Two Trades To Watch: GBP/USD, USD/JPY Forecast - Thursday, May 9

Image Source: Unsplash

GBP/USD falls ahead of the BoE rate decision

- BoE is expected to leave rates unchanged at 5.25%

- Could pave the way for a rate cut in the coming months

- GBP/USD falls below 1.25

The pound is falling for a third straight day amid USD strength and ahead of the Bank of England interest rate decision.

The central bank is widely expected to keep interest rates at 5.25% but could start to prepare for a rate cut in the coming months. Inflation in the UK was 3.2% in March YoY and is expected to continue cooling towards the central bank's target of 2% in April.

The market will be watching to see whether the Bank of England lowers its inflation forecasts, adopts more dovish forward guidance, or considers potentially cutting rates.

In the March Bank of England meeting, the vote split was 8 to 1. This vote split could become more dovish in this meeting. Several policymakers, including Sir David Ramsden, have suggested in recent speeches that they could be moving towards a position where they're comfortable cutting rates. A more dovish rate vote split of two or more waiting for a cart could point to a sooner rate cut from the central bank.

The market is currently pricing in a 40% probability of a June rate cut and is fairly pricey in a 25 basis point rate cut for August.

Meanwhile, the US dollar is heading higher, supported by Federal Reserve speakers who say that the Fed needs to keep rates high for longer.

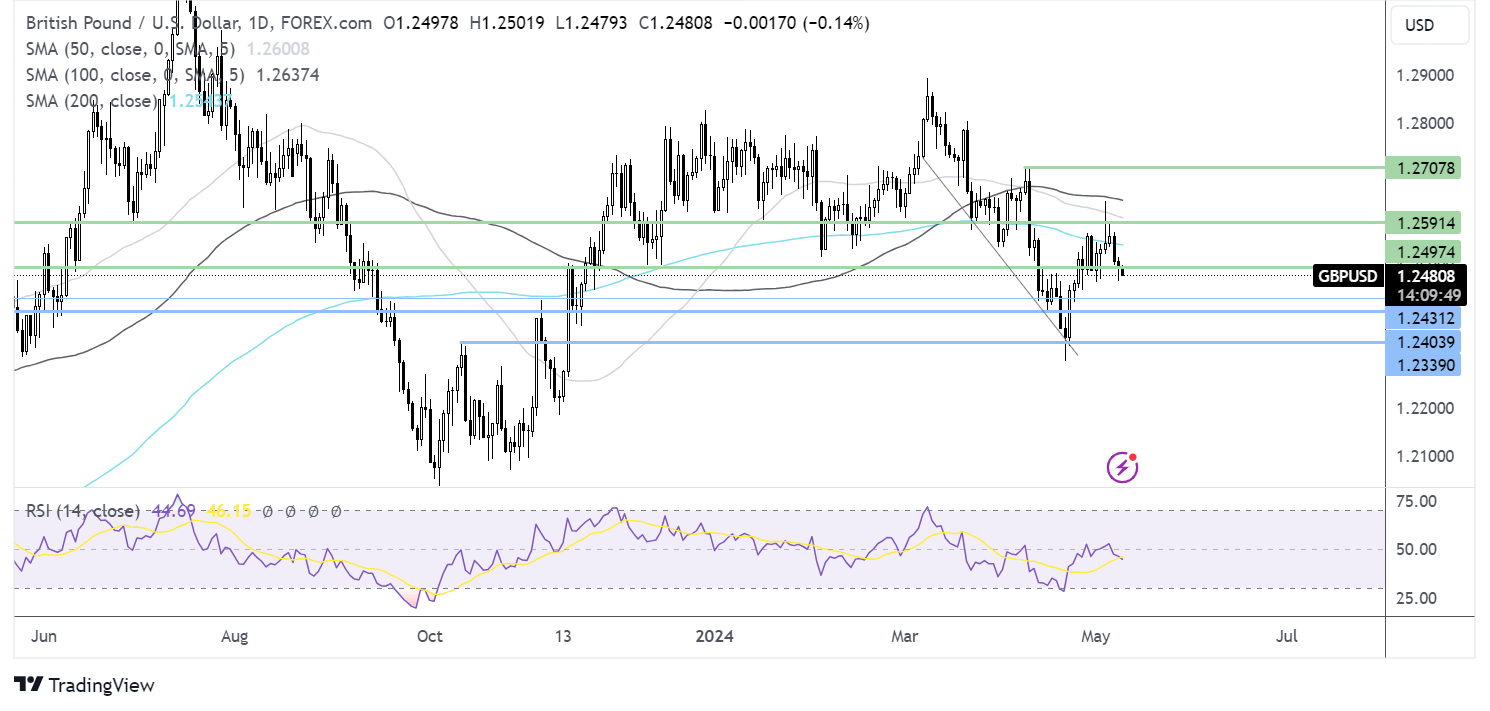

GBP/USD forecast – technical analysis

GBP/USD is extending its decline below the 200 SMA and 1.25 support. This, combined with the RSI below 50, could support further losses.

Sellers will look to extend losses towards 1.24, the mid-April low. Minor support can be seen at 1.2430. Below 1.24, the next level of support can be seen at 1.23.

A less dovish than expected BoE could see GBP/USD recover above 1.25, bringing the 200 SMA at 1.2540 into focus. Above here, the weekly high at 1.26 could offer resistance ahead of 1.2635, the May high, and 1.27, the April peak.

