US Dollar Outlook – Will Heavyweight Data Stem The US Dollar’s Ongoing Decline?

US DOLLAR (DXY) PRICE AND CHART ANALYSIS

- The US dollar remains under pressure after this week’s FOMC minutes.

- UD data releases will steer the greenback next week.

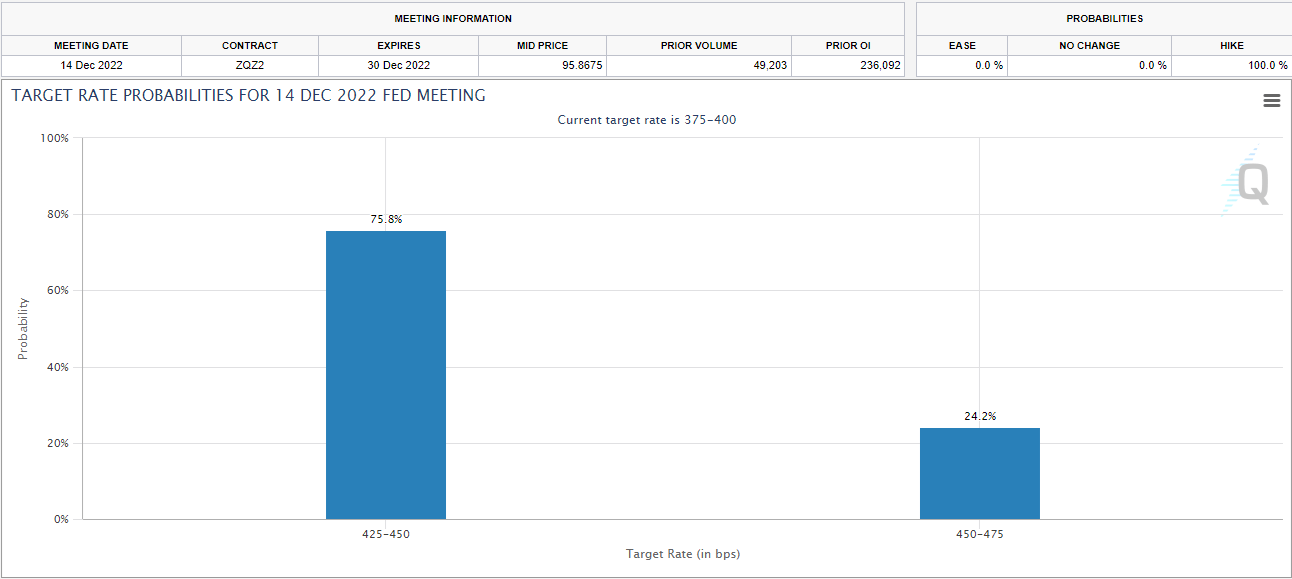

The Federal Reserve may reduce the size of future interest rate hikes soon after ‘a substantial majority of participants judged that a slowing in the pace of increase would likely soon be appropriate’ according to the latest FOMC minutes. This slowdown, due to uncertain lags and effects of prior increases on economic activity, could also ‘reduce the risks of financial instability in the financial system’ while the balance of risks to the US economy is now ‘skewed to the downside’. After hiking interest rates by 75 basis points at each of the last four FOMC meetings, the market now expects the US central bank to raise rates by half a percent at the mid-December meeting.

CME FedWatch Tool

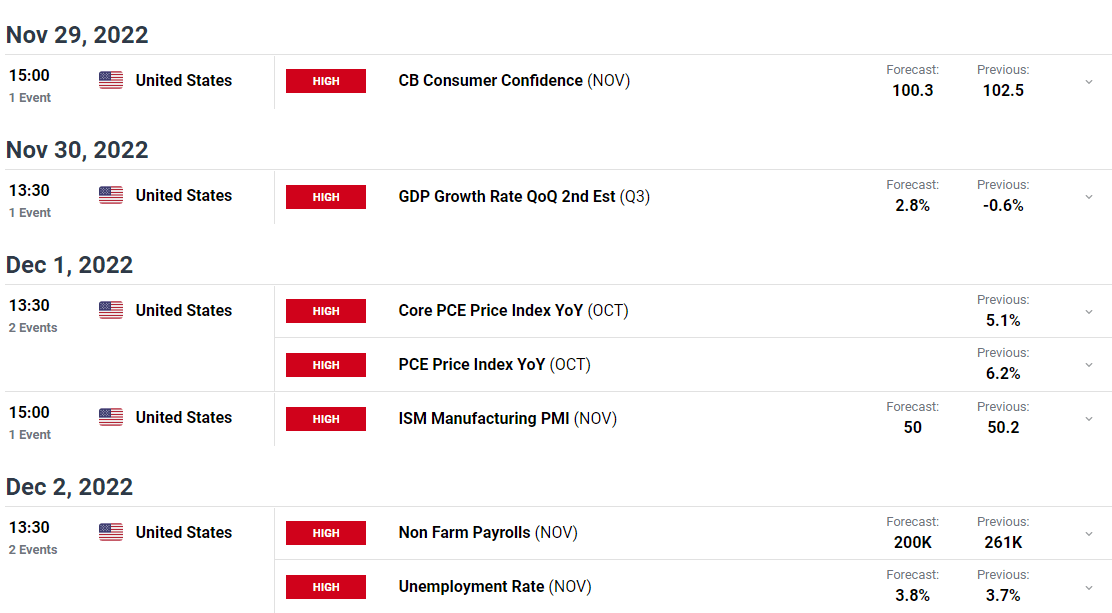

Next week the economic calendar is packed full of high-importance data releases and events that traders need to closely monitor. The front end of the week sees the latest CB consumer confidence release, followed the next day by the second look at US Q3 GDP, while the back end of the week sees the latest inflation and jobs numbers released. Last month’s core PCE data – a measure of prices paid for domestic purchases of goods and services – showed inflation moving higher but at a slightly slower pace than market expectations. After a brief bounce post-data, the US dollar resumed its downward path. The Jobs Report (NFP) set to be released on Friday is expected to show a slowdown in hiring in the US and a small uptick in the unemployment rate. A slowdown in hiring will please the Fed who are concerned that a robust jobs market will see wage increases continue to boost domestic inflation. The end of next week may be key in deciding the fate of the US dollar going into the end of the year.

