Two Trades To Watch: GBP/USD, DAX Forecast - Tuesday, Sep. 9

Image Source: Pixabay

GBP/USD rises as the USD falls to a 7-week low

GBP/USD is gaining ground, aided by the weaker USD, which trades at a 7-week low.

Data from the British Retail Consortium showed that UK shoppers spent more in August, helped by summer weather and stronger demand for food as well as back-to-school computers. However, some of this increase reflects the higher food prices as well.

The BRC said spending at its members increased by 3.1% in annual terms in August after a 2.5% rise in July. Food spending rose 4.7% in August compared to a 1.8% increase in other goods although the BRC warned that this was largely down to rising prices, which rose 4% in August, rather than increasing volumes.

Food inflation is feeding into the sticky UK inflation, which rose to 3.8% in July, an 18-month high. The Bank of England considers that inflation will rise further to 4%. Sticky inflation means the central bank, the Bank of England, is unlikely to cut interest rates again this year after reducing borrowing costs to 4% in a narrow 5 to 4 split in August.

The USD is falling as investors await US job data revisions, which could show that the labour market is in worse shape than initially thought, adding to the case for deeper Fed rate cuts.

The U.S. dollar index is trading at levels last seen in July 2024, against its major peers, as economists forecast a downward revision by as much as 800,000 jobs, which would signal the Fed is well behind the curve in efforts to achieve maximum employment.

The market is currently pricing in a 90% probability of a 25 basis point rate cut in September, along with a 10% chance of a 50 basis point rate reduction this month.

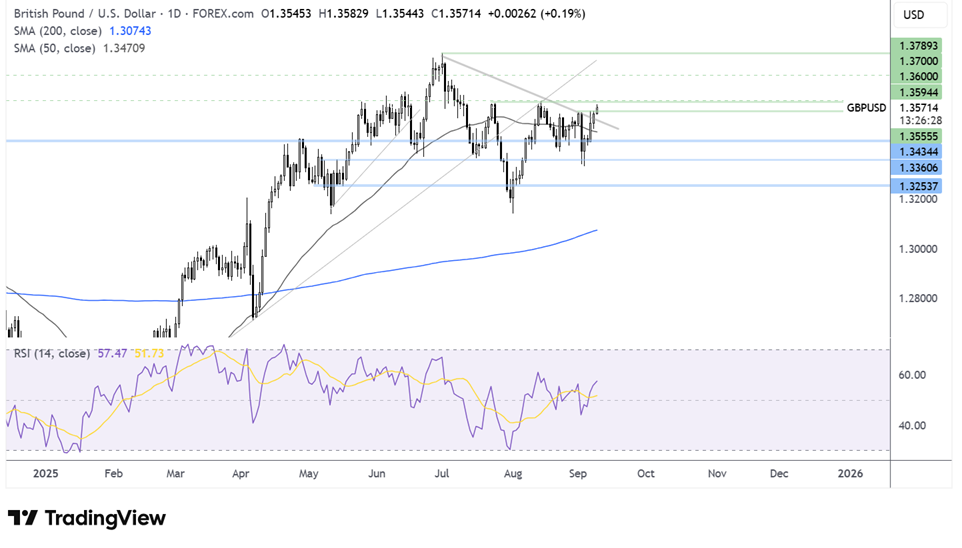

GBP/USD forecast- technical forecast

GBP/USD has extended its recovery from the 1.3330 September low, rising above the 50 SMA, the falling trendline, and 1.3550, the September high. This, combined with the RSI above 50, keeps buyers hopeful of further gains.

Buyers will look to extend gains above 1.36, the August high, to create a higher and bring the 1.37 round number into focus ahead of 1.38, the July high.

Support can be seen at 1.35, the falling trendline support, and below here, 1.3440 comes into play. A break below 1.3350 opens the door to deeper declines towards 1.3250.

(Click on image to enlarge)

DAX steady ahead of this week’s ECB and US CPI data

The DAX is holding steady around 23,800 on Tuesday following a 0.9% rally in the previous session. However, the mood remains cautious ahead of this week's key US inflation data and the upcoming ECB monetary policy meeting.

Investors are also waiting for further clarity on the political situation in France after Prime Minister Bayrou was ousted in a no-confidence vote. The French cat is trading modestly higher, while longer-dated bond yields are flat, as the market awaits President Macron's choice for the country's fifth Prime Minister in less than two years.

The market reaction to Bayrou’s downfall was largely expected after failing to gain support and unify over plans to tame the budget deficit.

Elsewhere in Europe, Anglo American trades almost 5% higher after it agreed to merge with Canada's Teck Resources, in a deal worth $50 billion.

The economic calendar is quiet today; all the attention will be turning towards US inflation data this week, as well as the ECB rate decision on Thursday, where the central bank is widely expected to leave rates unchanged at 2%. With inflation in line with target, the ECB has the possibility to wait and see how the US-EU trade deal impacts the EU economy.

DAX forecast- technical forecast

After a period of consolidation below the record high of 24,540, the DAX broke below the 24k support and the multi-month rising trendline, falling to a low of 23,475. From here, the price has attempted to grind higher and is testing the rising trendline resistance.

Buyers will need to close above the rising trendline and push above the 24k level to build gains back up towards the 24,540 record high.

Sellers will need to take out the 23,475 low to create a lower low and open the door towards 23,300, the August low. Below here, 23,000 comes back into play.

(Click on image to enlarge)

More By This Author:

Two Trades To Watch: EUR/USD, Oil Forecast - Monday, Sep. 8Two Trades To Watch: EUR/USD, Oil Forecast - Thursday, Sept. 4

Two Trades To Watch: GBP/USD, DAX Forecast - Wednesday, Sept. 3

Disclaimer: StoneX Financial Ltd (trading as “City Index”) is an execution-only service provider. This material, whether or not it states any opinions, is for general information ...

more