Two Trades To Watch: GBP/USD, DAX - Wednesday, Jan. 24

Image Source: Pixabay

GBP/USD rises ahead of PMI data

- UK services PMI expected at 53.2 from 53.4

- US services PMI expected at

- GBP/USD rises above 1.27

GBP/USD is rising, recovering losses from yesterday amid a slightly weaker U.S. dollar and ahead of PMI data.

The pound has shown resilience against the USD, which trades around a six-week high versus its major peers amid expectations that the Bank of England will cut interest rates after other major central banks such as the Fed and the ECB.

GBP is also supported by figures showing that the UK government borrowed less than expected in December. The data boosted the chance the government could announce multiple measures to stimulate growth, including tax cuts, in the March budget to increase the government's position in the polls ahead of an election. Tax cuts could be considered inflationary and may stimulate growth and help to ease the burden of the cost of living crisis.

Today, attention is on the UK services PMI, which was surprisingly strong at the end of last year, jumping to 53.4. This is expected to ease slightly to 53.2 in January, which is still above the 50 level, which separates expansion from contraction. The Bank of England will watch services growth closely as service sector inflation remains high; meanwhile, the manufacturing sector is expected to stay in contraction territory of 46.7, up very slightly from 46.2 in December.

The US dollar rose almost 1% last week owing to stronger-than-expected U.S. economic data supporting the soft landing narrative and hawkish Federal Reserve commentary. As a result, the market has pushed back early Fed rate cut expectations, and according to the CME Fed watch tool, the market is no longer expecting a rate cut in March.

On the data front, US PMIs will be in focus, and the service sector PMI, which was 51.4 in December, is expected to ease slightly to 51. Meanwhile, the manufacturing sector will likely remain in contractionary territory at 47.9. Stronger-than-expected PMI fears could see the market further push back on early rate-cut bets.

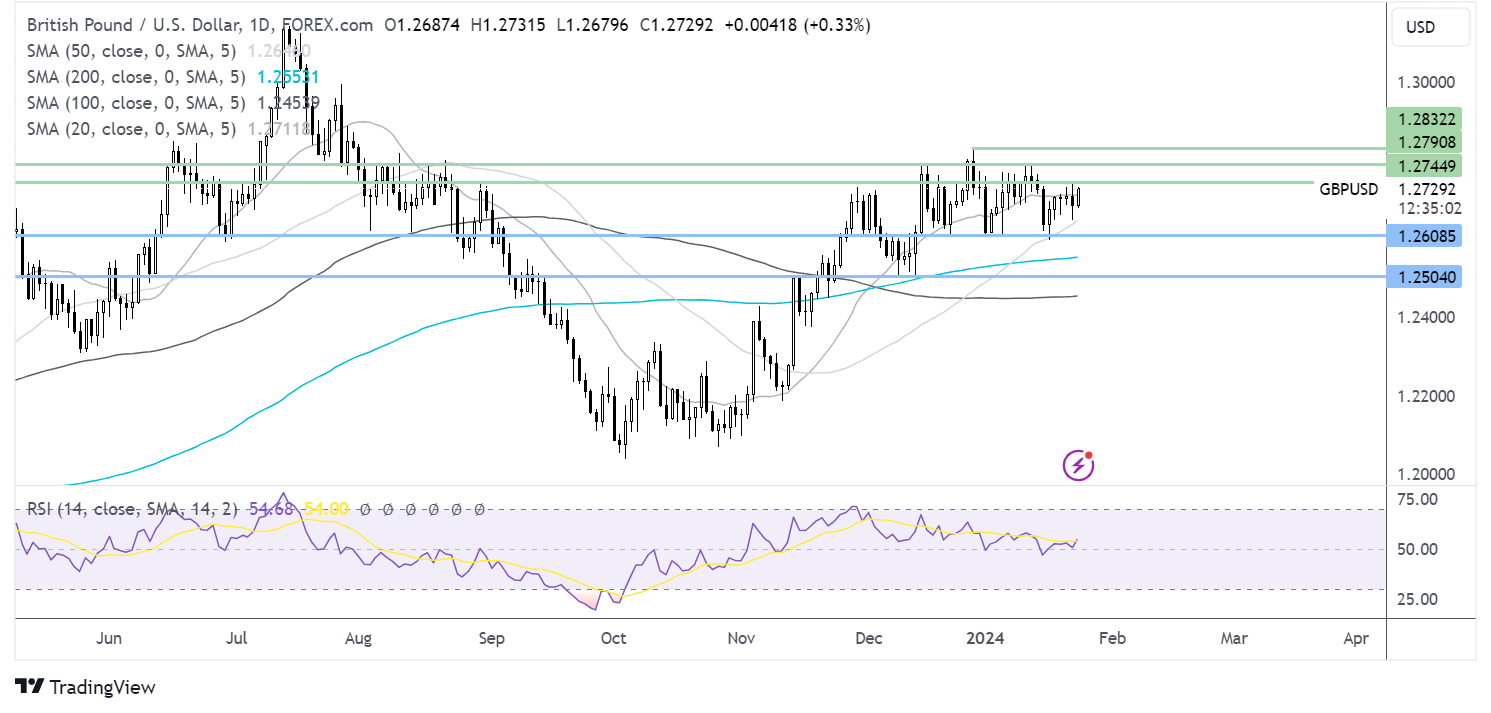

GBP/USD forecast – technical analysis

GBP/USD continues to trade within a horizontal channel, limited by 1.26 on the downside and 1.2750 caps the upside. The 50 SMA is helping the price higher off the 1.26 level, and the RSI is neutral, giving away a few clues.

