US Dollar Index Falls To Near 104.00 Amid Improved Risk Sentiment, Growth Concerns

Image Source: Pixabay

- The US Dollar Index keeps slipping as risk sentiment improves, thanks to President Trump’s latest tariff move.

- The White House just gave automakers in Mexico and Canada a one-month pass on the new 25% import tariffs.

- US job data disappointed—February’s ADP Employment Change showed just 77K new jobs, way below the 140K forecast.

The US Dollar Index (DXY), which measures the US Dollar (USD) against six major currencies, is trading around 104.00 during the European hours on Thursday. The DXY extends its losing streak for a fourth consecutive day amid improved risk sentiment, driven by another shift in US President Donald Trump’s tariff strategy.

On Wednesday, the White House announced a temporary one-month exemption for automakers in Mexico and Canada from the newly imposed 25% import tariffs. Additionally, Trump is considering excluding certain agricultural products from tariffs on both countries, according to a Bloomberg reporter on X.

President Trump also stated in a post on social media that he is working with House Republicans on a continuing resolution to fund the government through September, as reported by Reuters.

The Federal Reserve’s (Fed) March Beige Book carries added significance as concerns grow over the economic impact of Trump’s trade policies. Signs of strain are emerging within the US economy even before the full implementation of these measures.

The Greenback remains under pressure amid fears of slowing US economic momentum. The US ADP Employment Change for February reported just 77K new jobs, significantly missing the 140K forecast and falling well below January’s 186K figure. Moreover, the US ISM Manufacturing PMI came in at 50.3, slightly under the 50.5 forecast and down from January’s 50.9.

Traders are now focused on Friday’s US Nonfarm Payrolls (NFP) report, which is expected to show a modest rebound in job growth, with projections indicating an increase to 160K in February, up from January’s 143K.

US Dollar PRICE Today

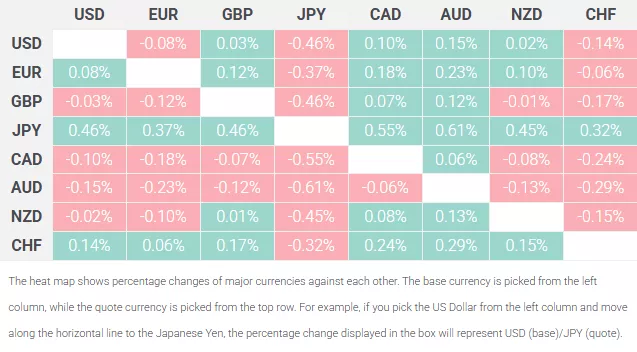

The table below shows the percentage change of US Dollar (USD) against listed major currencies today. US Dollar was the weakest against the Japanese Yen.

More By This Author:

USD/JPY Price Analysis: Tests Resistance At 149.50 Near Nine-Day EMAGold Price Declines As US Dollar Strengthens During Trump's Congressional Speech

US Dollar Index Breaks Below 106.50 Despite Risk-Off Sentiment Due To Global Tariff Fears

Information on these pages contains forward-looking statements that involve risks and uncertainties. Markets and instruments profiled on this page are for informational purposes only and should not ...

more