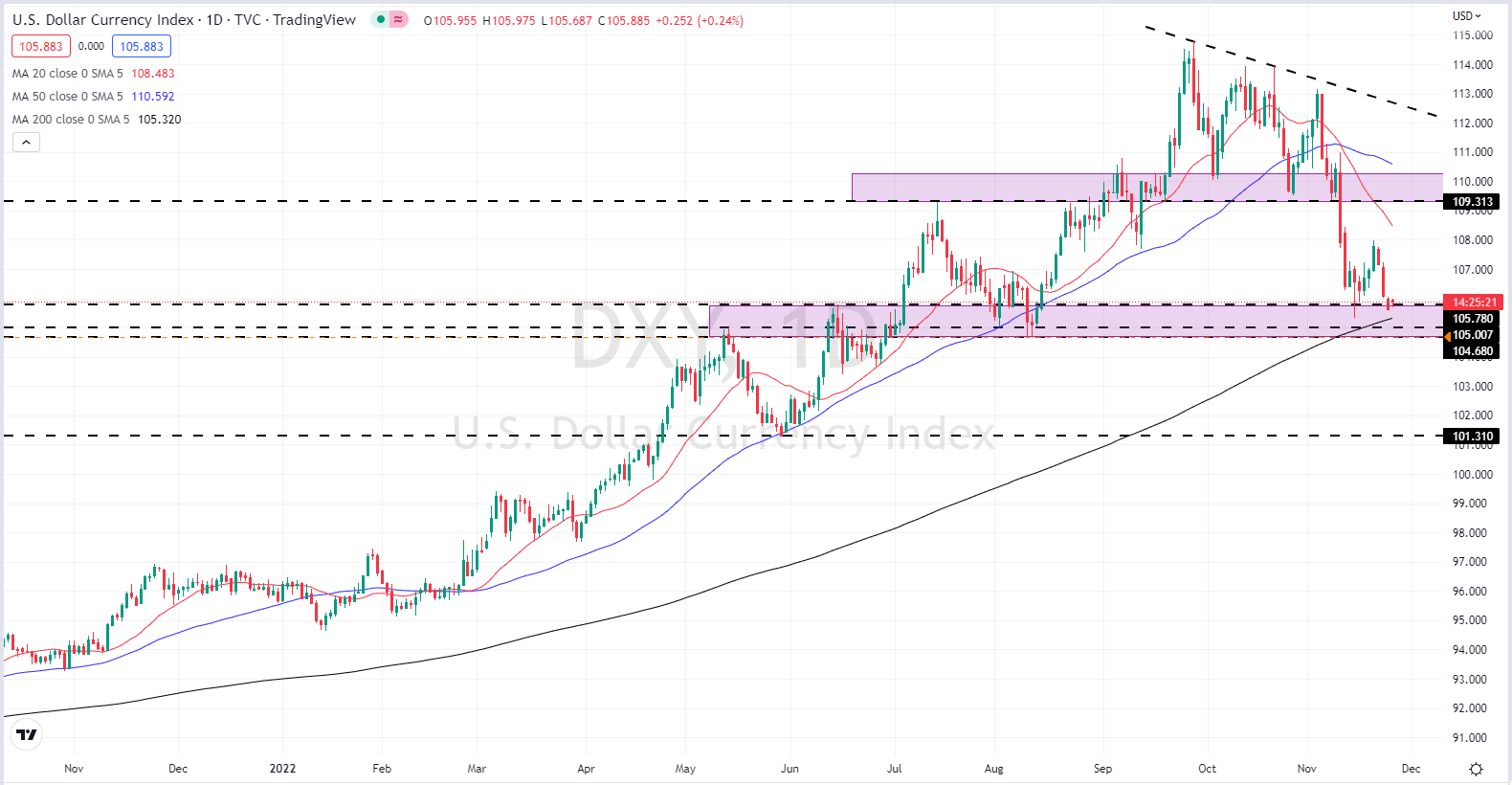

The US dollar is continuing to fade lower in anticipation of a slightly less hawkish Fed outlook. The US dollar had been a one-way trade for most of 2022, before the recent turnaround. The DXY has fallen 8% from late September with any bounces being sold into. The greenback is now threatening to break below the 200-day moving average, a technical indicator that has provided the USD with support since mid-June 2021. A confirmed break below the 200-dma, and it may not happen at the first attempt, and a push through a prior zone of recent highs and lows between 105.00 and 105.70, would leave the May swing-low at 101.30 the next downside objective. Any move higher is likely to meet stiff resistance at 108.00.

US DOLLAR CURRENCY INDEX DAILY PRICE CHART – NOVEMBER 25, 2022

More By This Author:

Australian Dollar Outlook: A Sinking US Dollar Floats All BoatsPound Fundamental Forecast: Retailers Hope For Booster Black Friday Sales

Crude Oil Whipsaws Around Key Level As Fundamental Drivers Clash

Disclosure: See the full disclosure for DailyFX here.