Two Trades To Watch: GBP/USD, DAX Forecast - Wednesday, Sept. 3

Image Source: Unsplash

GBP/USD recovers above 1.34 as PMI data overshadows fiscal fears

- UK services PMI rises to 54.2 in August

- UK fiscal worries linger

- GBP/USD rises above 1.34

GBP USD is climbing above 1.34 after yesterday’s steep selloff caused by investors' worries over the health of government finances. However, stronger-than-forecast PMI data is helping to offset these worries.

UK borrowing costs were at the highest level since 1998 on Tuesday, highlighting growing investor anxiety over the UK's government's ability to keep finances under control. The self in bonds set up in gilts coincided with selling across other major bond markets, with the focus on rising debt levels.

In the UK, the markets are increasingly concerned over the Labour government's ability to show fiscal constraint ahead of the Chancellor's autumn budget, which is expected in early November.

Today, those fears have been eased slightly following the output revision to the services PMI figure. Services PMI rose to 54.2 in August, up from 51.8 in July, reaching its highest level since April 2024. The grace in the UK's dominant sector came with concerns over US tariffs easing, but firms remained worried about the prospect of tax rises at home.

The data will bring some relief to the finance minister, Rachel Reeves, ahead of the autumn budget. Had decision to hike Social Security contributions in the last budget has been blamed for weak demand and higher costs.

The UK still has the highest inflation among the G7, and service sector businesses raised prices last month by the most since April, adding to the sticky inflationary outlook.

While data has shown that the UK quantum E group is faster than elsewhere in the G7 in the first half of this year, much of that reflected higher government spending and a temporary boost to exports.

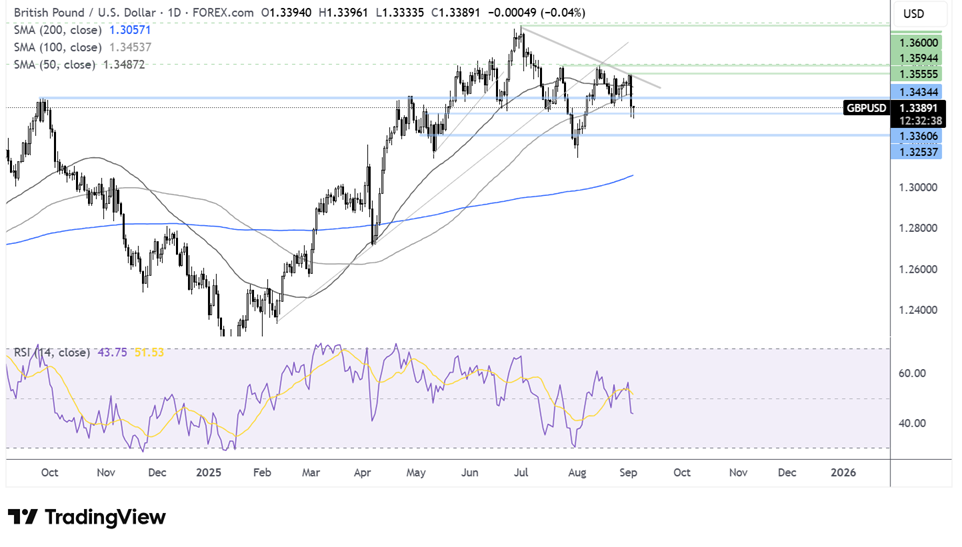

GBP/USD forecast – technical analysis

GBP/USD ran into resistance at 1.3540, the falling trendline resistance dating back to the 1.3788 2025 high, and rebounded sharply lower. The price aggressively broke below the 50 and 100 SMA. The bearish engulfing candle, combined with the RSI below, keeps sellers hopeful of further downside.

The price has found support around 1.3350 support zone. A break below here could open the door to a deeper selloff towards 1.3250.

Any recovery would need to rise above 1.3435 and the 100 SMA. A rise above 1.3550 creates a higher high.

(Click on image to enlarge)

DAX steadies as bond market selloff eases

- German composite PMI was 50.5

- European debt worries remain

- DAX rises from yesterday’s low of 23,475

The DAX is edging higher on Wednesday, an attempt to reverse sharp losses from the previous session. On Tuesday, a global sell-off in bond markets linked to concerns over debt sustainability in major economies in the US, the UK, France, and Japan poses a risk of a move. While the concerns remain, the setoff has steadied.

On the data front, German services PMI was downwardly revised to 49.3 in August, down from 50.6 in July. I'm back below the 50 threshold, which separates expansion from contraction.

Economic momentum remains sluggish with service sector firms scaling back their business operations in August.

However, the composite PMI, which includes manufacturing, remains an expansionary territory at 50.5, downwardly revised from 50.9 in July.

Looking ahead, US JOLTS job openings will be in focus ahead of Friday’s non-farm payroll. The market is pricing in a 90% chance of a Fed rate cut in September amid expectations of a weakening jobs market. Weak JOLTs job openings could reinforce this position and boost sentiment.

DAX forecast - technical analysis

The DAX broke out of range and broke below the rising trendline dating back to April, falling to a low of 23,475 just below the 50 SMA.

The bearish engulfing candle, and the RSI below 50 keep sellers hopeful of further losses. Sellers will look towards support at 23,350, the August low. Below here 23,000, the June low comes into focus.

Buyers would need to rise above the 40 SMA at 24,000 to stage a recovery and negate the near-term down trend.

(Click on image to enlarge)

More By This Author:

Two Trades To Watch: EUR/USD, USD/JPY Forecast - Tuesday, Sept. 2Two Trades To Watch: DAX, FTSE 100 Forecast - Monday, Sept. 1

Two Trades To Watch: EUR/USD, DAX Forecast - Thursday, Aug. 28

Disclaimer: StoneX Financial Ltd (trading as “City Index”) is an execution-only service provider. This material, whether or not it states any opinions, is for general information ...

more