Two Trades To Watch: GBP/USD, EUR/USD Forecast - Thursday, Feb. 5

Image Source: Unsplash

GBP/USD falls to 1.36 ahead of the BoE rate decision

The Bank of England will deliver its first monetary policy decision of 2026 at midday today. Expectations are that the central bank will leave interest rates unchanged at 3.75% after cutting rates by 25 basis points at the December meeting.

The December rate count was a narrow vote of five to four. Highlighting how finely balanced the debate about further rate cuts has become. The message from policymakers was still cautiously dovish, with a gradual downward path for rates, meaning that further cuts would be harder to justify as policy moves closer to neutral.

Growth momentum is showing signs of fading, with the economy expected to flatline in Q4. The central bank expects inflation to return to the 2% target by spring, despite CPI rising to 3.4% in January.

There are signs, however, that the labour market is cooling, with the unemployment rate 5.1% percent. PMI data from yesterday showed that the employment subcomponent fell sharply in January, continuing a trend that began in October 2024, marking the longest period of job shedding in the UK service sector in 16 years.

Further weakening in the jobs market would put downward pressure on wage growth and pull service sector inflation lower. Wage growth and service-sector inflation are currently too high for the Bank of England to be comfortable with further rate cuts, or to be consistent with inflation back at 2%.

The focus will be on the vote split, which is expected to be 7-2. A more dovish vote could put pressure on the pound. Bank of England Governor Andrew Bailey’s comments will be in focus, and dovish commentary would be pound-negative.

Meanwhile, the U.S. dollar is rising as it nears a 2-week high amid market pricing in a slower pace and potential Federal Reserve rate cuts.

Federal Reserve governor Lisa Cook emphasised concerns over sticky inflation rather than the cooling labour market, suggesting that she was not supporting a rate cut until there are further signs of inflation easing.

Data yesterday showed the ISM services index remained at 53.8 in January, aligning with the previous month's figure and exceeding expectations from a client of 53.5. However, prices paid also increased to 66.6 from 65.1, signalling rising inflationary pressures. Attention will now turn to U.S. initial jobless claims, which are expected to rise modestly to 212K, up from 209 K.

GBP/USD forecast – technical analysis

GBP/USD trended higher from 1.30 before running into resistance at 1.3870. GBP/USD rebounded lower from here and is testing support at the 1.36 zone, the round number, horizontal and trendline support.

A break below here exposes the 200 SMA at 1.3420. A break below 1.3350 creates a lower low, bringing 1.32 into focus.

Should the support hold, buyers will look to rise above 1.37. A rise above here brings 1.3870 back into play.

(Click on image to enlarge)

EUR/USD steadies around 1.18 ahead of the ECB rate decision

EUR/USD has fallen back to 1.18 ahead of the ECB rare decision at 13:15 GMT where the central bank is widely expected to leave interest rates unchanged at 2% (deposit rate). The ECB last cut rates in June last year. However, inflation hovering around the 2% target led policymakers to consider monetary policy to be in a good place.

However, this meeting comes after data yesterday showed inflation cooled by more than expected to 1.7% YoY in January, down from 1.9% in December and further from the ECB’s 2% target, reopening the debate over whether the ECB will cut again this year.

A stronger EUR, - EUR/USD rose to a 4-year high above 1.20 in late January, and cheap Chinese exports, which have flooded the eurozone, exert deflationary pressure and, if this persists, could amplify dovish calls within the ECB.

Given that no rate cut is expected, the focus will be on the tone of President Lagarde’s press conference as the near-term catalyst for the EUR.

A stronger USD and a slightly more dovish ECB could pull EUR/USD back towards 1.17.

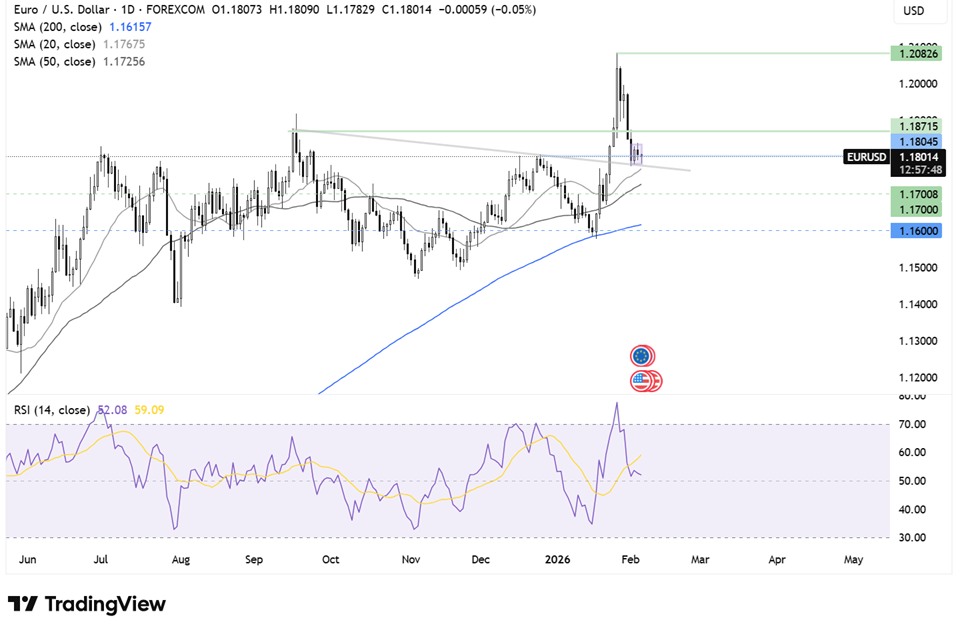

EUR/USD forecast - technical analysis

After recovering from the 200 SMA support and rising to a 4-year high of 1.2085, EUR/USD has fallen back and is testing the 1.18 support, the round number, the December high and the falling trendline support. The RSI is close to neutral.

Should buyers successfully defend this support, upside resistance is at 1.1870, with a rise above here bringing 1.20, the psychological level and 1.2085 back into focus.

Should sellers remove the 1.18 support, this would expose the 50 SMA and the 1.17 level. Below here, the 200 SMA at 1.16 comes into play, along with the 2026 low.

(Click on image to enlarge)

More By This Author:

Two Trades To Watch: EUR/USD, FTSE 100 Forecast - Wednesday, Feb. 4Two Trades To Watch: DAX, Oil Forecast - Tuesday, Feb. 3

Two Trades To Watch: USD/JPY, FTSE 100 Forecast - Thursday, Jan. 29

Disclaimer: StoneX Financial Ltd (trading as “City Index”) is an execution-only service provider. This material, whether or not it states any opinions, is for general information ...

more