Us Dollar Index Dives To Two-Week Low On Trump’s Tariff Threats And Fiscal Jitters

Image Source: Pixabay

- DXY tumbles below 99.50, down 1.8% for the week amid broad risk-off sentiment.

- Trump threatens 50% tariffs on EU goods, 25% on Apple products made overseas.

- Markets eye upcoming FOMC Minutes, GDP, and core PCE data for policy signals.

The US Dollar Index (DXY), which tracks the value of the US Dollar (USD) against a basket of six major currencies, slumps sharply on Friday, down over 1.8% for the week after posting a modest gain on Thursday to trade around 99.10 near a two-week low, ahead of the weekend.

Although the US Dollar was already facing headwinds due to lingering trade tensions and growing concerns around the US fiscal outlook, the renewed weakness on Friday comes in response to US President Donald Trump’s aggressive trade rhetoric as he threatened to impose 50% tariffs on all goods sent to United States from the European Union (EU) and floated a 25% tariff ‘at least’ on Apple products manufactured abroad. The threats reignited fears of an escalating trade war and added to risk-off sentiment in global markets.

The threats in the form of social media posts came just hours before high-level trade talks were scheduled between Washington and Brussels. Trump had initially imposed a 20% tariff on most EU goods last month but temporarily halved the levy to 10% until July 8 to provide space for negotiations.

"Our discussions with them are going nowhere!" Trump wrote in a post on social media on Friday. He said the new tariffs would kick in on 1 June.

This aggressive stance is expected to decrease 20% of exports from the EU to the US, according to estimates by the Kiel Institute.

Looking ahead, market participants will focus on commentary from Fed officials, as well as the FOMC Meeting Minutes, preliminary Q1 GDP, core PCE price index, personal income and spending, durable goods orders, and the goods trade balance, all due next week, for fresh cues on the US economic outlook and monetary policy direction.

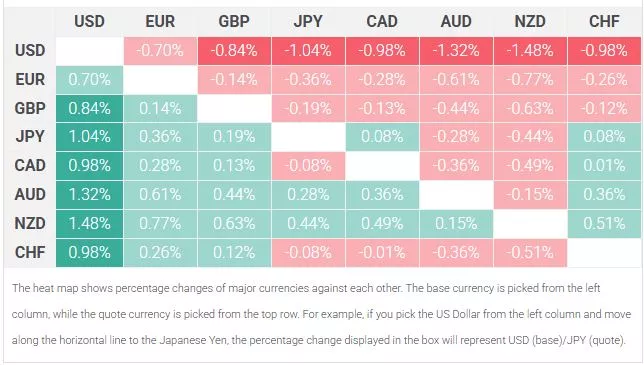

US Dollar PRICE Today

The table below shows the percentage change of US Dollar (USD) against listed major currencies today. US Dollar was the strongest against the Euro.

More By This Author:

Japanese Yen Remains On Track To Register Strong Weekly Gains Against USD; Bulls Not Ready To Give UpGBP/USD Holds Above 1.3400 As U.S. PMI Strength Offsets Fiscal Worries

Silver Price Forecast: Silver Retreats From Seven-Week Highs

Disclaimer: Information on these pages contains forward-looking statements that involve risks and uncertainties. Markets and instruments profiled on this page are for informational purposes only ...

more