Buyers will look for a rise above 1.2750, yesterday’s high, to extend gains to 1.2785, the January high, ahead of 1.2830, the December high.

Meanwhile, should sellers break below the 50 SMA at 1.2645, bears could look to retest 1.26 to expose the 200 SMA at 1.2550

(Click on image to enlarge)

DAX rises after another record close in the US

- S&P500 booked a third straight record close

- German composite PMI fell to 47.1

- DAX looks to 17000

The DAX is heading higher after a third-record high close on the S&P 500 overnight and despite further signs of contraction in the German economy.

The mood in Europe is broadly upbeat after stocks on Wall Street pushed higher and after Netflix's Q4 earnings smashed forecasts after the close.

The stronger close has translated into a positive start for European equities even though the German composite PMI highlighted weakness in the economy.

The composite PMI fell to 47.1, defying expectations of a rise to 47.8 and down from 47.4 in December. While the contraction in the manufacturing sector slowed to 45.4 from 43.3, services contracted at a faster pace, with the PMI falling toward 74.6 from 49.3, a sign that high interest rates are slowing demand.

The data points to a continued contraction in the eurozone's largest economy and could raise concerns about a prolonged recession, which could encourage the ECB to cut rates earlier. The ECB interest rate decision is due tomorrow, and rates are expected to be left unchanged.

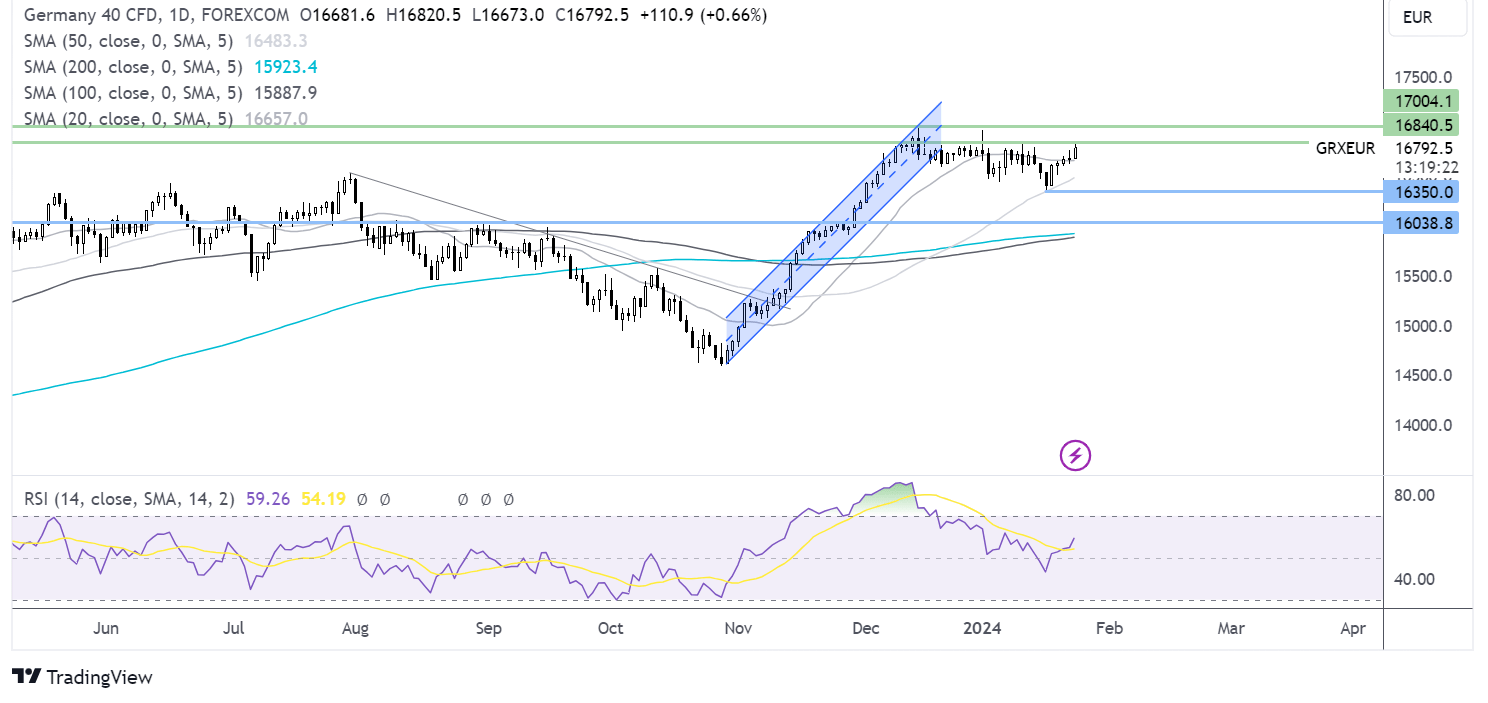

DAX forecast – technical analysis

The DAX rebounded from the 50 SMA at 16344 and is testing resistance at 16800, last week’s high. A rise above and continued momentum here brings 17000, the all-time high, back into focus.

On the downside, support can be seen at the 50 SMA 16430, with a breakdown of this level opening the door to 16344. A break below here is needed to create a lower-low.

(Click on image to enlarge)

More By This Author:

Two Trades To Watch: EUR/USD, USD/JPY - Tuesday, Jan. 23

Two Trades To Watch: EUR/USD, USD/JPY Forecast - Thursday, Jan. 18

Two Trades To Watch: GBP/USD, DAX - Tuesday, Jan. 16

Disclaimer: StoneX Financial Ltd (trading as “City Index”) is an execution-only service provider. This material, whether or not it states any opinions, is for general information ...

more