Two Trades To Watch: GBP/USD, USD/JPY Forecast

Image Source: Unsplash

GBP/USD struggles as GDP stalls

- UK Q3 GDP 0%, down from 0.2% in Q2

- USD has been lifted this week by hawkish Fed comments

- GBP/USD tests 20 sma

The pound is holding steady after four days of losses after slightly better-than-expected UK GDP data.

UK GDP stalled in the third quarter at 0% percent quarter-on-quarter growth after growing 0.2% in the second quarter. Expectations had been for a contraction of 0.1%.

The UK economy stalled in the July to September period as household spending, business investment, and government spending all fell, with just a better trade performance supporting the economy.

The lackluster data will do little to stem concerns that the UK economy is set to deteriorate over the coming quarters.

The stagnant economy could be sufficient to help convince Bank of England policymakers that they have done enough to control inflation, particularly after the bank downwardly revised its growth forecasts in the November meeting.

However, Governor Andrew Bailey and chief economist Huw Pill said this week that rates needed to remain restrictive for an extended period to control inflation. The question here is how long is extended?

Traders are betting that peak rates have been reached and that the BoE could start cutting rates by mid-2024 inflation number.

Meanwhile, the US dollar pushed higher this week after hawkish comments from Federal Reserve officials, including chair Jerome Powell. Yesterday, Powell pushed back on the prospect of the Fed ending its rate hiking cycle and said that the central bank stands ready to hike again if needed.

US University of Michigan consumer sentiment data is due later.

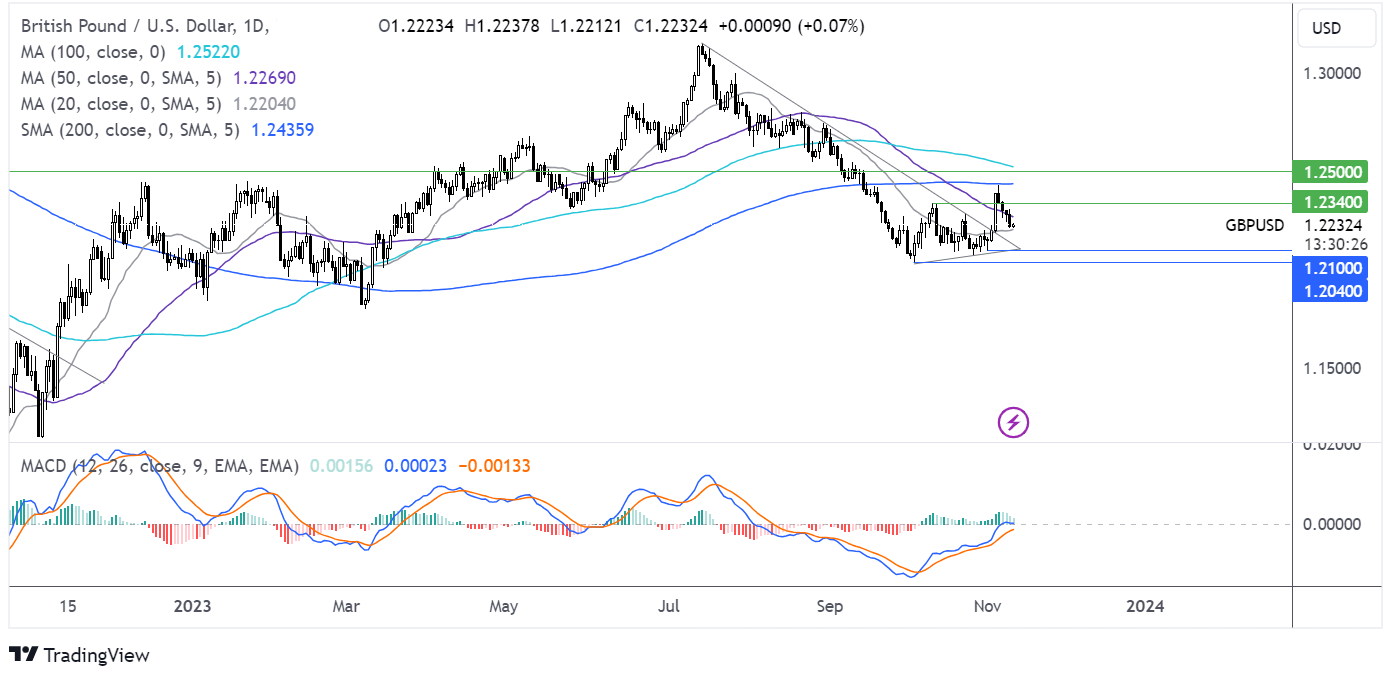

GBP/USD forecast - technical analysis

After running into resistance at the 200 sma, GBP/USD rebounded lower. The price has broken below support at 1.2330, the October high, and the 50 sma, which, combined with the receding bullish bias on the MACD, supports further downside for the pair.

Sellers will look to break below the 20 sma at 1.22 to extend the selloff to 1.21, the November low. A break below here opens the door to 1.2040, the October low.