(Click on image to enlarge)

USD/JPY rises despite a more hawkish BoJ

- BoJ minutes are slightly more hawkish

- US jobless claims are in focus ahead of next week’s CPI

- USD/JPY extends gains above 155.00

USDJPY is extending gains for a fourth straight day amid modest U.S. dollar strength and despite a more hawkish stance from the Bank of Japan in the April meeting.

The policy meeting minutes showed that the majority of BoJ board members see the chance of interest rates rising faster than initially expected. This summary of the minutes showed that several of the nine-member board called for steady rate hikes on expectations that inflation could remain or even exceed the central bank's 2% target.

Meanwhile, Bank of Japan governor Ueda also warned that inflationary pressures stemming from a weaker yen could result in tighter management policy. This was a change of stance from the previous month when Ueda said that the recent decline in the yen did not directly impact inflation.

The US dollar is heading higher against its major peers for a third straight day, supported by the prospects of interest rates staying higher for longer even after Friday's weaker-than-expected jobs data.

Recent fed speakers have supported the view that rates need to remain restrictive in order to bring inflation back to the 2% target. Earlier in the week, Minneapolis Fed president Neel Kashkari questioned whether the Fed would be able to raise interest rates at all this year.

The US economic calendar remains light with just US jobless claims in focus. The US economic calendar remains relatively quiet until next week's US inflation report which could give more clues over the federal reserve's policy outlook.

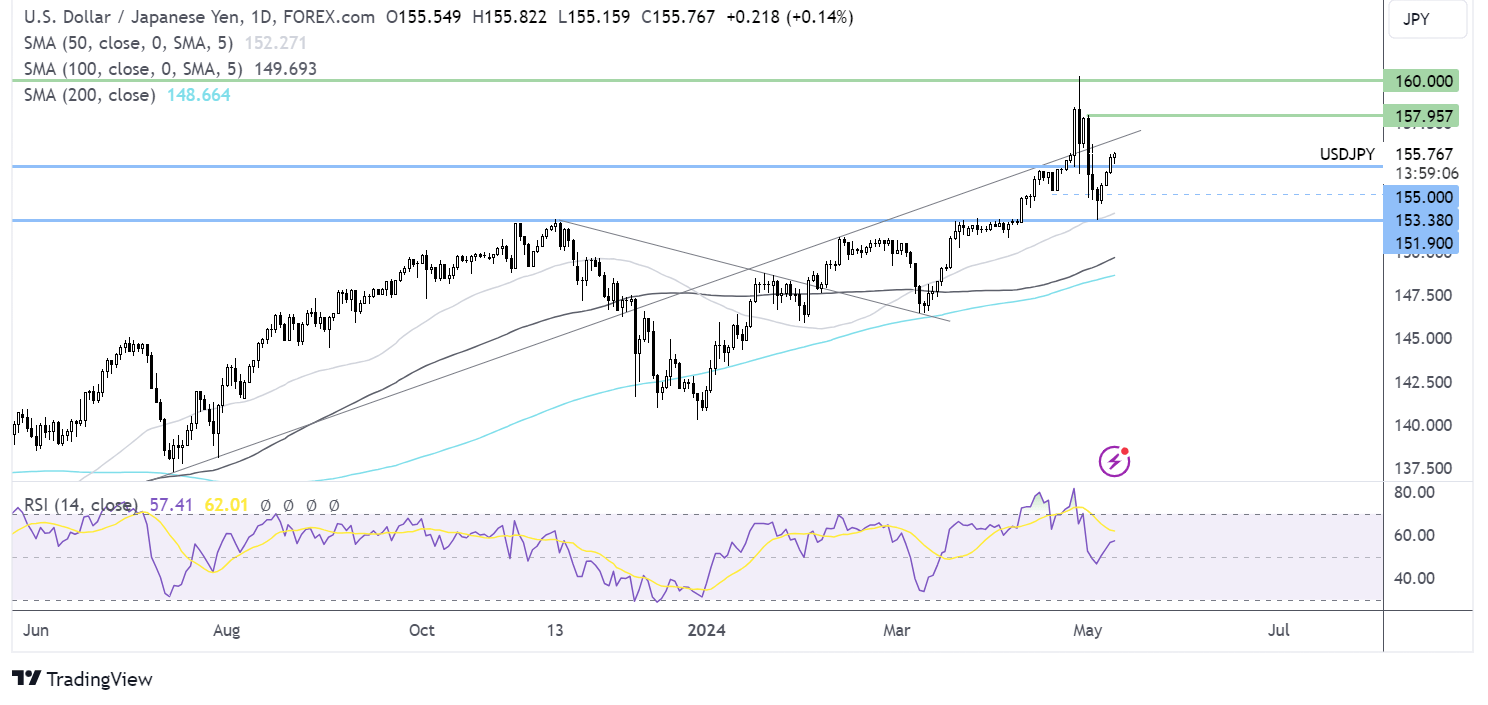

USD/JPY forecast – technical analysis

USD/JPY is extending its recovery from 152.00, rising back above resistance at 155. Should momentum continue, buyers could look to rise back above the rising trendline resistance at 156.50. Above here 158.00, the May high becomes the target.

Support is seen at 155.00; below here, there is minor support around 153.50, but strong support is seen at 152.00.

(Click on image to enlarge)

More By This Author:

Two Trades To Watch: EUR/USD, FTSE Forecast

Two Trades To Watch: FTSE, EUR/USD Forecast - Tuesday, April 23

Two Trades To Watch: EUR/USD, Oil Forecast - Monday, April 22

Disclaimer: StoneX Financial Ltd (trading as “City Index”) is an execution-only service provider. This material, whether or not it states any opinions, is for general information ...

more