technical barrier, however, could open up the door to a sharp move toward the 92.00-handle. Though it appears more likely that the broader DXY Index might be headed for technical support posed by the 90.50-price level, which is underpinned by a confluence of April’s swing low, an ascending trendline as well as the bottom Bollinger Band.

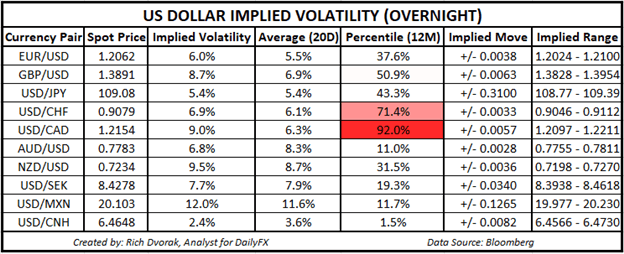

USD PRICE OUTLOOK – US DOLLAR IMPLIED VOLATILITY TRADING RANGES (OVERNIGHT)

Looking ahead to Friday’s trading session, we see that the US Dollar could be in store for some more heightened market activity. This is judging by overnight implied volatility readings for major currency pairs, which are generally above their respective 20-day averages. USD/CAD price action looks ripe for volatility in particular. USD/CAD overnight implied volatility of 9.0% compares to its 20-day average reading of 6.3% and ranks in the top 92nd percentile of measurements taken over the last 12-months. Taking a quick gander at the DailyFX Economic Calendar shows that the US Dollar and Canadian Dollar both face high-impact event risk stemming from the release of monthly jobs data. This fundamental catalyst due Friday, 07 May at 13:30 GMT will likely be front and center for USD/CAD traders.

Disclosure: See the full disclosure for DailyFX here.