(Click on image to enlarge)

USD/JPY rises after a hawkish Powell

- Federal Reserve chair Powell pushed back on rate hike pause bets

- US University of Michigan consumer sentiment data due

- USD/JPY grinds higher towards 151.70

USD/JPY Is rising for a fifth straight day as it approaches 151.50 amid a weak yen and after hawkish commentary from Federal Reserve officials this week.

Fed Reserve Chair Jerome Powell said yesterday that monetary policy may not be sufficiently restrictive to rein in inflation to the central bank's 2% target. He added that the Fed stood ready to hike rates again if it was necessary.

His tone was more hawkish than that of the FOMC meeting last week as he pushed back on expectations that the Federal Reserve was done hiking rates. This was in a similar line to other Federal Reserve officials they had spoken to this week, citing the resilience of the US economy and sticky inflation as reasons for a possible another hike.

The more hawkish-sounding Federal Reserve is in sharp contrast to the BOJ, which has signaled few plans to wind down its ultra-dovish monetary policy.

With the yen weakened past the 151.00 level to the dollar, the market is on edge over a potential intervention in the FX markets by Japanese authorities.

Looking ahead, attention now turns to you as University of Michigan's consumer sentiment data, which is expected to show that consumer confidence fell to 63.7, down from 63.8. This would mark the fourth straight monthly decline in consumer sentiment as households fret over sticky.

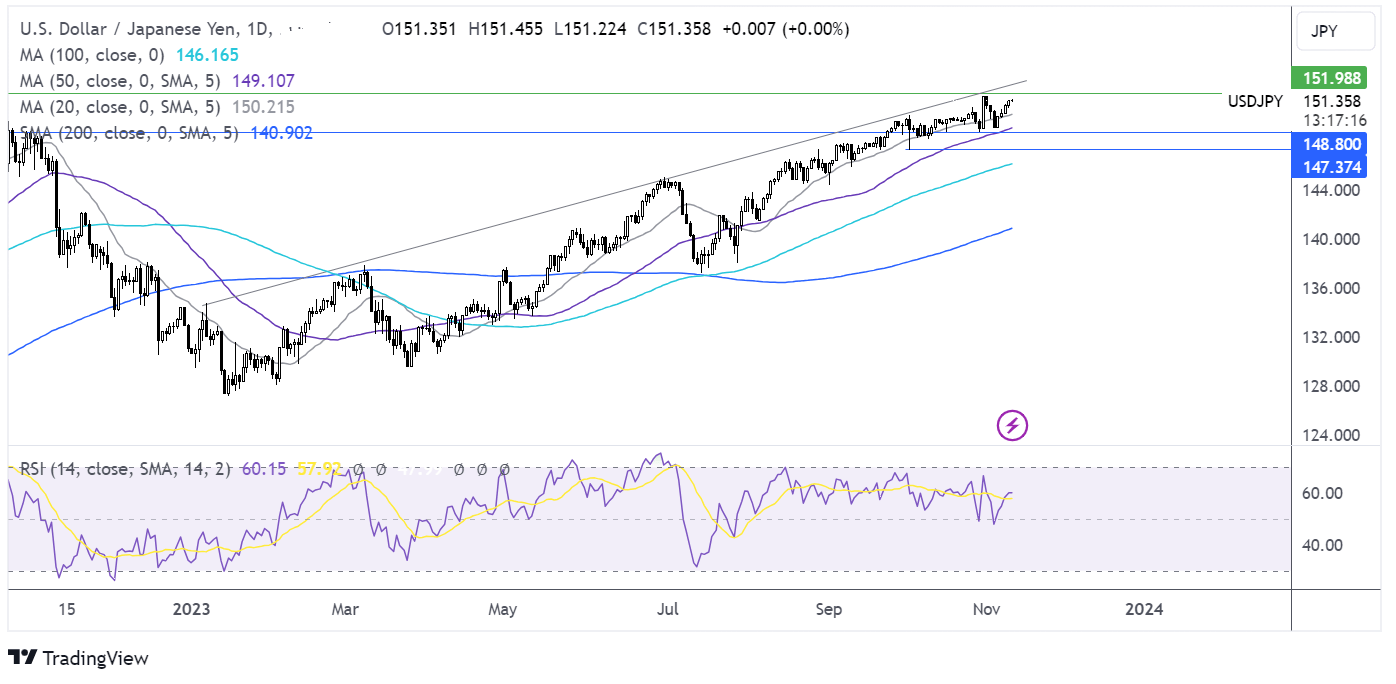

USD/JPY forecast technical analysis

USD/JPY continues to grind higher, guided northwards by the 20 sma, towards 151.70, the 2023 high and 152.50, the rising trendline resistance.

On the downside, support can be seen at 150.20, the 20 sma, with a fall below here exposing the 50 sma at 149.10 and 148.80 the weekly low.

(Click on image to enlarge)

More By This Author:

Two Trades To Watch: EUR/USD, USD/JPY Outlook

S&P 500 Forecast: S&P 500 Trades Cautiously Ahead Of Fed Chair Powell's Speech

GBP/USD, DAX Forecast: Two Trades To Watch

Disclaimer: StoneX Financial Ltd (trading as “City Index”) is an execution-only service provider. This material, whether or not it states any opinions, is for general information ...

more